Last Update 08 Dec 25

Fair value Decreased 0.95%CEG: Data Center Power Deals Will Drive Nuclear Cash Flows Higher

Analysts have raised their average price target on Constellation Energy by roughly $30 to $400, citing accelerating commercial momentum, growing nuclear and thermal cash flows, and the scarcity value of its generation assets in an environment of robust electricity demand and expanding data center power needs.

Analyst Commentary

Recent research updates reflect a broadly constructive stance toward Constellation Energy, with several firms lifting price targets in response to strengthening fundamentals and a more supportive power market backdrop. Target hikes into the high 300s and low 400s suggest that the Street is beginning to price in both higher earnings power and the strategic value of the company’s portfolio.

While the overall tone is positive, the mix of Neutral and Overweight ratings indicates that some analysts remain cautious on valuation, execution around growth initiatives, and the pace at which upside can be realized.

Bullish Takeaways

- Bullish analysts highlight accelerating commercial momentum, particularly ahead of upcoming earnings, as evidence that Constellation can convert robust demand into sustained revenue and margin growth.

- Multiple price target increases into the $390 to $422 range signal confidence that the company’s nuclear and thermal assets can deliver higher cash flows, supporting a premium valuation versus peers.

- The expanding data economy and recent long term power agreements with large technology customers are seen as reinforcing long duration growth visibility and underpinning higher long term earnings multiples.

- Some analysts see the scarcity value of Constellation’s generation fleet and potential buybacks as powerful capital allocation levers that can drive further upside to the share price.

Bearish Takeaways

- Despite higher targets, several Street views remain Neutral. This suggests concern that the current share price already discounts a robust growth trajectory and leaves less room for multiple expansion.

- Bearish analysts are cautious that the company must execute flawlessly on integrating planned transactions and capturing data center demand. Any delay or misstep could potentially pressure earnings expectations.

- There is lingering uncertainty around the durability of elevated power and capacity prices. This could limit upside if market conditions normalize faster than anticipated.

- Some commentary implies that further upside will increasingly depend on additional large scale power deals and M&A. This introduces event risk around the timing and valuation of future transactions.

What's in the News

- The U.S. Department of Energy outlined plans for the federal government to own as many as 10 large nuclear reactors, highlighting Constellation as one of several publicly traded beneficiaries of expanded nuclear investment (Bloomberg).

- Constellation secured a $1 billion DOE loan for its Crane Clean Energy Center, lowering financing costs and supporting the restart of a key nuclear unit to meet surging data center and electrification-driven power demand (Company announcement).

- The company announced senior leadership changes tied to the pending Calpine transaction, including the promotion of CFO Dan Eggers to Senior Executive Vice President, Finance and Data Economy, and the appointment of Shane Smith as the new CFO, effective at closing (Company announcement).

- Constellation provided an update on share repurchase activity, disclosing buybacks of 183,135 shares in Q3 2025 and bringing total repurchases to roughly 5.4% of shares outstanding under its 2023 authorization (Company filing).

- Constellation reported that its 21 nuclear reactors ran at 98.8% capacity during the summer heatwaves, underscoring nuclear reliability and supporting up to 2,000 megawatts of incremental baseload capacity through uprates and the Crane restart (Company announcement).

Valuation Changes

- Fair Value Estimate has edged down slightly, from approximately $403.77 to $399.93 per share, implying a modest reduction in modeled intrinsic value.

- Discount Rate is effectively unchanged, moving fractionally from 6.956% to 6.956%, signaling no meaningful shift in perceived risk or cost of capital.

- Revenue Growth has been revised lower, from about 7.31% to 7.05%, reflecting slightly more conservative top line expansion assumptions.

- Net Profit Margin has increased modestly, from roughly 13.45% to 13.67%, indicating a small improvement in expected profitability.

- Future P/E has decreased from about 37.11x to 36.42x, suggesting a slightly less aggressive multiple on forward earnings in the valuation framework.

Key Takeaways

- Long-term, higher-margin contracts driven by demand for carbon-free power and new energy solutions are improving revenue growth and diversifying earnings.

- Federal support and strategic investments in nuclear energy are enhancing cash flow stability, capacity, and overall financial strength.

- Heavy dependence on regulated nuclear and centralized assets, shifting market dynamics, and customer concentration heighten long-term regulatory, operational, and revenue risks for the company.

Catalysts

About Constellation Energy- Produces and sells energy products and services in the United States.

