Key Takeaways

- Modernizing the fleet and focusing on eco-friendly vessels positions the company to benefit from regulatory changes and operational efficiency improvements.

- Strong financial flexibility and proactive capital allocation enhance resilience and support potential value creation for shareholders.

- Aging fleet, rising regulatory costs, shifting trade patterns, revenue volatility, and smaller scale all threaten future profitability, stability, and competitive positioning.

Catalysts

About Genco Shipping & Trading- Engages in the ocean transportation of drybulk cargoes worldwide.

- Prolonged growth in global population and the expanding middle class in Asia is expected to drive long-term increases in demand for dry bulk commodities such as iron ore, grains, and coal. This results in higher shipping volumes and the potential for sustained elevated charter rates, directly supporting top-line revenue growth and cash flow for Genco Shipping & Trading.

- Long-haul trade growth of key commodities, particularly iron ore and bauxite from Brazil and West Africa to Asia, is projected to accelerate in 2026 and 2027. The longer distances and larger shipment sizes required for these trades will increase ton-mile demand, which should tighten vessel supply and boost utilization rates, contributing to stronger earnings and operating leverage.

- Genco’s fleet modernization and continued investment in more fuel-efficient, eco-friendly vessels positions the company to benefit as stricter global decarbonization regulations (such as IMO2020, EEXI, and CII) phase out older, less efficient tonnage. This should support improved net margins through reduced operating costs and higher charter premiums for compliant vessels.

- With one of the lowest net loan-to-value ratios in the industry, a substantial cash position, and access to significant undrawn revolver capacity, Genco is well-capitalized to act on accretive fleet renewal and expansion opportunities as they arise. This prudent financial structure reduces risk and provides flexibility to scale revenue and earnings during market upswings.

- Ongoing capital allocation measures—including a well-established variable dividend and the newly initiated $50 million share repurchase program—demonstrate management’s commitment to returning value to shareholders. In the event that equity remains undervalued, buybacks can enhance earnings per share and support upward re-rating of the stock.

