Key Takeaways

- Strategic initiatives like partnerships and new customer products are expected to drive additional revenue streams, supporting future growth.

- Efforts to enhance operational efficiency through cost control measures and fleet strategies aim to improve margins and optimize capital spending.

- Rising unit costs, conservative aircraft deliveries, slow cost-reduction implementation, and market pressures could threaten Southwest Airlines' financial performance and revenue growth.

Catalysts

About Southwest Airlines- Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

- The launch of the Southwest. Even Better. plan aims to boost operational efficiency and lower costs by introducing initiatives like flying red-eye flights and reducing aircraft turn times, which could positively impact net margins by enhancing operational efficiency.

- Strategic partnerships, such as the new partnership with Icelandair, and the introduction of new customer products like Getaways by Southwest, are expected to drive additional revenue streams, positively affecting future revenue growth.

- The implementation of revenue management enhancements, including the reorganization of revenue teams and development of revenue forecasting tools, has already shown positive results and is expected to continue contributing to revenue growth.

- The introduction of digitally-based efficiencies and communication tools is aimed at cost reduction and increased operational agility, which should help in controlling overhead costs and improving net margins.

- The fleet monetization strategy, including the possibility of aircraft sales and sale-leasebacks, aims to optimize capital spending while modernizing the fleet, potentially lowering costs, and enhancing earnings through a reduction in operating and maintenance costs.

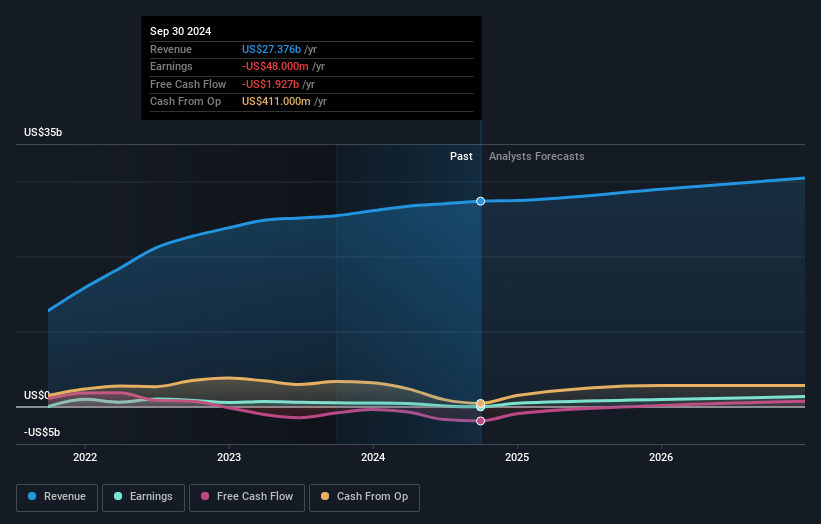

Southwest Airlines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Southwest Airlines's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 4.8% in 3 years time.

