Key Takeaways

- Iridium's NTN Direct using L-band technology and Certus IoT service expansions aim to grow its consumer and maritime communications markets, driving revenue growth.

- Strategic partnerships and acquisitions, including Satelles for PNT solutions and expanded government contracts, enhance Iridium's market offerings and revenue stability.

- Heightened competition, reliance on large contracts, and high investment needs pose risks to Iridium's market share, revenue stability, and financial flexibility.

Catalysts

About Iridium Communications- Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

- Iridium's Project Stardust, which will launch as NTN Direct in early 2026, is making significant progress and will use L-band technology in new industry-standard chipsets as part of 3GPP Release 19. This project aims to expand Iridium's reach in the consumer D2D market and supports future revenue growth in smartphone and wearable technology markets.

- The introduction of new products, like the Garmin inReach Messenger Plus, leveraging Iridium's Certus IoT service, is expected to drive increased usage and attract more consumers globally, thereby positively impacting revenue through increased product adoption and sales.

- Iridium is positioning its GMDSS services to take advantage of new terminals and expanded capabilities, providing essential maritime safety services in a cost-effective manner, which is expected to solidify its market position and contribute to revenue growth in maritime communications.

- The ongoing expansion of the Space Development Agency contract, now valued at approximately $400 million, significantly increases Iridium's scope of work in managing and integrating satellite ground infrastructure, supporting revenue growth in engineering services and increasing predictability in government contract revenue.

- The acquisition of Satelles and the integration of Satellite Time and Location (STL) services into Iridium's offerings positions the company as a leader in alternative PNT solutions. This is expected to address growing threats to GPS signals, driving additional revenues from commercial and civil applications, with the potential for significant future earnings as the market for secure PNT services grows.

