Key Takeaways

- Demand tailwinds and industry supply constraints support revenue growth, but volatile trade flows and market overcapacity risks can quickly compress earnings and margins.

- Maintaining strong capital returns faces headwinds from variable spot rates, stricter regulations, and geopolitical uncertainties that challenge profit stability and dividend sustainability.

- Ongoing earnings weakness, oversupply risk, pressured dividends, high capital needs, and persistent geopolitical uncertainty challenge profitability and revenue reliability for Genco Shipping & Trading.

Catalysts

About Genco Shipping & Trading- Engages in the ocean transportation of drybulk cargoes worldwide.

- Although sustained long-haul trade growth from Brazil and West Africa and increasing infrastructure investments across emerging markets point to steady demand and higher tonne-mile utilization supporting future revenue, Genco faces ongoing trade route volatility and risks from potential protectionist measures or disrupted export flows, which can undermine revenue stability as seen with recent fluctuations in Chinese steel and grain import patterns.

- While low orderbooks for Capesize vessels and rising global fleet age set the stage for favorable supply-demand dynamics and increased pricing power that could boost margins and cash flows, the company remains exposed to risks from front-loaded vessel deliveries and persistent underinvestment in scrapping, which could limit any uplift in freight rates and compress earnings if fleet growth outpaces demand longer-term.

- Despite Genco’s focus on balance sheet strength, with net loan-to-value at 6% and significant undrawn revolver availability to pursue accretive fleet renewal and expansion, continued earnings volatility is likely given the company’s exposure to variable spot market rates, which challenging operating environments could pressure, thereby constraining both near-term earnings and the ability to sustain current dividend levels.

- Although decarbonization of supply chains and the expansion of renewable energy infrastructure are projected to drive sustained demand for commodities that Genco transports, increasingly strict environmental regulations may oblige further capital expenditures for fleet modernization and compliance, eating into free cash flow and potentially reducing net margins if regulatory burdens intensify ahead of expectations.

- While the share repurchase program and 23-quarter track record of uninterrupted dividends highlight management’s confidence and capital return commitment, persistent industry challenges such as unpredictable geopolitical developments and structurally lower utilization during trade disputes can quickly erode operating leverage advantages, presenting downside risk to both revenue growth and total shareholder return.

