Last Update 14 Dec 25

GWRS: Private Placement Will Support Future Rate Base And Connection Expansion

Analysts have modestly lowered their price target for Global Water Resources to $9.60 from $11.50, citing weaker than expected Q3 results, accelerated operating expense growth, and increased uncertainty around the timing and magnitude of upcoming rate base revisions, despite what they describe as a still constructive long term growth outlook.

Analyst Commentary

Recent Street commentary reflects a more balanced view on Global Water Resources, with earlier optimism about the company’s rate base expansion and earnings visibility now tempered by execution risks and regulatory uncertainty.

Bullish Takeaways

- Bullish analysts highlight the company’s exposure to some of Arizona's fastest growing counties, supporting above average connection growth of 3 to 4 percent and underpinning a favorable long term demand backdrop.

- They view the company’s established consolidation strategy as a structural driver of scale and operating leverage, which should support earnings growth and valuation expansion over time.

- Participation by executive management and board members in the recent 13.1 million dollar private placement is seen as a strong signal of internal confidence in rate base growth and risk adjusted returns.

- Forecasts for net income to potentially more than double between 2024 and 2027, as new rates are phased in, are cited as evidence of a robust medium term growth trajectory if execution remains on track.

Bearish Takeaways

- Bearish analysts point to the weak Q3 performance, with pressure on the bottom line and EBITDA from faster than expected operating expense growth, as a sign that cost discipline may lag revenue growth in the near term.

- Reduced expectations for the upcoming rate base revision, including a 25 percent cut to modeled outcomes, signal increased regulatory and timing risk that could weigh on earnings visibility.

- The lower price target and rating downgrade reflect concern that prior valuation assumptions were too optimistic relative to the company’s execution risk and the evolving regulatory backdrop.

- Some analysts now see a more balanced risk reward profile, arguing that investors may need to wait longer for the full benefit of rate case approvals and integration synergies to be reflected in financial results.

What's in the News

- Completed a private placement of 1,270,572 common shares at $10.30 per share, raising approximately $13.1 million in gross proceeds on September 30, 2025 (Key Developments)

- Levine Investments LP led the financing with the purchase of 728,197 shares for about $7.5 million, which indicates strong institutional support (Key Developments)

- Additional participation came from Andrew M. Cohn with 154,026 shares and Verde Investments Inc with 388,349 shares, together contributing roughly $5.6 million (Key Developments)

- The offering was executed under a Regulation D exemption, which allowed the company to secure capital from three accredited investors without a public registration (Key Developments)

Valuation Changes

- Fair Value Estimate: Unchanged at approximately $12.53 per share, indicating no revision to the intrinsic value assessment.

- Discount Rate: Edged down marginally to about 6.96 percent, reflecting a slightly lower required return in the valuation model.

- Revenue Growth: Effectively unchanged at roughly 8.84 percent, signaling stable expectations for top line expansion.

- Net Profit Margin: Remained essentially flat at about 16.05 percent, suggesting no material change in long term profitability assumptions.

- Future P/E: Held steady at approximately 46.8 times, indicating no adjustment to the long term valuation multiple applied to earnings.

Key Takeaways

- Strategic acquisitions, rate increases, and infrastructure modernization drive sustained revenue and earnings growth while positioning the company for long-term margin stability and resilience.

- Supportive legislation and local development projects bolster recurring revenue by enabling population expansion, increased water demand, and greater service area scale.

- Slowing customer growth, rising costs, regulatory uncertainty, geographic concentration, and ambitious capital spending could constrain profitability and increase exposure to local economic and climate risks.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems in metropolitan Phoenix and Tucson, Arizona.

- The recent Tucson acquisition adds immediately accretive revenue at an attractive multiple, allows for cost synergies due to adjacency with existing systems, and secures future organic customer growth from platted lots and planned rate increases, positively impacting both revenue and long-term net margins.

- Legislative actions, such as the Ag-to-Urban water law, are expected to enable new groundwater supply and support additional long-term growth in Global Water's regional service areas, directly supporting future population expansion and rising water demand, which should drive recurring revenue growth.

