Key Takeaways

- Operational cost optimization initiatives and technology-driven efficiencies are expected to structurally improve margins and earnings leverage as demand rebounds.

- Strong positioning in healthcare logistics and global e-commerce enhances revenue growth potential and pricing power amid evolving cross-border trade dynamics.

- Structural cost pressures, changing customer preferences, and macroeconomic headwinds threaten FedEx's revenue quality, operating margins, and future growth prospects.

Catalysts

About FedEx- Provides transportation, e-commerce, and business services in the United States and internationally.

- While analysts broadly agree that the DRIVE initiative will deliver $4 billion in cost savings and materially improve net margins, the rapid institutionalization of DRIVE as a permanent operational discipline could unlock cost efficiencies well beyond targets, structurally lowering FedEx's cost base and enabling significantly higher margin expansion and earnings leverage once volume rebounds.

- Analyst consensus appreciates Network 2.0's projected 12 percent optimized volume flow in FY '25, but with 40 percent of global daily volume targeted for optimized facilities by the end of FY '26 and continuous process learning, the resulting productivity gains and asset utilization efficiencies could support sustained double-digit operating income growth as volumes recover, far exceeding consensus estimates.

- FedEx's surging momentum in high-margin healthcare logistics-demonstrated by the onboarding of nearly $400 million in new annualized revenue and deployment of proprietary AI-driven visibility solutions-positions the company to capitalize on secular growth in healthcare and life sciences shipping, offering robust incremental revenue and margin upside.

- The expansion of flexible, technology-enabled global infrastructure, together with Sunday residential delivery now reaching two-thirds of the U.S. population, places FedEx in an unrivaled position to capture disproportionate share from accelerating e-commerce and urban middle-class growth internationally, driving long-term volume and pricing power.

- FedEx's real-time, proprietary global data infrastructure and automated customs capabilities uniquely equip it to navigate increasingly complex cross-border trade environments and regulatory shifts, making it the partner of choice as new trade corridors and e-commerce flows emerge-supporting both customer retention and premium yield expansion.

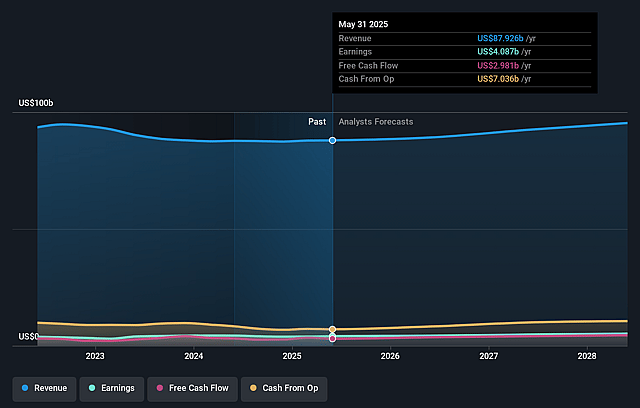

FedEx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on FedEx compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming FedEx's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.5% today to 5.8% in 3 years time.

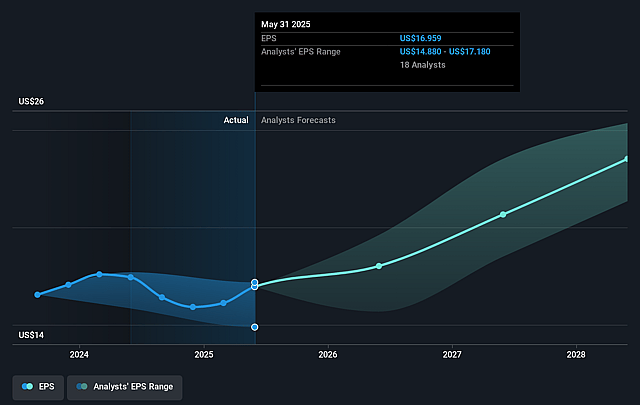

- The bullish analysts expect earnings to reach $5.7 billion (and earnings per share of $25.5) by about June 2028, up from $3.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 13.6x today. This future PE is greater than the current PE for the US Logistics industry at 15.8x.

- Analysts expect the number of shares outstanding to decline by 1.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

FedEx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness and uncertainty in the industrial economy, particularly in B2B segments, is weighing on FedEx's higher-margin freight volumes and resulting in flat to declining revenue guidance for fiscal year 2025, which could further compress operating income if global industrial activity does not recover.

- Ongoing and higher-than-expected inflationary pressures, especially in labor and operational costs, are proving difficult to fully offset and are a structural challenge; this risk could continue to erode net margins and limit future earnings growth even as cost-cutting programs like DRIVE progress.

- The shift in customer demand to lower-yielding, deferred service offerings and volume growth in lower-margin products is placing downward pressure on average yields and increasing the risk that overall revenue quality is diluted, potentially impacting both revenue and earnings.

- The acceleration of digitalization and customer adoption of remote work may limit the long-term growth of commercial shipping volumes, eroding a core revenue base and putting future top-line growth at risk if e-commerce and new verticals do not fully compensate.

- Global trade uncertainty, supply chain re-localization, and impending regulatory changes such as those related to de minimis shipments and environmental sustainability could increase compliance costs and reduce cross-border shipping activity, leading to lower international revenue and higher expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for FedEx is $339.85, which represents two standard deviations above the consensus price target of $272.65. This valuation is based on what can be assumed as the expectations of FedEx's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $354.0, and the most bearish reporting a price target of just $200.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $97.3 billion, earnings will come to $5.7 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $222.53, the bullish analyst price target of $339.85 is 34.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.