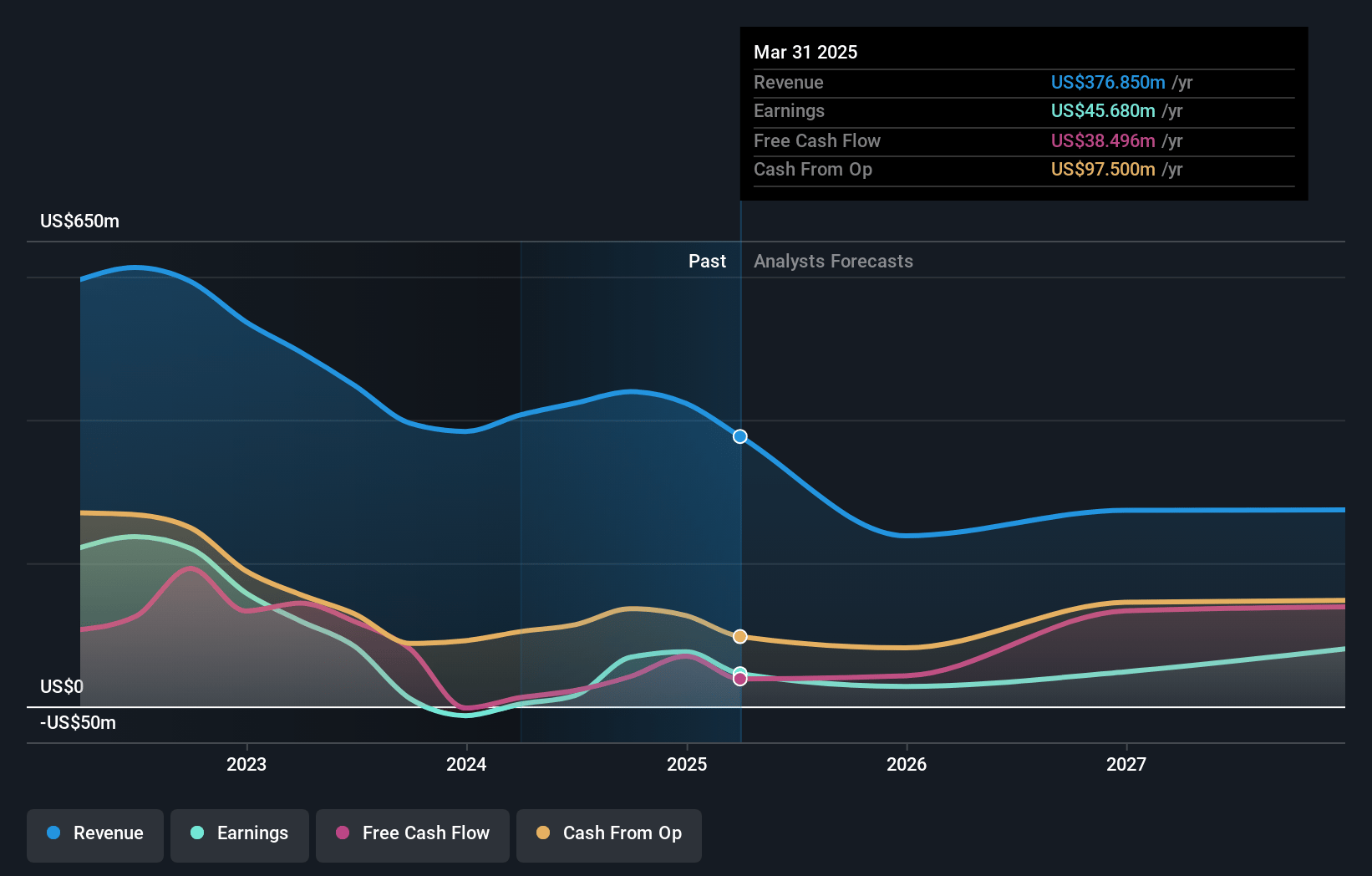

Genco Shipping & Trading Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Genco Shipping & Trading compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Genco Shipping & Trading's revenue will decrease by 12.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.1% today to 30.8% in 3 years time.

