Last Update30 Apr 25Fair value Increased 3.47%

Key Takeaways

- Edison International's wildfire-related challenges and capital projects could strain financials, impacting earnings, margins, and necessitating increased financing with potential regulatory hurdles.

- Uncertainties from the 2025 General Rate Case and wildfire legislation could affect revenue recognition, net margins, and overall financial stability.

- Ongoing investigations and regulatory uncertainties pose financial risks, potentially impacting margins, earnings, and future profitability for Edison International.

Catalysts

About Edison International- Through its subsidiaries, engages in the generation and distribution of electric power.

- Edison International is facing ongoing challenges related to the Eaton fire investigation, which could result in material losses if the utility's equipment is implicated, potentially impacting future earnings and requiring the use of its self-insurance and the wildfire fund.

- The company's capital expenditure plans, including the proposed undergrounding of power lines and other grid hardening projects, are designed to enhance system resilience and reliability but may necessitate increased regulatory approvals, affecting future revenue streams.

- Despite recent EPS growth, the uncertainty surrounding the 2025 General Rate Case decision, which affects revenue recognition, may limit earnings visibility and create downward pressure on net margins.

- The potential need for increased financing, highlighted by significant upcoming capital projects and regulatory obligations, could elevate interest expenses, impacting net income and overall financial performance.

- Engagement with state legislators to address wildfire legislation may introduce regulatory risks, altering the cost structure and financial metrics like net margins, depending on the outcomes of policy changes.

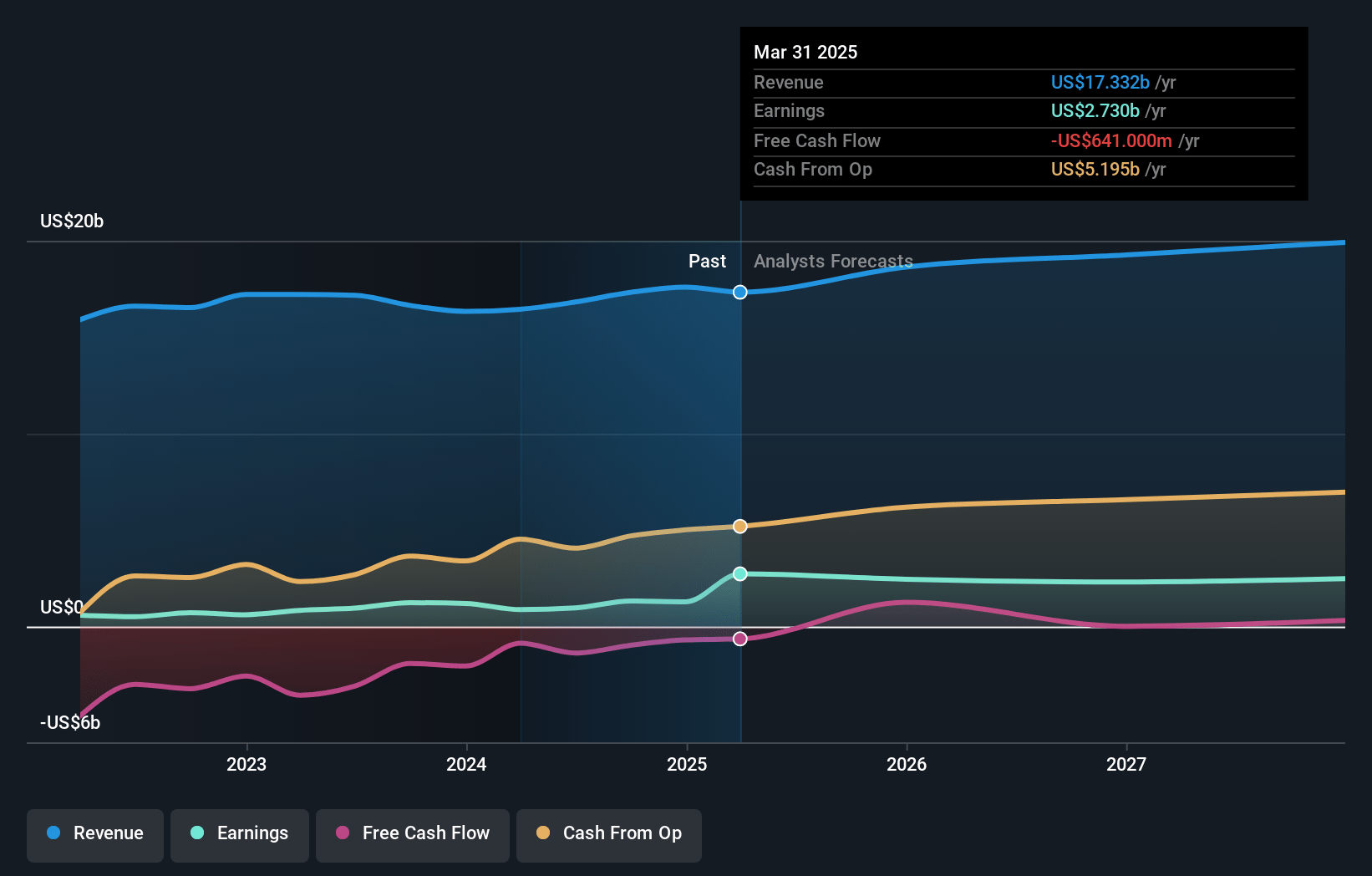

Edison International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Edison International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Edison International's revenue will grow by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 15.8% today to 9.5% in 3 years time.