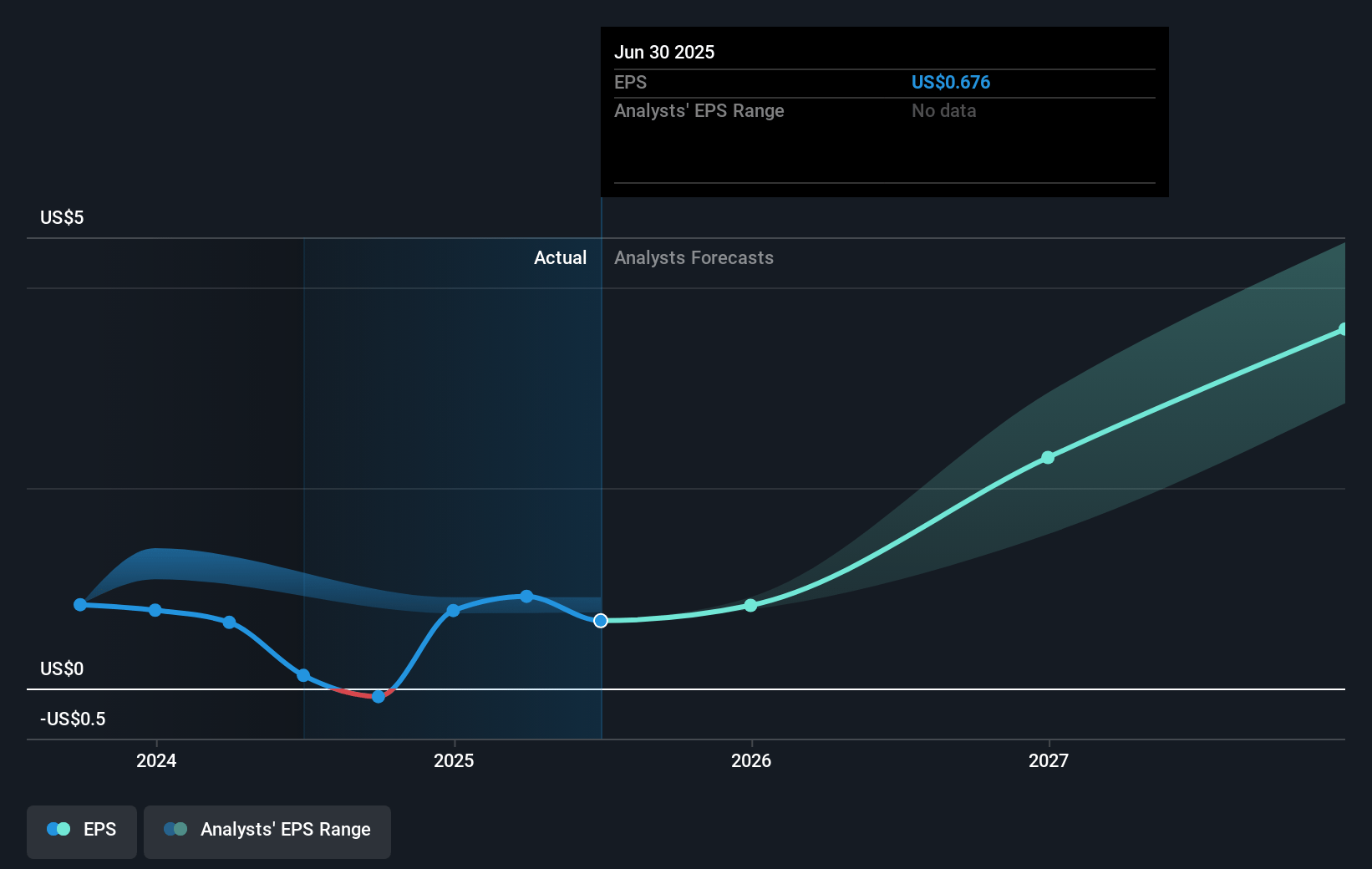

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $2.93) by about March 2028, up from $465.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.8 billion in earnings, and the most bearish expecting $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, down from 37.2x today. This future PE is greater than the current PE for the US Airlines industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Southwest Airlines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Southwest Airlines is experiencing above-normal unit cost inflation, notably from market-driven wage rates, airport costs, and healthcare. This could impact net margins if cost-reduction strategies are not effective.

- The airline is facing conservative aircraft delivery assumptions from Boeing, planning for a lower delivery number than expected. This could affect capacity growth and ultimately impact revenue if aircraft supply issues persist.

- The company acknowledges a delay in fully implementing the $500 million cost reduction plan, which could prolong high operational costs, thereby affecting net earnings if not accelerated.

- Southwest's fleet monetization strategy relies on Boeing's production capabilities; any shortfalls in deliveries could hinder the execution of sales and lead to missed EBIT targets, affecting overall financial performance.

- Above-normal market pressures in the first half of 2024 and concerns about maintaining momentum in revenue growth and yield improvements throughout 2025 could pose risks to achieving targeted revenue and earnings benchmarks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.46 for Southwest Airlines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $32.1 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 7.8%.

- Given the current share price of $29.2, the analyst price target of $31.46 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives