Last Update 19 Dec 25

Fair value Increased 22%SBLK: Future Returns Will Reflect Dividend Payouts And Share Repurchases

Analysts have raised their price target on Star Bulk Carriers from 15.50 dollars to 18.90 dollars, citing a shift to positive revenue growth expectations, stronger profit margins, and a modestly lower discount rate. Together, these factors justify a higher valuation multiple.

What's in the News

- Board declares a quarterly cash dividend of $0.11 per share, payable on or about December 18, 2025 to shareholders of record as of December 5, 2025. This highlights continued capital returns to investors (Key Developments).

- Company reports completion of a share repurchase tranche totaling 462,476 shares, or 0.4% of shares, for $8.6 million under its buyback program announced on August 6, 2025. This signals confidence in intrinsic value (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen moderately from $15.50 to $18.90 per share, reflecting a higher intrinsic valuation.

- The Discount Rate has declined slightly from 11.62% to about 11.15%, implying a modestly lower required return on capital.

- The Revenue Growth outlook has improved significantly from a projected contraction of approximately 7.9% to expected growth of about 4.5%.

- The Net Profit Margin forecast has increased from roughly 39.4% to about 43.6%, indicating expectations of stronger profitability.

- The Future P/E multiple has edged down from about 6.16x to roughly 5.16x, suggesting a cheaper valuation relative to expected earnings.

Key Takeaways

- Decarbonization trends and supply chain localization threaten core revenue streams, shrinking Star Bulk's market and pressuring growth prospects.

- An aging fleet and slow modernization risk higher operating costs and reduced competitiveness, magnifying profitability challenges and hurting long-term returns.

- Cost synergies, fleet modernization, and reduced debt position Star Bulk for improved profitability and competitiveness as tighter regulations and modest industry growth support freight rates.

Catalysts

About Star Bulk Carriers- A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

- The accelerating global shift toward decarbonization and energy transition is set to steadily erode long-term demand for seaborne transportation of coal, iron ore, and other fossil fuel-related cargoes, which represent a significant portion of Star Bulk Carriers' revenues. This secular decline in core cargo volumes is likely to suppress top-line growth and lead to recurring pressure on long-term company revenue.

- Major economies are increasingly prioritizing localized manufacturing and supply chain resiliency, reflected in policy shifts toward nearshoring and reshoring production. As a result, the addressable market for global seaborne bulk trade is likely to shrink structurally, leading to reductions in vessel utilization rates and day rates, which will negatively impact Star Bulk's revenue and earnings power over the next decade.

- Star Bulk's aging fleet, with an average age of nearly 12 years, faces escalating capital expenditure requirements for retrofitting or replacement to comply with tightening environmental regulations. As the International Maritime Organization introduces stricter greenhouse gas emissions targets and fuel intensity standards, recurring high CapEx and increased depreciation will depress operating margins and erode long-term return on assets.

- Heavy reliance on global commodity cycles exposes Star Bulk to volatility in freight rates and charter markets. With projected contractions in bulk trade volumes for iron ore, coal, and grains in the coming years, combined with persistent overcapacity in the dry bulk shipping sector due to sluggish demolition of older vessels, there is a severe risk of suppressed profitability and earnings through recurring market downturns.

- Anticipated ramp-up of digitalization and operational efficiency among competitors, coupled with adoption of larger, more fuel-efficient vessels industrywide, could outpace Star Bulk's current fleet renewal efforts and push operating costs higher relative to peers. This competitive disadvantage will compress margins and erode Star Bulk Carriers' earnings unless dramatic reinvestment occurs, which would further pressure free cash flow and long-term shareholder returns.

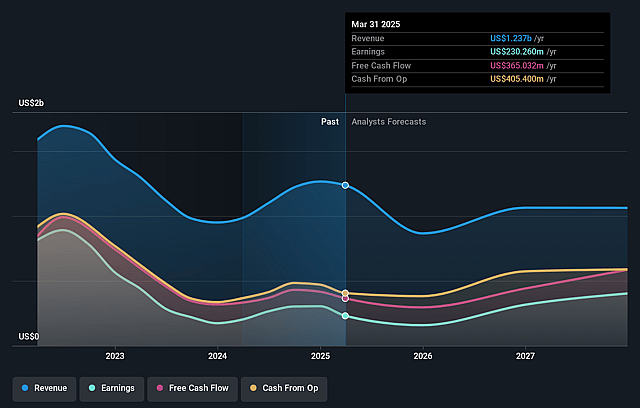

Star Bulk Carriers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Star Bulk Carriers compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Star Bulk Carriers's revenue will decrease by 7.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 18.6% today to 39.4% in 3 years time.

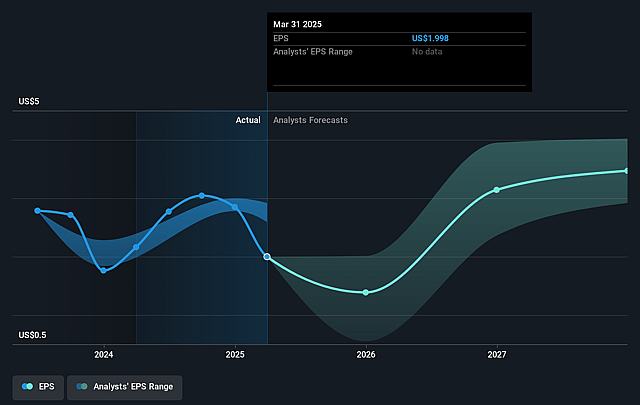

- The bearish analysts expect earnings to reach $381.4 million (and earnings per share of $3.26) by about July 2028, up from $230.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, down from 9.0x today. This future PE is greater than the current PE for the US Shipping industry at 5.2x.

- Analysts expect the number of shares outstanding to decline by 1.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.62%, as per the Simply Wall St company report.

Star Bulk Carriers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has achieved nearly $40 million in cost synergies from the Eagle Bulk integration, with significant reductions in operating expenses, dry dock costs, and interest expenses, which are likely to support profitability and net margins even in a challenging market environment.

- Star Bulk has been actively deleveraging, reducing its average net debt per vessel by over 50% since 2021 and now holds a net debt position covered by fleet scrap value, greatly strengthening its balance sheet and lowering financial risk, which supports future earnings and dividends.

- The company is modernizing its fleet by disposing less efficient, older vessels and investing in new eco-friendly ships and energy-saving retrofits, a strategy that should enhance fleet efficiency, reduce operating costs, and help safeguard future net margins and vessel utilization as regulations tighten.

- Supply discipline in the industry is evident, with the global order book at multi-year lows, high newbuilding costs, uncertainty around future fuel technologies, and limited shipyard capacity, all of which are expected to keep fleet growth modest and tighten supply-demand balance, providing potential upside to vessel charter rates and Star Bulk's revenue.

- Regulatory changes, such as the new IMO greenhouse gas fuel intensity metric and stricter emission targets, may incentivize slow steaming and support higher freight rates for compliant operators like Star Bulk, giving them a competitive advantage and potentially boosting long-term revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Star Bulk Carriers is $15.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Star Bulk Carriers's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $15.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $967.7 million, earnings will come to $381.4 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 11.6%.

- Given the current share price of $17.95, the bearish analyst price target of $15.5 is 15.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Star Bulk Carriers?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.