Key Takeaways

- Expansion into digital booking channels and new fare structures will boost customer acquisition, increase direct bookings, and improve revenue growth and margins.

- Enhancements in the loyalty program and operational efficiency support repeat business, maximize aircraft utilization, and sustain long-term earnings growth.

- Southwest’s heavy reliance on the domestic market, rising labor costs, Boeing 737 risks, regulatory pressures, and shifting travel preferences all threaten revenue and margin growth.

Catalysts

About Southwest Airlines- Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

- The implementation of enhanced digital booking channels, such as the recent expansion into Expedia and metasearch platforms, is expected to significantly broaden Southwest’s customer base by attracting new and infrequent travelers, increasing direct bookings and boosting ancillary revenues, which should drive sustained top-line revenue growth.

- The upcoming introduction of a more segmented fare structure—including basic economy, assigned seating, and premium buy-up options—will allow Southwest to capture greater willingness to pay among both value-seeking and premium customers, raising per-passenger yields and providing a strong lift to revenues and net margins.

- Ongoing optimization of the Rapid Rewards loyalty program and a newly amended credit card partnership with Chase are strengthening customer engagement and spending, as seen in record first-quarter co-brand card usage. This trend should drive higher repeat business and provide a recurring, high-margin revenue stream supporting long-term earnings growth.

- Continued focus on point-to-point, direct-route networks and operational efficiency initiatives, such as turn time reduction and strategic scheduling, are boosting aircraft utilization and capital efficiency while controlling costs, supporting higher operating margins and increased earnings stability over time.

- As the experience economy expands and younger generations increasingly prioritize affordable travel and flexibility, Southwest’s low-fare, customer-friendly model is uniquely positioned to capture expanding leisure demand, particularly in untapped or underpenetrated markets, fueling long-term, above-market revenue growth.

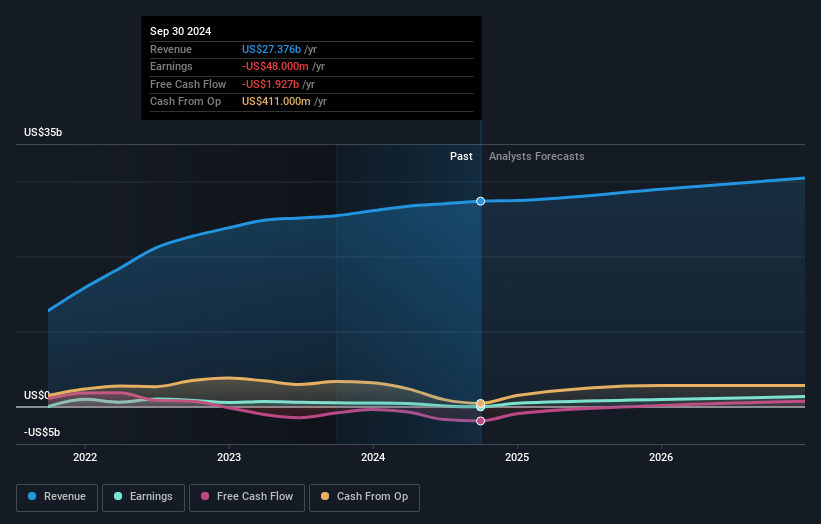

Southwest Airlines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Southwest Airlines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Southwest Airlines's revenue will grow by 7.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.0% today to 9.0% in 3 years time.

