Catalysts

About Vishay Precision Group

Vishay Precision Group is a sensor and measurement company focused on high precision resistors, strain gages, weighing solutions and specialized measurement systems for industrial, semiconductor, aerospace and other technical applications.

What are the underlying business or industry changes driving this perspective?

- Growing interest in humanoid robotics is starting to show up in orders, with approximately US$3.6 million in humanoid related projects year to date and discussions under way with additional developers. This trend could support higher sensor volumes and help revenue and earnings as these projects move from prototypes to production.

- Semiconductor test and AMS demand is supporting higher precision resistor bookings in the Sensors segment, with sensor bookings up 13.5% sequentially and at the highest level in 12 quarters. This can underpin revenue growth and support gross margin if product mix remains favorable.

- Broader industrial and automation use of high performance sensing is reflected in stable global trends and higher strain gage sales in General Industrial markets. This can help smooth cyclical swings in individual end markets and support more consistent revenue and cash generation.

- Cost optimization initiatives, including shifting manufacturing to India and targeting US$5 million of annualized cost reductions by year end with US$4 million already reached, are aimed at keeping Weighing Solutions gross margin near record levels and improving consolidated operating margin and net earnings over time.

- New leadership roles in business, product and operations, combined with approximately US$26 million of business development orders in the first nine months toward a US$30 million goal for 2025, are intended to speed commercialization of new applications such as ceramics testing and fiber optics. This can broaden the revenue base and support adjusted EBITDA growth.

Assumptions

This narrative explores a more optimistic perspective on Vishay Precision Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

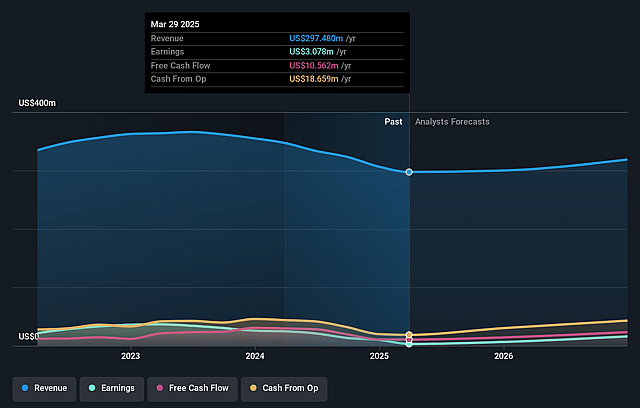

- The bullish analysts are assuming Vishay Precision Group's revenue will grow by 7.2% annually over the next 3 years.

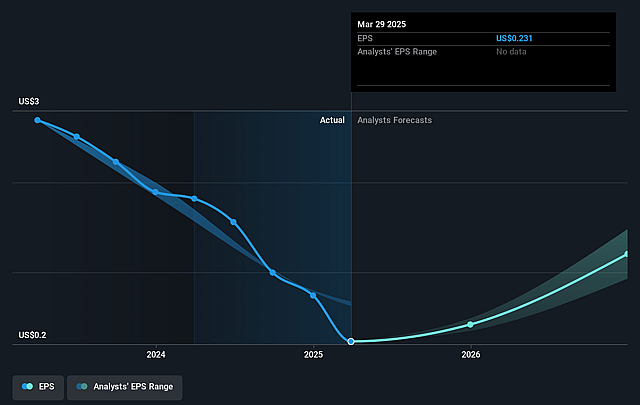

- The bullish analysts assume that profit margins will increase from 2.7% today to 8.9% in 3 years time.

- The bullish analysts expect earnings to reach $32.8 million (and earnings per share of $2.41) by about February 2029, up from $7.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.8x on those 2029 earnings, down from 88.4x today. This future PE is greater than the current PE for the US Electronic industry at 27.2x.

- The bullish analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The humanoid robotics opportunity is still very early, with only about US$3.6 million of orders year to date and no clear visibility on ramp timing. Any delay in customer design freezes or real world deployment could limit sensor volumes and keep revenue and earnings below the more optimistic expectations.

- Weighing Solutions shows order softness, with third quarter sales down 6.4% sequentially and a book to bill of 0.89. Management indicates larger OEM customers in precision agriculture and construction do not see strong demand, which could weigh on segment revenue and put pressure on consolidated gross and operating margins if this persists.

- Measurement Systems bookings decreased 6.9% sequentially, and management highlighted ongoing softness and project delays in DTS related to defense and space programs, including effects from a U.S. government shutdown that could reach at least hundreds of thousands of US dollars. This may restrain revenue growth and limit operating leverage.

- The business is exposed to foreign exchange and product mix, with third quarter gross margin affected by about US$600,000 of unfavorable FX and US$800,000 from unfavorable mix. Sustained FX headwinds or a less profitable mix of Sensors, Weighing Solutions and Measurement Systems could constrain gross margin and net earnings even if revenue is stable.

- The company’s long term plans rely on cost optimization and business development, including US$5 million of annualized cost reductions and US$30 million of business development orders targeted for 2025. If these programs do not convert into durable demand, or if savings are offset by higher operating expenses, adjusted operating margin, EBITDA and free cash flow could fall short of the assumptions behind the bullish scenario.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Vishay Precision Group is $63.0, which represents up to two standard deviations above the consensus price target of $48.0. This valuation is based on what can be assumed as the expectations of Vishay Precision Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $368.4 million, earnings will come to $32.8 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of $52.82, the analyst price target of $63.0 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Vishay Precision Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.