Key Takeaways

- Unique zero-carbon nuclear capabilities and premium contracts with major customers provide durable pricing power, stable cash flows, and increased revenue certainty.

- Long-term growth is fueled by rising electricity demand from AI, digitization, and electrification, supported by operational improvements and favorable policy incentives.

- Structural shifts in energy demand, asset obsolescence, and regulatory complexities threaten core utility revenues, compress margins, and create long-term uncertainty for profitability and growth.

Catalysts

About Constellation Energy- Produces and sells energy products and services in the United States.

- The accelerating build-out of data centers, driven by widespread adoption of AI and digitization, is leading to structural increases in long-term electricity demand and positioning Constellation as a key supplier of clean, reliable power; this is expected to drive significant top-line revenue growth and long-term earnings expansion.

- The company's unique ability to provide large-scale, zero-carbon nuclear power—well ahead of new-build alternatives hampered by rising costs and extended construction timelines—gives it durable pricing power and capacity utilization advantages, supporting higher net margins and more stable cash flows over time.

- Electrification across the economy, including transportation, industry, and heating, is forecast to produce sustained load growth over multiple decades and creates multi-year visibility on demand for Constellation’s power generation assets, increasing revenue certainty and supporting ambitious earnings guidance through the decade.

- Large customer segments—including hyperscalers and corporates focused on ESG mandates—are pursuing long-term contracts for carbon-free energy, which allows Constellation to secure premium pricing, reduce pricing volatility, and improve free cash flow predictability.

- Strategic operational improvements—such as nuclear fleet uprates, digitalization, and efficiency investments—combined with an inflation-protected nuclear PTC structure and supportive policy incentives, enable Constellation to enhance EBITDA margins and drive double-digit base earnings growth, justifying bullish expectations for future profitability.

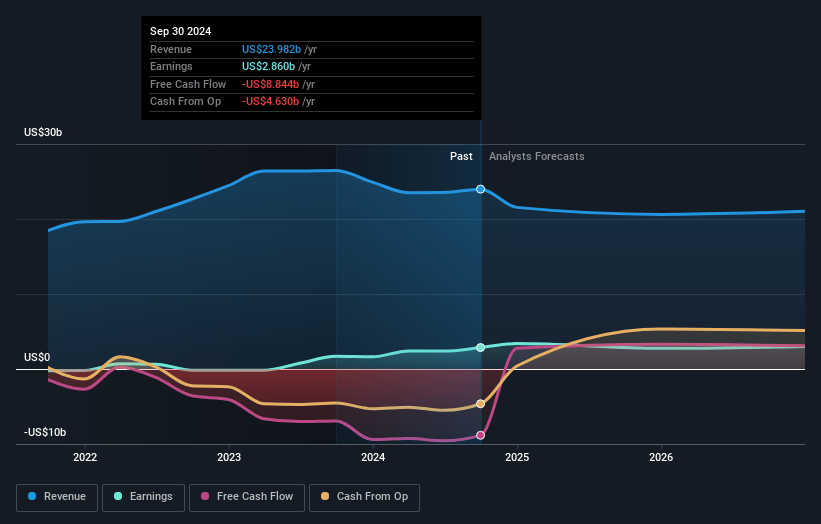

Constellation Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Constellation Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Constellation Energy's revenue will grow by 3.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.3% today to 18.7% in 3 years time.

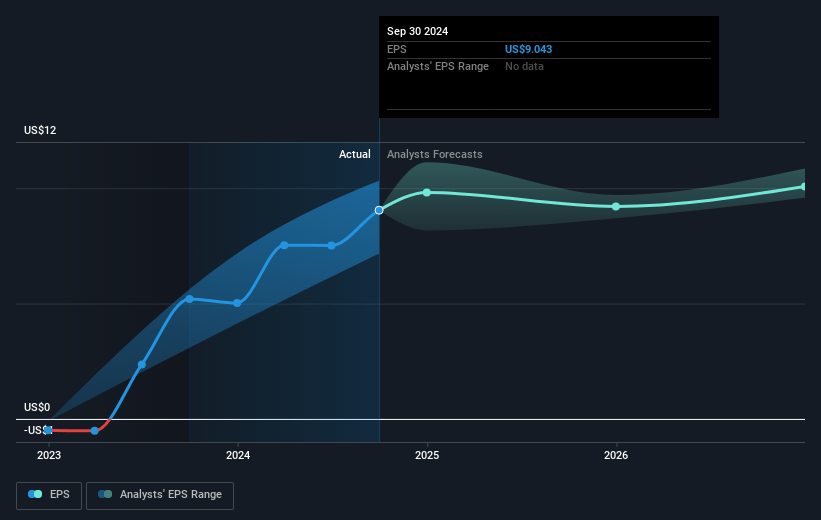

- The bullish analysts expect earnings to reach $5.1 billion (and earnings per share of $14.55) by about July 2028, up from $3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, down from 33.4x today. This future PE is greater than the current PE for the US Electric Utilities industry at 22.0x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Constellation Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overstated projections for data center and AI-induced electricity demand could result in overinvestment or stranded assets, making revenue growth and long-term earnings less robust if actual demand falls short of expectations.

- The accelerating adoption of distributed energy resources like rooftop solar and battery storage directly threatens demand for grid-supplied electricity, which could structurally erode Constellation Energy’s core utility revenues over the coming decade.

- Heavy reliance on aging nuclear and legacy fossil assets exposes Constellation Energy to elevated maintenance, safety, and regulatory compliance costs, raising the risk of asset retirement or reduced utilization, which may compress net margins and dampen free cash flow.

- Rapid technological progress in alternative energy solutions, such as advanced batteries, hydrogen, and small modular nuclear reactors, could obsolete existing generation assets faster than anticipated, putting downward pressure on asset values and future profitability.

- Ongoing policy momentum toward decarbonization, evolving regional regulatory environments, and market liberalization increase the risk of volatile wholesale prices and increased compliance-related capital expenditures, all of which could destabilize long-term earnings growth and impact shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Constellation Energy is $385.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Constellation Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $385.0, and the most bearish reporting a price target of just $184.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $27.2 billion, earnings will come to $5.1 billion, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $317.79, the bullish analyst price target of $385.0 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.