- Completion of the Highway 347 project is set to catalyze further housing and population expansion in key service areas like Maricopa, reinforcing above-average connection and consumption growth, which translates into sustained increases in core revenues and operating scale.

- Continued execution of rate case strategies, with multiple pending and recently implemented increases, positions the company to offset inflationary pressures and higher capital investment, supporting predictable and resilient earnings growth through periodic rate adjustments.

- A focus on consolidating and modernizing water infrastructure with significant ongoing capital investment aligns with increasing public and regulatory emphasis on sustainability and drought resilience, enhancing eligibility for external funding and improving long-term asset efficiency, supporting future net margin stability.

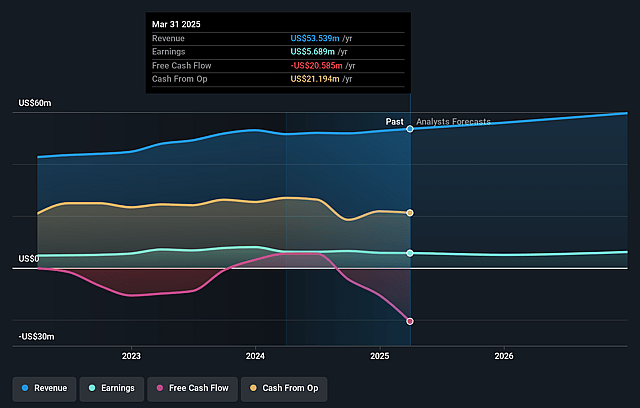

Global Water Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Water Resources's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.3% today to 10.4% in 3 years time.

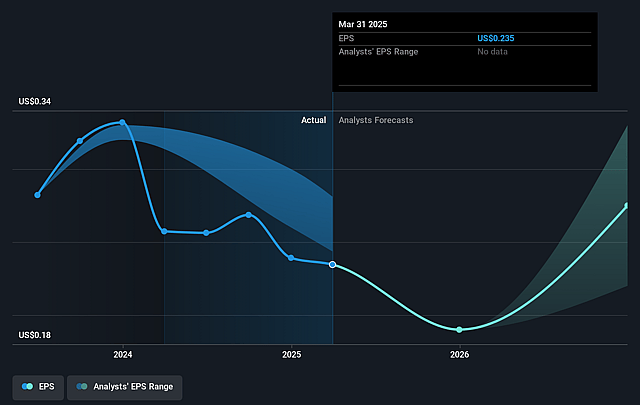

- Analysts expect earnings to reach $6.8 million (and earnings per share of $0.32) by about September 2028, up from $5.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 91.7x on those 2028 earnings, up from 48.4x today. This future PE is greater than the current PE for the US Water Utilities industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Single-family housing permit issuances in both the City of Maricopa and the greater Phoenix area have declined sharply year-over-year (24% and 14% respectively for Q2), signaling potential stagnation or even contraction in organic customer growth, which could limit future rate and revenue expansion for Global Water Resources.

- The company faces elevated operating costs-including an 8.5% increase in operating expenses in Q2, notably from higher depreciation, staffing, and service provider costs-which, without corresponding rate increases, could compress net margins and earnings.

- A heavy reliance on favorable rate case outcomes and regulatory approval is evident, as significant earnings and recovery of cost inflation hinge on Arizona Corporation Commission decisions; any delays, unfavorable rulings, or regulatory policy shifts could materially impact revenue predictability and profitability.

- Despite recent acquisitions, Global Water Resources remains geographically concentrated in Arizona, leaving it exposed to localized economic slowdowns, stricter water-use regulations, or adverse climate-related events (such as prolonged drought or supply constraints), which could increase costs or reduce water demand, negatively affecting revenues.

- The company's substantial ongoing capital investments to upgrade and expand infrastructure ($35.4 million year-to-date) risk outpacing actual connection and revenue growth, potentially resulting in lower free cash flow, restricted ability to raise dividends or reinvest, and downward pressure on shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.5 for Global Water Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $65.2 million, earnings will come to $6.8 million, and it would be trading on a PE ratio of 91.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $9.82, the analyst price target of $15.5 is 36.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Global Water Resources?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.