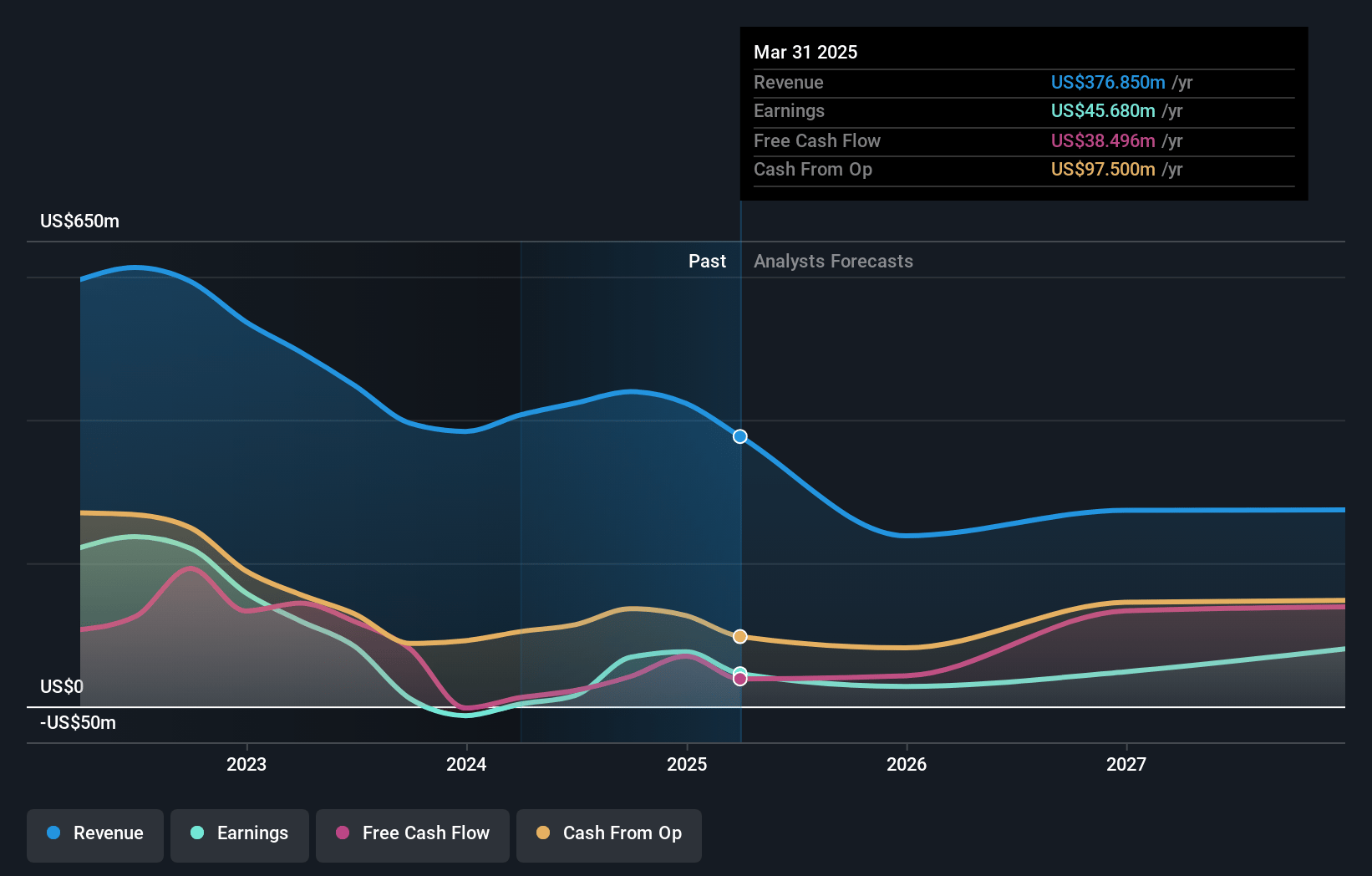

Genco Shipping & Trading Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Genco Shipping & Trading compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Genco Shipping & Trading's revenue will decrease by 12.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.1% today to 38.0% in 3 years time.