- Growing demand for carbon-free, reliable power from large-scale customers such as data centers (Meta, Microsoft) and corporates (Comcast)-driven by digitalization, electrification, and decarbonization goals-is creating new, longer-term, higher-margin contracts with price premiums, likely resulting in significant revenue and earnings growth as more transactions close.

- Bipartisan political support for nuclear energy, exemplified by recent federal legislation and executive orders, has expanded and extended nuclear production tax credits (PTC) and zero-emission credits (ZEC), securing protected, higher-margin cash flows and increasing earnings visibility for at least the next decade.

- Acceleration of customer interest in time-matched, 24/7 carbon-free energy solutions is positioning Constellation to lock in longer-duration and higher-premium contracts across a broadening industrial base, supporting improved net margins and diversified revenues beyond volatile wholesale markets.

- Strategic investments and progress in nuclear plant restarts (Crane Clean Energy Center), upgrades (900MW in engineering), and selective M&A (Calpine acquisition) provide visible avenues for substantial capacity additions and operational synergies, enhancing EBITDA and free cash flow over the medium to long term.

- Sustained focus from institutional investors on ESG-aligned, emissions-free utilities is likely to reduce Constellation's cost of capital and support share price appreciation, especially as the company's clean energy profile strengthens through federally backed credits and continued expansion of nuclear and renewable assets.

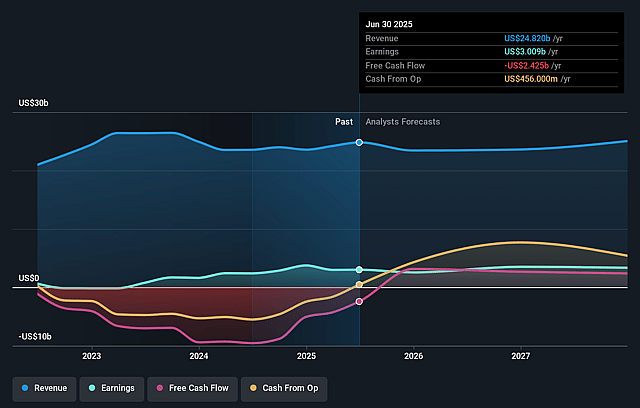

Constellation Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Constellation Energy's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.1% today to 13.4% in 3 years time.

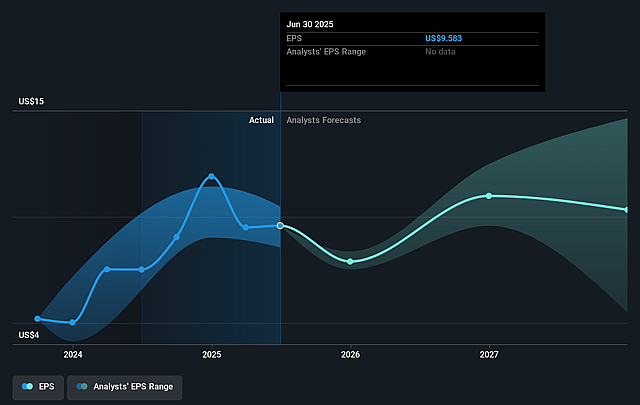

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $11.28) by about September 2028, up from $3.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.1 billion in earnings, and the most bearish expecting $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.2x on those 2028 earnings, up from 31.2x today. This future PE is greater than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Constellation Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Constellation Energy's heavy reliance on regulated nuclear assets exposes it to rising long-term regulatory compliance, operational, and eventual decommissioning costs, which could erode net margins and free cash flow as nuclear fleets age and capital requirements mount.

- Accelerated penetration and cost competitiveness of distributed energy resources (like rooftop solar and batteries) may reduce demand for centralized utility-scale generation, threatening the company's long-term revenue growth and potentially stranding legacy assets.

- The company's focus on large, long-term contracts with hyperscalers and major data center customers risks concentration and exposure to evolving customer preferences, grid localization trends, or potential regulatory backlash, making revenue streams less predictable.

- Increasing grid interconnection complexity and infrastructure bottlenecks-highlighted in the text by dependence on external utility actions and regulatory approvals-could delay new project completion, defer revenue realization, and add cost uncertainty to growth investments.

- Sustained growth in utility-scale renewables or abrupt market/pricing changes from market redesigns, capacity market reforms, or reduced state/federal subsidy support could compress wholesale power prices, shrinking earnings and potentially leading to underperformance versus expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $351.095 for Constellation Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $393.0, and the most bearish reporting a price target of just $184.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.7 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 37.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $300.82, the analyst price target of $351.1 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Constellation Energy?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.