Key Takeaways

- New satellite IoT solutions and proprietary wireless technologies drive expansion into enterprise markets and recurring service revenues.

- Enhanced global partnerships, regulatory support, and upgraded infrastructure strengthen long-term revenue stability and operational scale.

- Heavy investment needs, customer concentration, and regulatory uncertainty create margin pressure and financial risk amid intense competition and evolving technology in satellite and wireless markets.

Catalysts

About Globalstar- Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

- The launch of Globalstar's new 2-way satellite IoT solution expands the company's addressable market beyond one-way tracking, directly targeting rising demand for reliable, low-power, low-latency IoT applications in sectors like logistics and agriculture, supporting sustained subscriber growth and higher service revenues.

- Continued innovation and near-term commercial deployment of proprietary XCOM RAN and Band 53 terrestrial wireless solutions position Globalstar for rapid entry into private network markets and new enterprise use cases, unlocking incremental recurring revenues and margin expansion as utilization grows.

- The advanced Satellite Operations Control Center and next-generation LEO constellation rollout enable improved network performance, expanded service capabilities, and higher-volume partnerships, reinforcing the stability and scalability of long-term contract and service revenues.

- Deepened relationships with major wholesale partners (e.g., anchor wholesale customer, government, large retailers), combined with a global supply chain strategy mitigating tariff risk, drive revenue visibility and might contribute to more stable, growing earnings.

- Global regulatory support for expanded spectrum utilization-evidenced by influential stakeholders at company events and differentiated global spectrum holdings-enhances Globalstar's positioning as a key enabler for critical and emergency communications, underpinning long-term revenue growth and improved operating leverage.

Globalstar Future Earnings and Revenue Growth

Assumptions

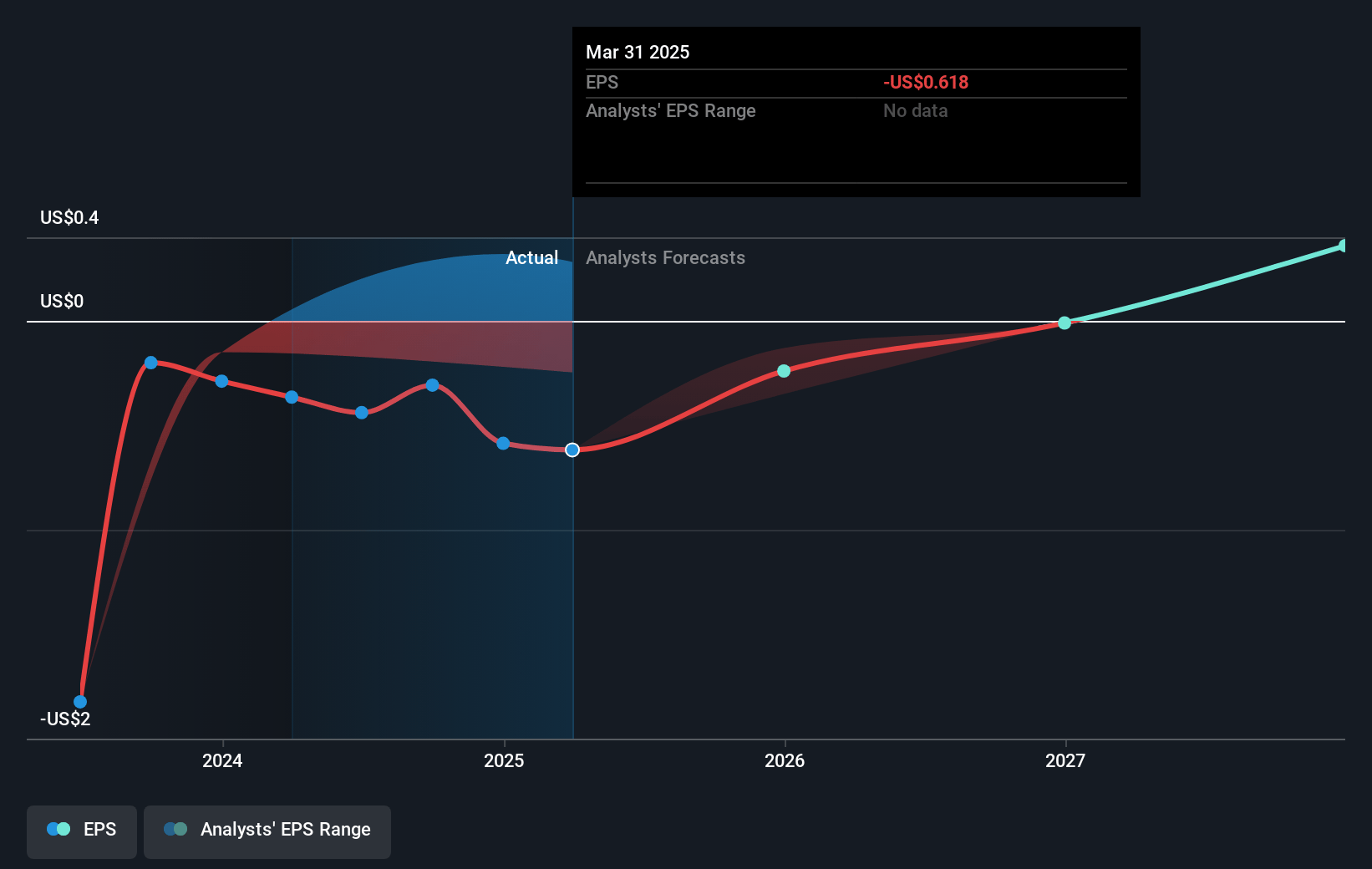

How have these above catalysts been quantified?- Analysts are assuming Globalstar's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -30.7% today to 11.5% in 3 years time.

- Analysts expect earnings to reach $43.8 million (and earnings per share of $0.27) by about July 2028, up from $-77.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 181.8x on those 2028 earnings, up from -42.1x today. This future PE is greater than the current PE for the US Telecom industry at 15.8x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Globalstar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is incurring higher cash costs and upfront investments to develop and enhance its XCOM RAN product offering, which is currently reducing adjusted EBITDA margins and could pressure future earnings if the new business is slow to achieve profitability.

- The near-term and future revenue outlook is highly dependent on the timing and scale of adoption by a very large initial customer for new product launches; delays or changes in the customer's deployment could create significant volatility in projected revenues and margins due to customer concentration risk.

- Ongoing need for substantial capital expenditures for satellite replenishment and network expansion creates pressure on free cash flow and may necessitate further debt or equity financing, impacting net earnings and increasing financial risk.

- The competitive landscape in both private wireless networks and satellite communications remains intense, with other established and well-capitalized industry players and rapidly evolving technology potentially leading to limited pricing power and margin compression over time.

- The shifting regulatory environment for spectrum allocation and reliance on proprietary spectrum bands (e.g., Band 53) introduces the risk that regulatory or technological changes-such as the evolution or underperformance of the CBRS band-could limit future addressable markets or require additional investments, further impacting long-term revenue growth and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.5 for Globalstar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $379.6 million, earnings will come to $43.8 million, and it would be trading on a PE ratio of 181.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $25.88, the analyst price target of $52.5 is 50.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.