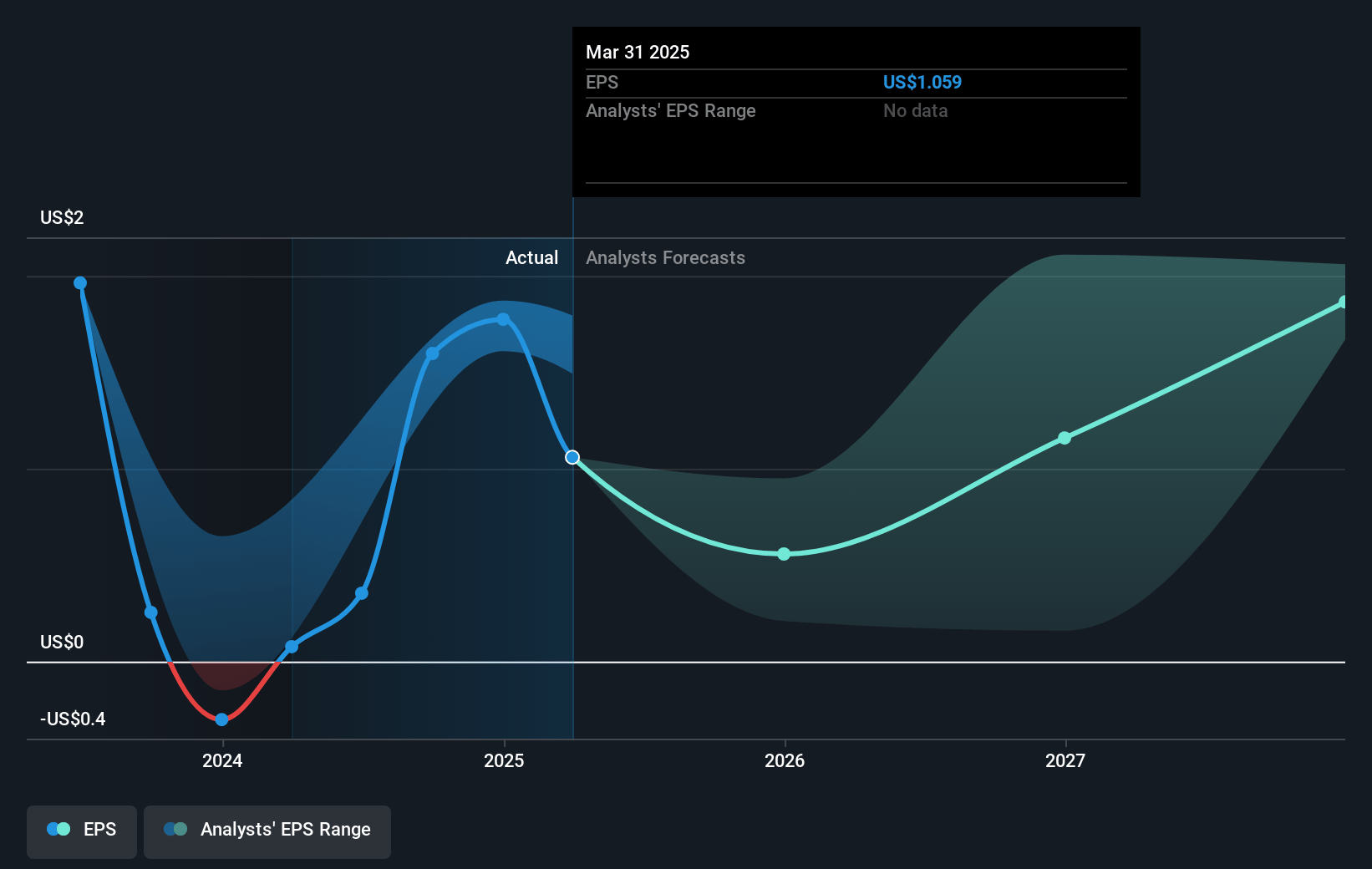

- The bullish analysts expect earnings to reach $96.2 million (and earnings per share of $2.24) by about July 2028, up from $45.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 14.2x today. This future PE is greater than the current PE for the US Shipping industry at 5.8x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Genco Shipping & Trading Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Genco Shipping & Trading operates an aging fleet, with rising average vessel age across the industry and over 10 percent of their fleet 20 years or older, potentially leading to higher maintenance costs, increased capital expenditures for fleet renewal, and risk of asset obsolescence that could erode future net margins and free cash flow.

- As global decarbonization pressures and stricter emissions regulations intensify, Genco’s traditionally fueled vessels face escalating compliance costs and may require expensive technological upgrades, thereby squeezing future net margins and requiring substantial capital outlays.

- Structural shifts in global trade patterns, including the ongoing trend toward nearshoring and regionalization, threaten to reduce demand for long-haul dry bulk shipping. This could depress vessel utilization and put downward pressure on Genco’s long-run fleet revenue and growth potential.

- Genco’s ongoing reliance on the spot market for much of its revenue exposes the company to significant earnings volatility, as evidenced by quarter-to-quarter swings in freight rates. This volatility raises the risk of inconsistency in future earnings and potential disruption in dividend payments.

- The company’s relatively modest scale compared to larger, more diversified peers may limit its bargaining power with customers and suppliers, posing challenges to sustaining healthy margins and diminishing resilience during periods of cyclical downturns or industry overcapacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Genco Shipping & Trading is $29.18, which represents two standard deviations above the consensus price target of $19.77. This valuation is based on what can be assumed as the expectations of Genco Shipping & Trading's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $14.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $253.6 million, earnings will come to $96.2 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $15.1, the bullish analyst price target of $29.18 is 48.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.