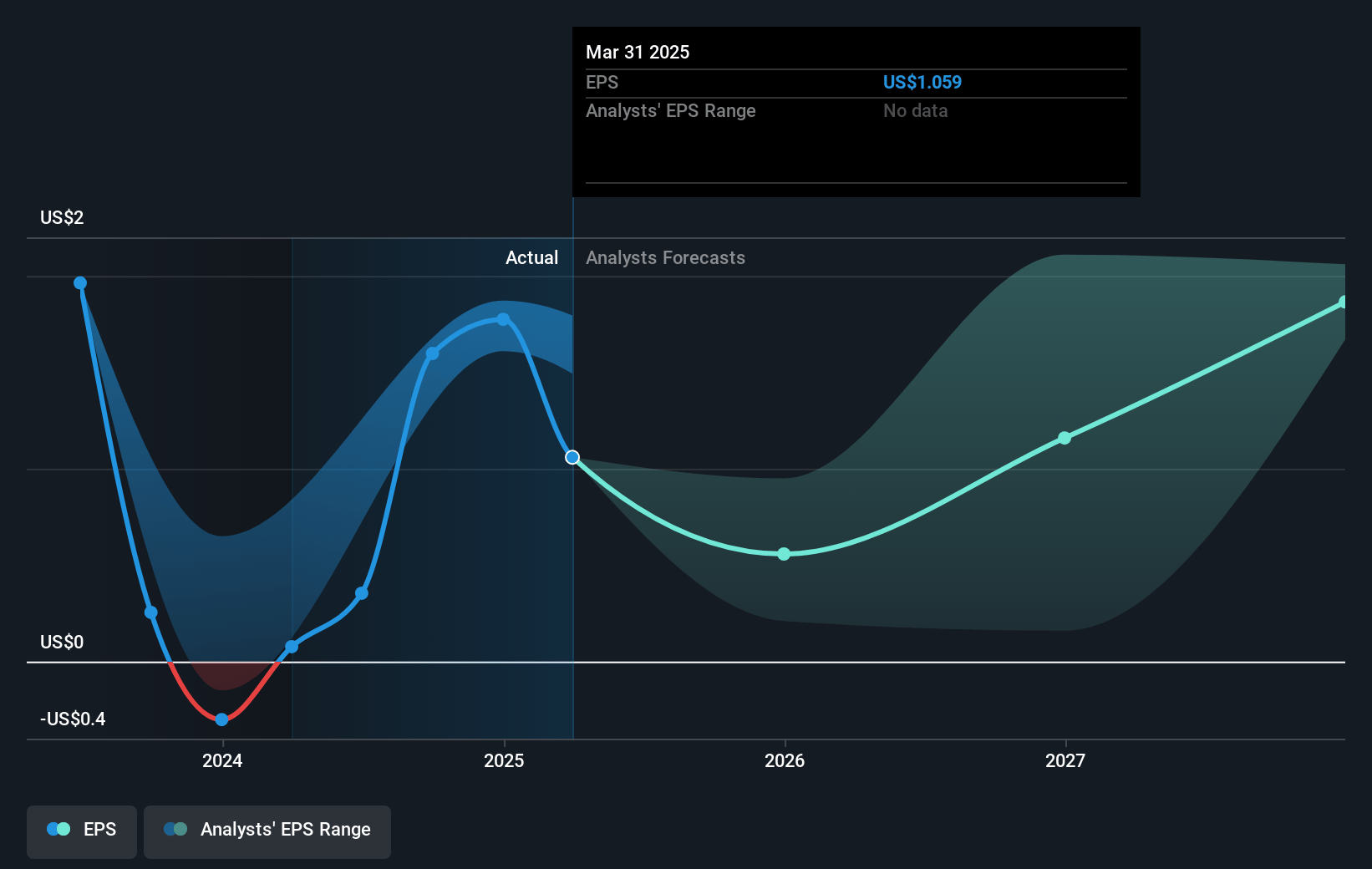

- The bearish analysts expect earnings to reach $78.4 million (and earnings per share of $1.82) by about July 2028, up from $45.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 13.8x today. This future PE is greater than the current PE for the US Shipping industry at 5.6x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Genco Shipping & Trading Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Genco Shipping & Trading reported a net loss of $11.9 million for the first quarter of 2025, indicating ongoing earnings volatility that could persist due to continued dependence on spot market rates, which may pressure future profitability and earnings stability in extended periods of market weakness.

- Annualized net fleet growth in 2025 is running at 3.3%, with even higher growth in Panamax and Handy size segments, suggesting that supply could outpace demand in certain vessel categories and lead to sustained or recurring freight rate weakness, negatively impacting operating revenues.

- The underlying driver of recent dividend payments was an active choice to reduce voluntary reserves rather than strong operating cash flow, as the company said its normal dividend formula would not have produced a dividend this quarter, demonstrating potential stress on free cash flow and greater reliance on discretionary capital allocation to maintain shareholder distributions.

- The company references a fleet modernization program but also acknowledges a need to front-load dry dockings and continued exposure to older vessels, which highlights ongoing requirements for significant capital expenditures to maintain compliance with global environmental standards, potentially reducing net margins due to higher operating and upgrade costs.

- Persistent geopolitical volatility, including tariff disputes and trade friction between the U.S. and China, as well as shifting grain buying patterns, create unpredictable cargo flows and the risk of sudden demand shocks, which may result in lower and less reliable revenues given Genco’s exposure to both minor and major bulk commodities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Genco Shipping & Trading is $14.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Genco Shipping & Trading's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $14.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $254.0 million, earnings will come to $78.4 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $14.66, the bearish analyst price target of $14.9 is 1.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.