Last Update 21 Nov 25

Fair value Increased 4.21%SBLK: Dividend Increase Will Drive Higher Profit Margins And Earnings

Analysts have raised their price target for Star Bulk Carriers from $21.86 to $22.78. They cite improved revenue growth expectations and stronger profit margins as key drivers for the increased valuation.

What's in the News

- The company announced a quarterly cash dividend increase to $0.11 per share, effective December 18, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $21.86 to $22.78.

- Discount Rate has fallen moderately from 11.31% to 10.93%.

- Revenue Growth expectations have shifted positively, moving from -3.81% to 1.43%.

- Net Profit Margin is now higher, increasing from 51.77% to 56.58%.

- Future P/E ratio has declined from 6.01x to 5.16x, which indicates improved value relative to earnings.

Key Takeaways

- Fleet modernization and eco-upgrades position the company to capitalize on tighter emissions regulations and improved efficiency, supporting margin and earnings growth.

- Tight vessel supply, rising demand for key commodities, and disciplined capital allocation strategies are expected to drive strong fleet utilization and enhanced shareholder returns.

- Structural demand weakness, an aging fleet, high leverage, rising compliance costs, and volatile trade dynamics threaten long-term profitability and financial stability.

Catalysts

About Star Bulk Carriers- A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

- The ongoing replacement of older, less efficient vessels with newbuilds and eco upgrades positions the fleet to benefit from tightening global emissions standards, enabling lower operating expenses and potential for higher charter rates, thereby supporting improved net margins and overall earnings.

- Limited new vessel supply, caused by a historically low orderbook, strong shipyard constraints, and uncertainty around future green technologies, should maintain a tight tonnage market through 2027-allowing Star Bulk to benefit from stronger utilization and higher time charter revenues.

- Global GDP growth revisions and renewed infrastructure spending, especially in emerging markets, are expected to revive demand for iron ore, steel, grains, and minor bulks-key commodities for dry bulk shipping-offering upside to fleet utilization and revenue growth.

- Active capital allocation-demonstrated through ongoing share buybacks and disciplined dividend payouts-optimizes EPS by reducing share count and supporting shareholder returns even during volatile market periods.

- Investments in digitalization, operational optimization, and new energy-saving technologies are set to reduce OpEx per vessel and enhance fleet productivity, boosting EBITDA margins and sustainable long-term profitability.

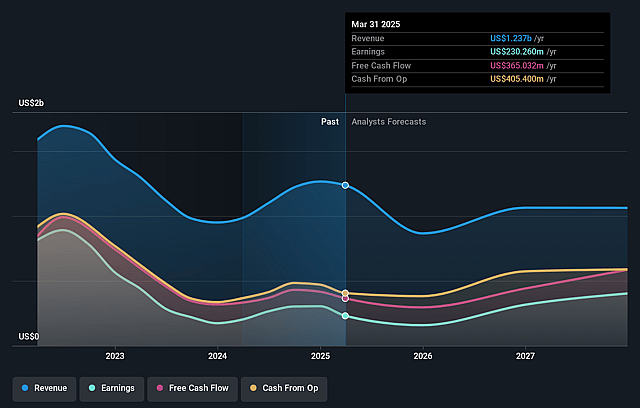

Star Bulk Carriers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Star Bulk Carriers's revenue will decrease by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.0% today to 51.8% in 3 years time.

- Analysts expect earnings to reach $521.3 million (and earnings per share of $3.35) by about September 2028, up from $124.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, down from 18.1x today. This future PE is lower than the current PE for the US Shipping industry at 8.4x.

- Analysts expect the number of shares outstanding to decline by 3.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.31%, as per the Simply Wall St company report.

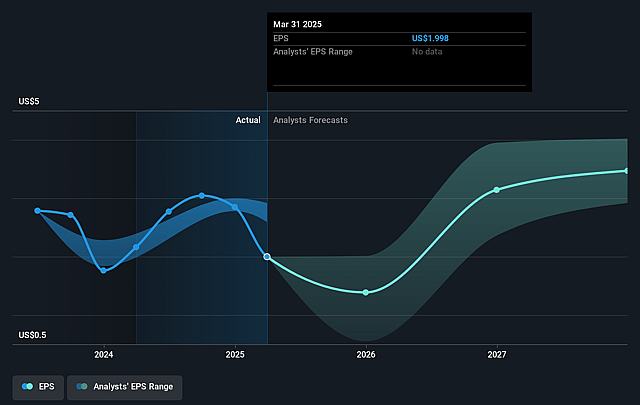

Star Bulk Carriers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dry bulk trade growth is projected to be nearly flat, with 2025 volumes expected to contract by 0.9% and only marginal growth in subsequent years, signaling structural weakness in demand for Star Bulk's services and risking long-term revenue stagnation.

- The company has an aging fleet with an average age of 11.9 years, requiring ongoing and significant capital expenditures for vessel upgrades, dry docking, and compliance retrofits, likely compressing net margins and increasing capex relative to peers with newer fleets.

- Heavily relying on debt ($1.12 billion total debt against total cash of $407 million), Star Bulk's high leverage exposes it to higher financial risk, especially if interest rates rise or if freight rates drop, which would adversely affect earnings and balance sheet flexibility.

- Intensifying decarbonization and global environmental regulations (e.g., IMO 2028 and beyond) may drive up operational and compliance costs, particularly as the company still needs to invest in alternative fuel technologies and is only in the early stages of exploring these options, risking further margin erosion.

- Exposure to volatile commodity cycles and shifting global trade dynamics-such as the decline in Chinese dry bulk imports, contracting coal trade, and uncertainties from tariffs-may cause unpredictable cash flows and earnings volatility, undermining long-term financial stability and investor returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.86 for Star Bulk Carriers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $18.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $521.3 million, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 11.3%.

- Given the current share price of $19.72, the analyst price target of $21.86 is 9.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.