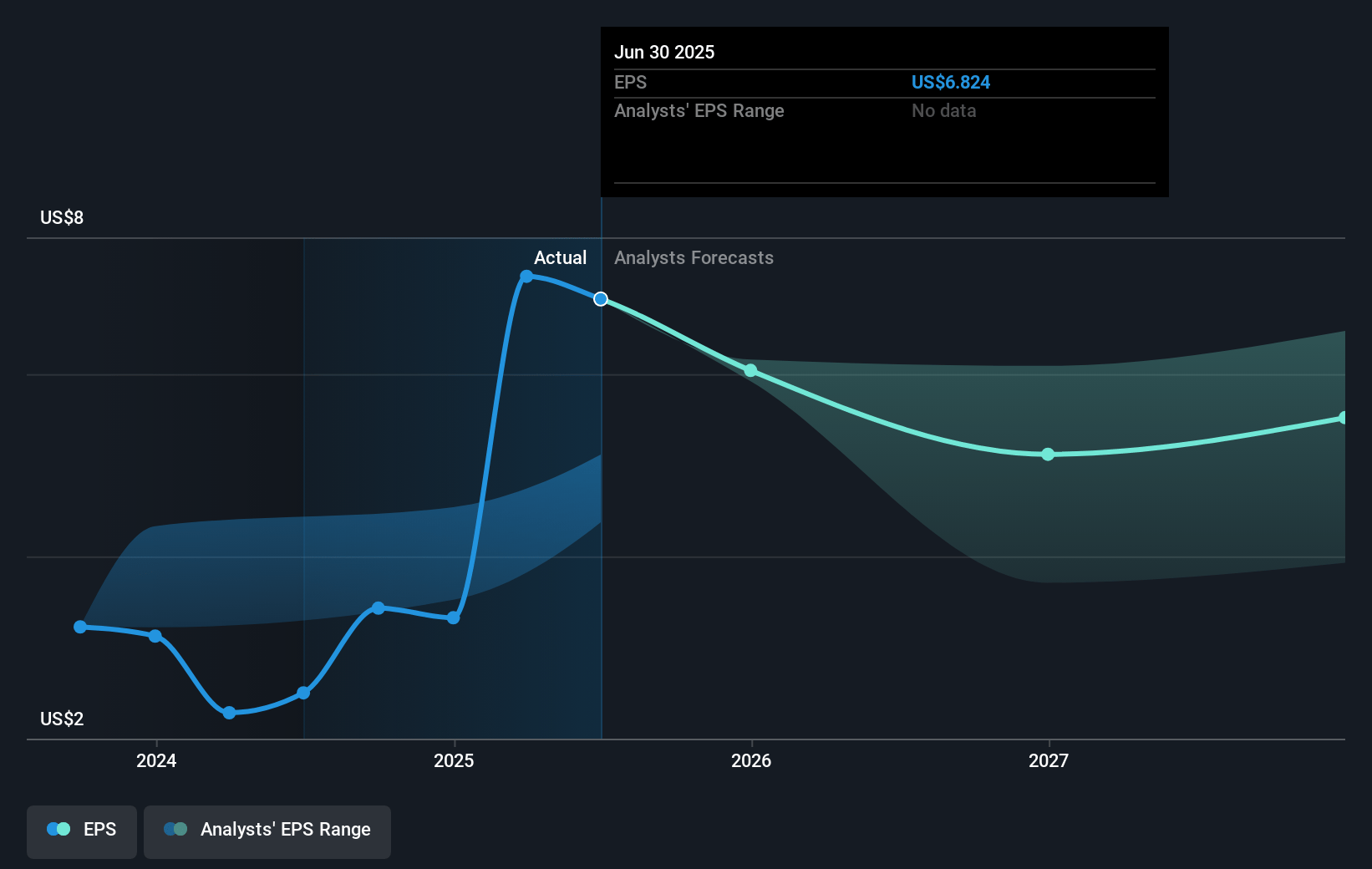

- The bearish analysts expect earnings to reach $1.8 billion (and earnings per share of $4.58) by about April 2028, down from $2.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 7.5x today. This future PE is lower than the current PE for the US Electric Utilities industry at 21.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Edison International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing investigation into the Eaton fire raises the likelihood of Edison International incurring material losses, which could significantly impact net margins and earnings.

- Potential liability from the Eaton fire, which is not yet fully estimable, may affect financial stability depending on the outcome of investigations and litigation, influencing overall earnings.

- Uncertainty in regulatory decisions, including the pending 2025 General Rate Case, complicates revenue projections and can introduce volatility into earnings.

- The necessity to finance significant wildfire mitigation investments and infrastructure projects could lead to increased debt and interest costs, thereby impacting net margins.

- Given the complexity of the legislative landscape in California, regulatory risks associated with changes or updates to wildfire legislation and the recovery fund could adversely affect potential future revenues and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Edison International is $60.24, which represents one standard deviation below the consensus price target of $69.99. This valuation is based on what can be assumed as the expectations of Edison International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $53.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $18.5 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 6.7%.

- Given the current share price of $53.51, the bearish analyst price target of $60.24 is 11.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.