Key Takeaways

- Anticipated recession could lower demand and impact United's topline growth, as weaker consumer spending reduces revenue projections.

- Investments in brand loyalty and strategic capacity adjustments may not yield immediate gains, affecting short-term margins and earnings.

- United Airlines faces significant revenue challenges from decreased travel demand, weaker bookings, declining international volumes, and potential tariff impacts on aircraft.

Catalysts

About United Airlines Holdings- Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

- There is anticipation of lower demand due to a recessionary environment, which may lead to reduced revenue projections as weaker consumer spending impacts United Airlines' sales. This forward-looking risk reflects potential challenges in maintaining topline growth.

- United Airlines plans to invest in building brand loyalty through customer experience enhancements such as larger clubs and high-speed WiFi. However, there is a concern that these investments may not translate to immediate revenue gains, affecting short-term net margins.

- The company's deliberate reduction in domestic capacity, specifically off-peak flights, is aimed at stabilizing yield in light of lower demand. This strategic move may not fully offset the revenue decline and could exert pressure on future earnings.

- A slowdown in co-brand and loyalty revenue growth from government and related segments could impact net margins and earnings if economic conditions drive softer demand.

- Anticipated supply challenges with international aircraft deliveries may limit United's ability to capitalize on international travel recovery, which risks constraining revenue expansion opportunities and dampening expected earnings growth.

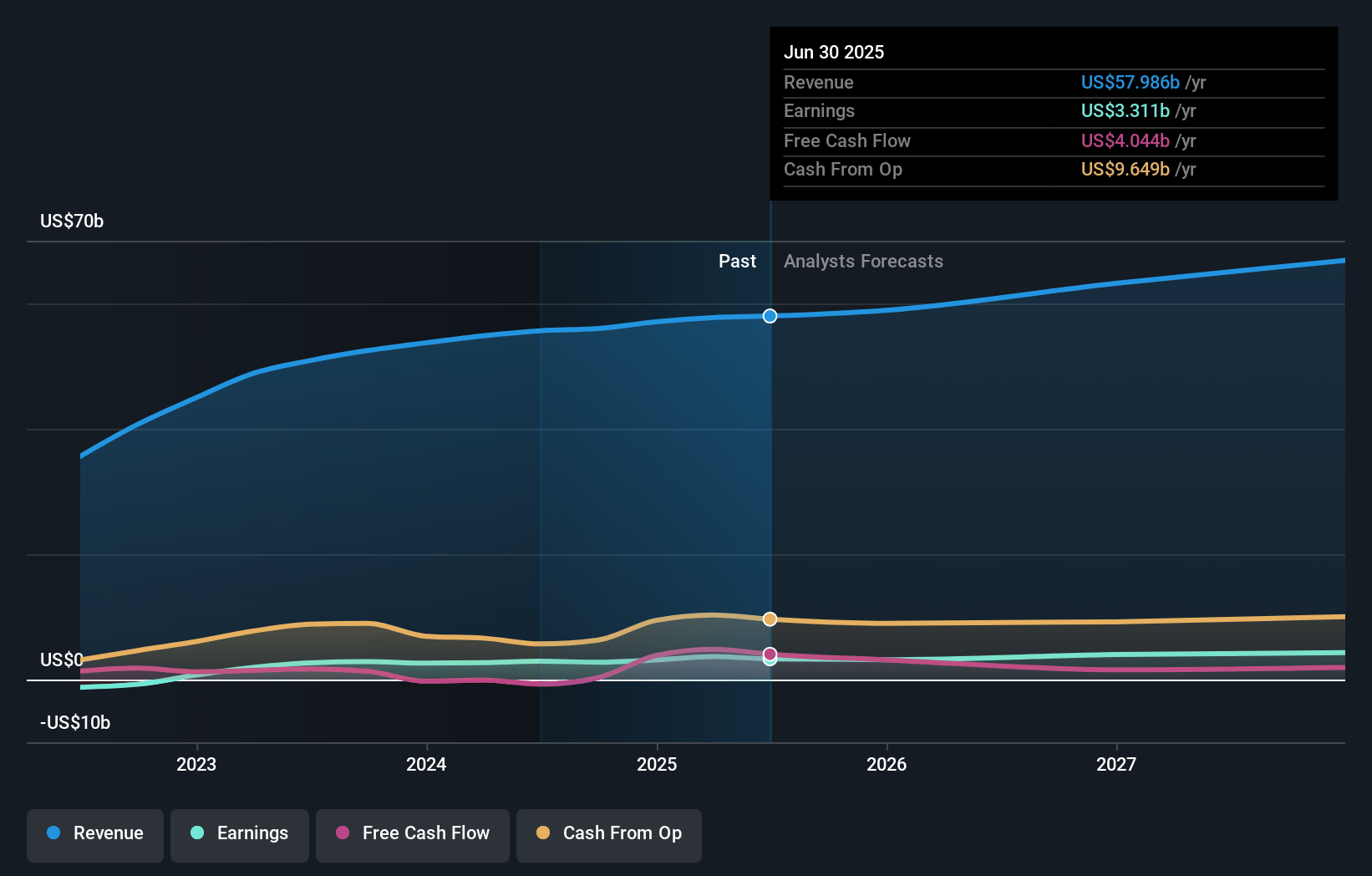

United Airlines Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on United Airlines Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming United Airlines Holdings's revenue will grow by 2.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.3% today to 5.6% in 3 years time.

