Key Takeaways

- Southwest Airlines aims to boost revenue and earnings by enhancing customer offerings and operational efficiency, capitalizing on industry demand.

- Fleet modernization and cost-saving measures are expected to optimize capital, increase profitability, and drive shareholder returns.

- Fleet delivery shortfalls and unit cost inflation could constrain capacity, revenue, and profitability if efficiency initiatives and cost management aren't successful.

Catalysts

About Southwest Airlines- Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

- Southwest Airlines is leveraging its Southwest. Even Better. plan, aimed at enhancing operational efficiency and expanding customer offerings, including new partnerships and the introduction of an all-new vacations product. This strategic plan is expected to increase revenues through improved customer experience and enhanced loyalty programs, leading to higher earnings.

- The airline is seeing strong revenue momentum, demonstrated by an impressive year-over-year increase in unit revenues, with expectations to maintain this progression into 2025. The constructive industry backdrop, characterized by strong demand and capacity moderation, is expected to further boost revenue growth.

- Southwest is implementing a comprehensive cost plan targeting $500 million in cost savings to mitigate above-normal unit cost inflation. By achieving greater efficiency in operations and reducing corporate overhead, the company anticipates improved net margins, enhancing overall profitability.

- A significant component of Southwest's forward strategy is its fleet monetization approach, which involves modernizing its aircraft fleet through the execution of sales and sale-leaseback agreements. This strategy is expected to capitalize on favorable market conditions, optimize capital allocation, and contribute to an estimated $500 million in incremental EBIT, driving earnings growth.

- The company is also committed to substantial shareholder returns through a $2.5 billion share repurchase authorization and strategic dividend payments. The share repurchase program is anticipated to be accretive, boosting earnings per share and enhancing shareholder value.

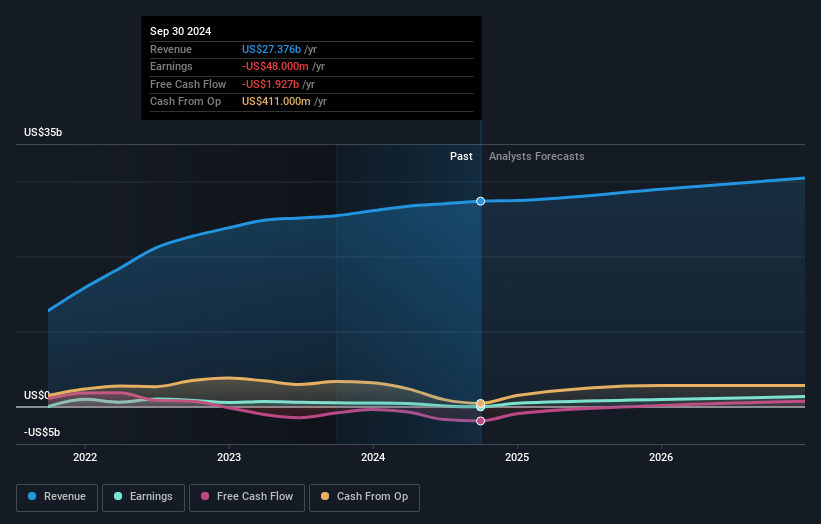

Southwest Airlines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Southwest Airlines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Southwest Airlines's revenue will grow by 7.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.7% today to 7.6% in 3 years time.