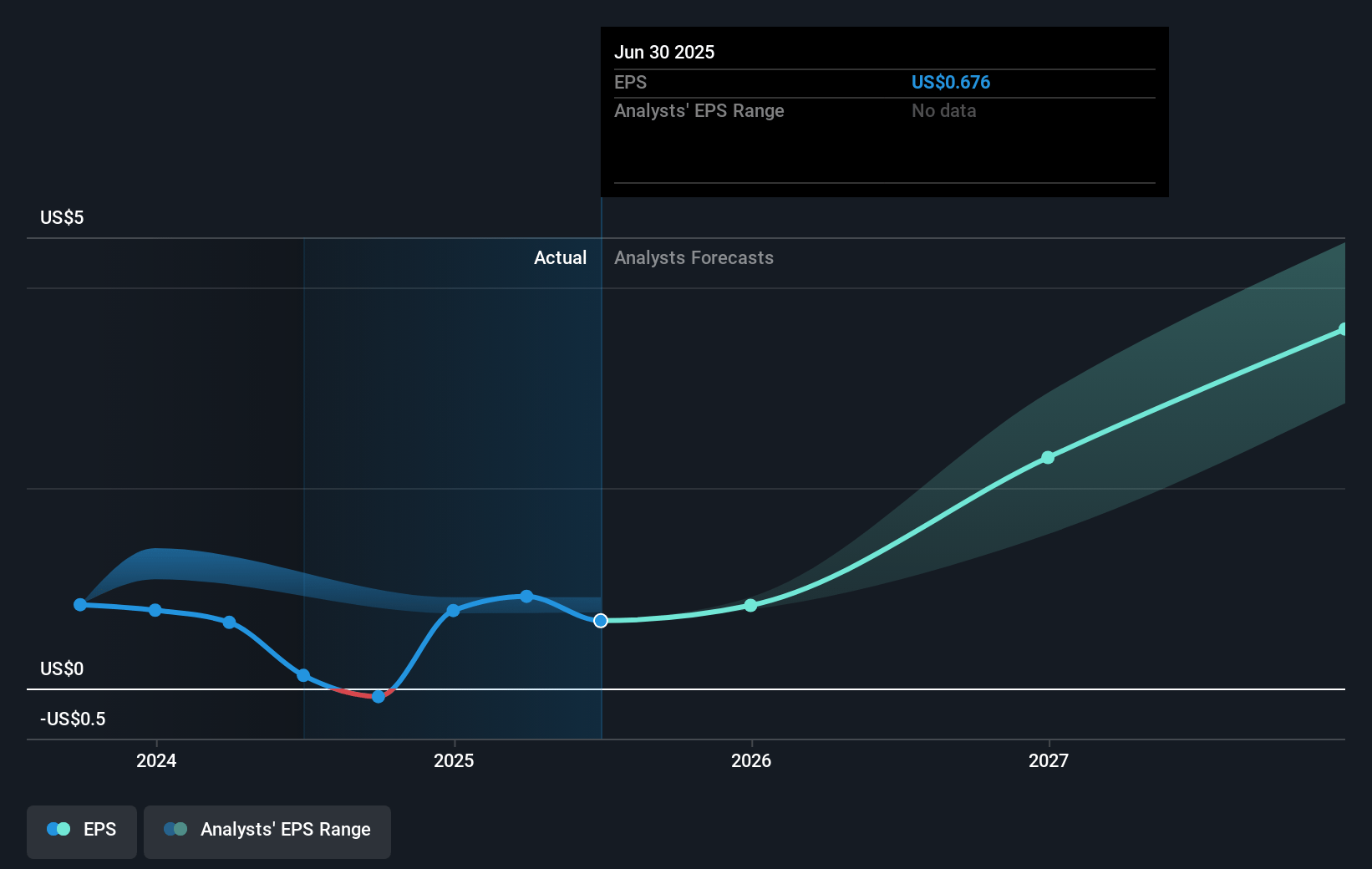

- The bullish analysts expect earnings to reach $3.1 billion (and earnings per share of $4.45) by about July 2028, up from $547.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 34.8x today. This future PE is lower than the current PE for the US Airlines industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 4.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Southwest Airlines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Southwest’s business is heavily concentrated in the domestic market, and as noted in the call, any sustained downturn or stagnation in the US economy or shifts in domestic travel demand would have an outsized negative effect on revenue growth opportunities, leading to potential long-term revenue stagnation.

- The company faces significant cost pressures from its heavily unionized workforce and recently negotiated labor contracts; this environment, paired with industry-wide pilot and skilled labor shortages, is likely to drive wages and benefits higher over time, which could compress net margins and reduce earnings growth.

- Southwest’s exclusive reliance on Boeing 737 aircraft introduces material risk; ongoing delivery delays, technical issues, or regulatory action affecting the Boeing 737 fleet would result in capacity constraints, higher maintenance and operating costs, and potential interruptions to service, all of which would increase revenue volatility and pressure operating margins.

- The text references ongoing cost initiatives and tight cost controls, but accelerating regulatory and societal pressure for decarbonization—through mandated technological upgrades or new carbon taxes—would materially increase long-term operating expenses, directly impacting net margins and potentially requiring additional capital investments.

- Changing consumer behavior, particularly the long-term reduction in business travel and increasing preference for virtual meetings, is impacting Southwest's core market; this trend, combined with demographic headwinds such as an aging traveler base, risks lower load factors and weaker demand that could undermine both revenues and future profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Southwest Airlines is $42.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Southwest Airlines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $34.3 billion, earnings will come to $3.1 billion, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $33.41, the bullish analyst price target of $42.0 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.