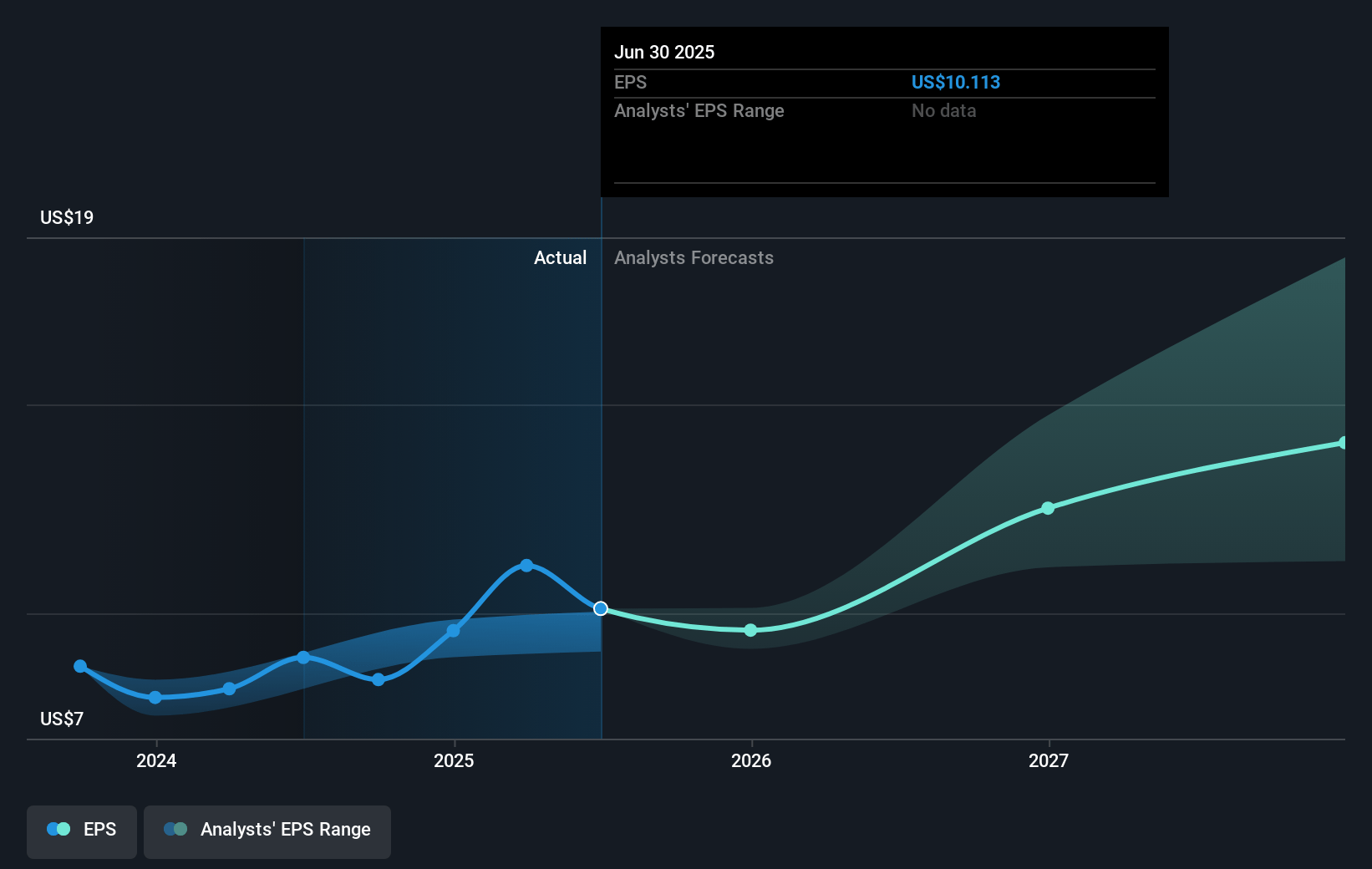

- The bearish analysts expect earnings to reach $3.5 billion (and earnings per share of $11.18) by about April 2028, down from $3.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from 5.8x today. This future PE is greater than the current PE for the US Airlines industry at 8.6x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.06%, as per the Simply Wall St company report.

United Airlines Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The softer macroeconomic environment is leading to market volatility and decreased demand for travel, which could negatively impact United Airlines' revenues and earnings.

- The company anticipates reasonable chances of bookings weakening further, creating potential downside risks for their revenue forecasts.

- Off-peak flight revenues are significantly lower, and with projected cancellations and lower utilization relying on less profitable capacity, this could challenge United's net margins.

- International non-U.S. origin passenger volumes are declining, with noticeable booking drops from Europe and Canada, which could impact international flight revenues.

- United Airlines is exposed to risks from tariffs on aircraft, particularly non-U.S. manufactured Airbus planes, which could affect capital expenditures and net margins if tariffs are enforced.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for United Airlines Holdings is $72.6, which represents one standard deviation below the consensus price target of $94.94. This valuation is based on what can be assumed as the expectations of United Airlines Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $62.0 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of $65.3, the bearish analyst price target of $72.6 is 10.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.