Last Update01 May 25Fair value Increased 1.02%

AnalystConsensusTarget has decreased revenue growth from 0.4% to -0.1%.

Read more...Key Takeaways

- Strategic spin-off of Sunrise and UK fiber investments aim to enhance shareholder value through dividend potential, revenue growth, and improved competitive positioning.

- AI initiatives and asset disposals for share buybacks focus on driving cost savings, boosting EPS, and enhancing net margins through infrastructure and technology investments.

- Execution risks, capital expenditure burdens, and competitive pressures challenge Liberty Global's revenue growth, impacting net margins and market valuation perceptions negatively.

Catalysts

About Liberty Global- Provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers.

- The strategic spin-off of Sunrise has unlocked shareholder value and is expected to drive future valuation growth by tapping into local investor demand and offering potential for sizable dividends, impacting both revenue and free cash flow.

- The establishment of a fixed NetCo in the U.K. to finance fiber build-out highlights Liberty Global's focus on infrastructure investments, expected to enhance EBITDA by attracting infrastructure investors and potentially offering better competitive positioning against BT Openreach.

- Liberty Global's intention to leverage AI initiatives is anticipated to drive $200 million to $300 million in annual benefits, focusing primarily on cost savings and revenue enhancements, thus supporting improvements in net margins.

- A commitment to significant share buybacks of up to 10% in 2025, funded by non-core asset disposals and strategic investments, is designed to enhance EPS by reducing the share count and increasing the ownership stake of existing shareholders.

- The ongoing pivot towards Liberty Growth, with plans to sell $500 million to $750 million of non-core assets and focus on higher-return investments in technology, media, and infrastructure, is expected to bolster future earnings and provide a clearer valuation of growth assets.

Liberty Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Liberty Global's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts are not forecasting that Liberty Global will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Liberty Global's profit margin will increase from 41.7% to the average US Telecom industry of 12.9% in 3 years.

- If Liberty Global's profit margin were to converge on the industry average, you could expect earnings to reach $558.3 million (and earnings per share of $1.97) by about May 2028, down from $1.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 2.1x today. This future PE is lower than the current PE for the US Telecom industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 6.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

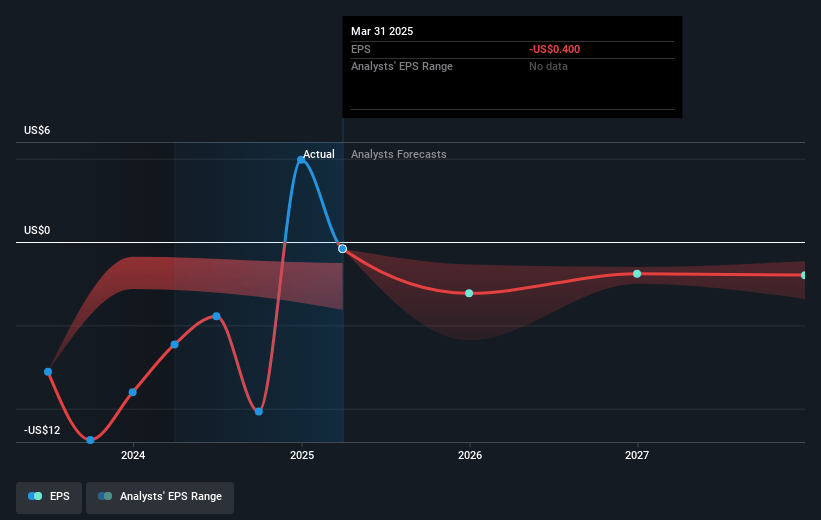

Liberty Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The telecom assets of Liberty Global are perceived to have zero equity value, highlighting market skepticism about the company's ability to realize higher valuations, which can affect revenue and earnings.

- The financial performance in key markets, such as Telenet and VodafoneZiggo, shows revenue declines and adjusted EBITDA decreases due to customer base contractions and competitive pressures, directly impacting net margins.

- There are execution risks related to the strategic pivot and asset sales or spins planned for the coming years, which if delayed or unfavorable, could hamper the company's projected earnings and revenue growth.

- The company's significant capital expenditure on network infrastructure, especially in broadband and 5G, could burden short-term cash flows and delay free cash flow realization, affecting net margins.

- Potential future increases in MSA fees from operating companies could strain their individual EBITDA or free cash flow, thus impacting the overall valuation and perceived growth prospects of Liberty Global.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.516 for Liberty Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $10.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $558.3 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 7.2%.

- Given the current share price of $11.02, the analyst price target of $16.52 is 33.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.