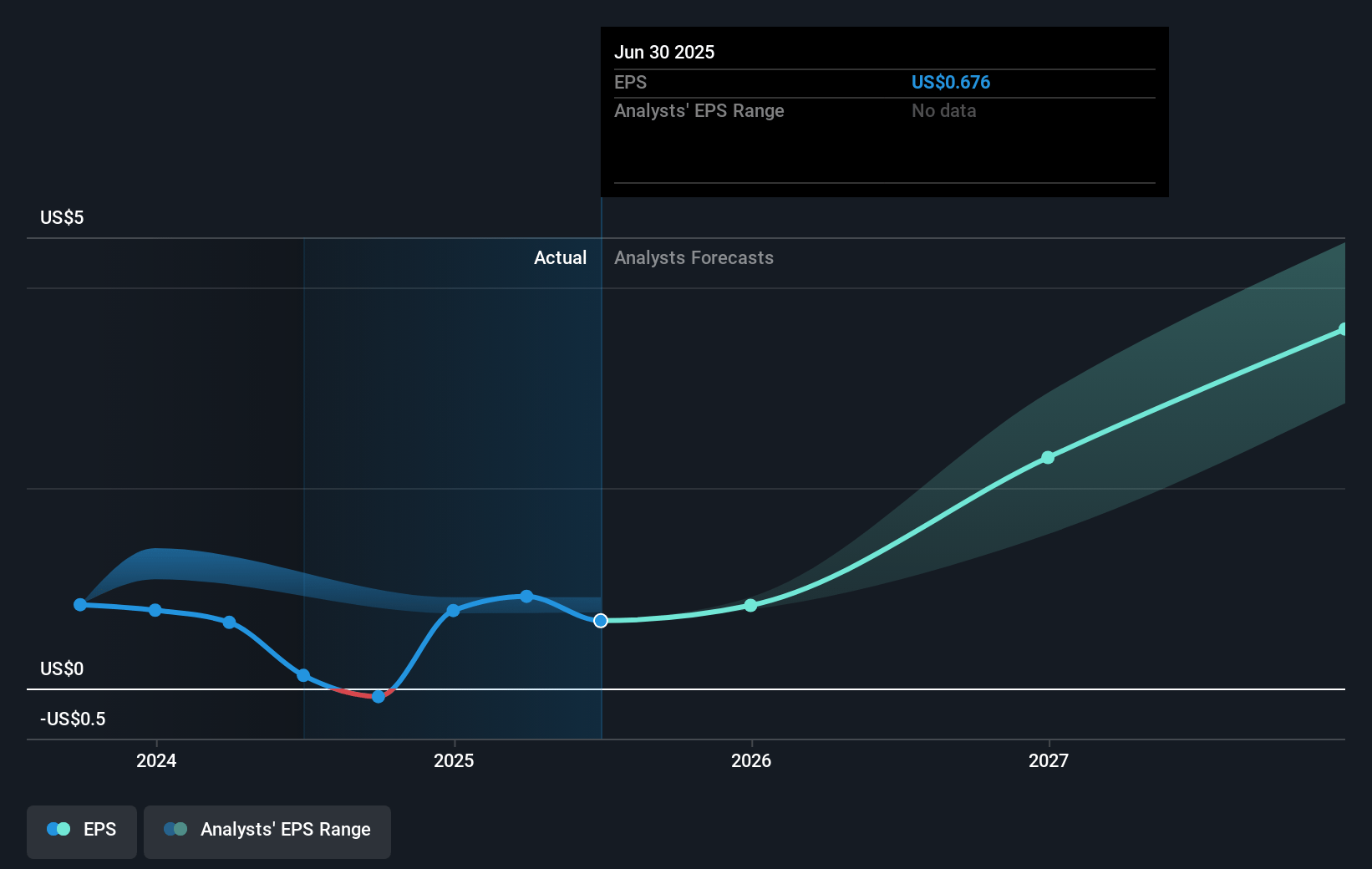

- The bullish analysts expect earnings to reach $2.6 billion (and earnings per share of $4.75) by about April 2028, up from $465.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 32.9x today. This future PE is greater than the current PE for the US Airlines industry at 8.6x.

- Analysts expect the number of shares outstanding to decline by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Southwest Airlines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing above-normal unit cost inflation, particularly in wage rates, airport costs, and healthcare, which could squeeze net margins if these costs are not effectively mitigated.

- There are potential risks with fleet deliveries as Southwest is conservatively planning for just 38 Boeing aircraft deliveries in 2025, significantly lower than the contractual expectation of 136, which could impact capacity and revenue growth.

- The company admitted to cost pressures due to inflation and operational overhead, which if not managed aggressively, could adversely affect net earnings and the ability to meet targeted cost savings.

- Capacity growth is expected to be modest, funded by efficiency initiatives rather than new aircraft, suggesting that revenue growth could be constrained if these initiatives do not yield the anticipated efficiency gains.

- There is uncertainty surrounding the execution timeline of initiatives such as the aircraft cabin retrofits and premium seating upgrades, which could incur additional costs or lead to delays affecting revenue and profit targets for 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Southwest Airlines is $35.94, which represents one standard deviation above the consensus price target of $29.65. This valuation is based on what can be assumed as the expectations of Southwest Airlines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $33.7 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of $25.81, the bullish analyst price target of $35.94 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:LUV. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.