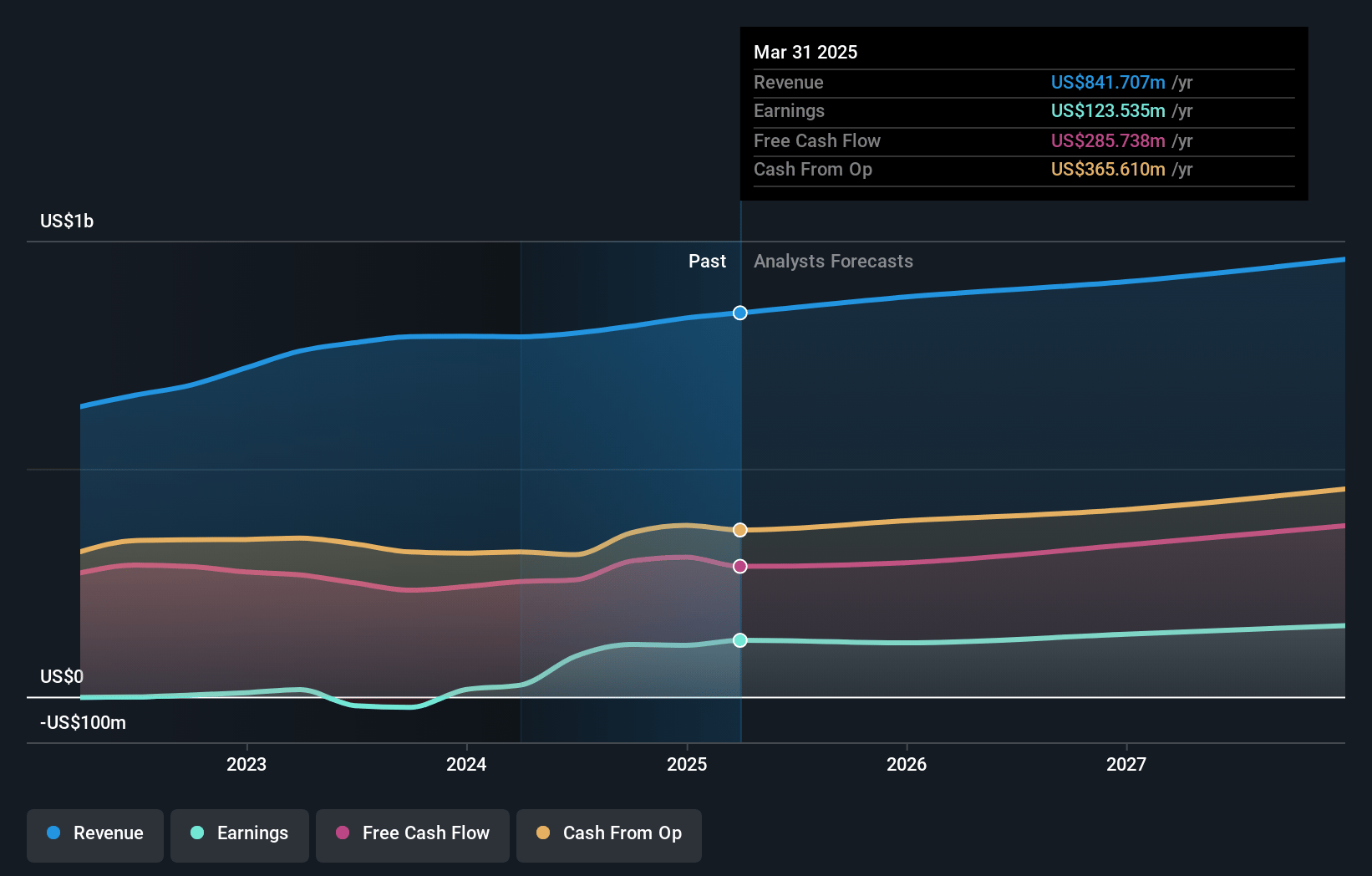

Iridium Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Iridium Communications's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.1% today to 13.8% in 3 years time.

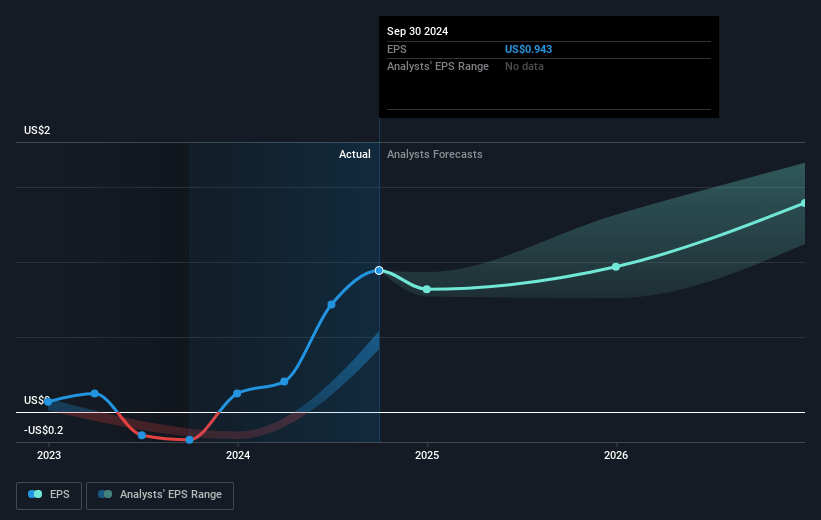

- Analysts expect earnings to reach $128.0 million (and earnings per share of $1.22) by about January 2028, up from $114.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $163.0 million in earnings, and the most bearish expecting $110.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.4x on those 2028 earnings, up from 29.9x today. This future PE is greater than the current PE for the US Telecom industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 2.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Iridium Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing competition from Starlink and other providers in satellite communication could challenge Iridium's position, potentially impacting future market share and revenues.

- Changes in subscription plans or contracts with key IoT customers, leading to varying net subscriber additions, present a risk to subscriber growth trends and future projected earnings.

- The reliance on sales from large contracts such as those with government agencies implies a risk of revenue fluctuations should these contracts face issues or delays, impacting revenue stability.

- The projected increase in net leverage due to share repurchases and dividend programs could strain financial flexibility and margins in the near term.

- The need to continuously invest in new product development and integration for services like Iridium NTN Direct requires significant capital, which might affect short-term net margins and liquidity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.43 for Iridium Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $929.7 million, earnings will come to $128.0 million, and it would be trading on a PE ratio of 39.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $30.1, the analyst's price target of $40.43 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

LA

latentbiologist

Community Contributor

IRDM: Leveraging Satelles Synergies with Opportunistic Buybacks for Long-Term Growth

Investment Thesis : Iridium Communications (IRDM) represents a compelling long-term investment opportunity driven by its strategic positioning in the satellite communications industry and its recent acquisition of Satelles. This acquisition enables Iridium to leverage its existing infrastructure to capitalize on the growing demand for secure positioning, navigation, and timing systems (PNTS) as alternatives to aging GPS technology.

View narrativeUS$38.60

FV

19.5% undervalued intrinsic discount3.87%

Revenue growth p.a.

5users have liked this narrative

0users have commented on this narrative

43users have followed this narrative

3 months ago author updated this narrative