Narratives are currently in beta

Key Takeaways

- A major design win positions Pure Storage for growth in the hyperscale market, potentially impacting long-term revenue significantly.

- Collaborations and innovations signal growth opportunities in AI and flash storage, enhancing product offerings and margin efficiency.

- Dependency on a major customer and market shifts pose revenue risks, while operating investments and competitive pressures challenge margin and earnings growth.

Catalysts

About Pure Storage- Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

- The design win with a top 4 hyperscaler is a potential game-changer for Pure Storage, allowing them to penetrate the hyperscale market which accounts for 60-70% of global hard disk drive purchases. This is expected to significantly impact revenue starting in FY '27.

- Increased collaboration with Kioxia is set to support the anticipated rise in flash demand, indicating potential growth in product offerings and cost efficiencies impacting net margins.

- Engagements within the AI sector, including partnerships with NVIDIA and CoreWeave, suggest future revenue growth driven by demand for high-performance storage solutions for AI and machine learning.

- The launch of Pure Fusion, which automates data management and simplifies operations, is expected to enhance Pure's enterprise offerings and drive revenue growth through upgrades and new sales.

- The shift of more customers towards traditional sales from Evergreen//One subscription service due to current OpEx pressures might be temporary but, if reversed, will positively impact recurring revenue and cash flow stability.

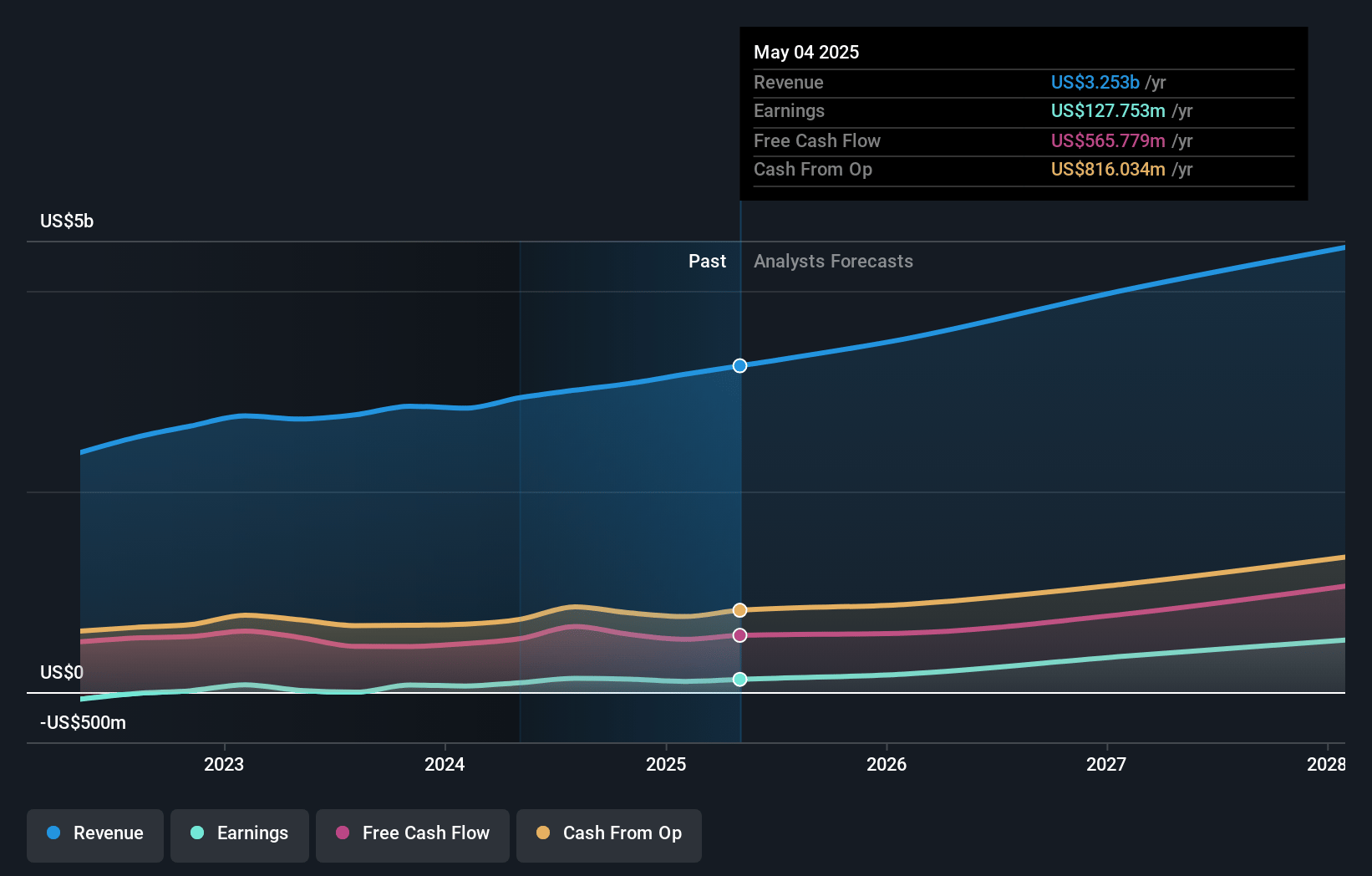

Pure Storage Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pure Storage's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 10.8% in 3 years time.

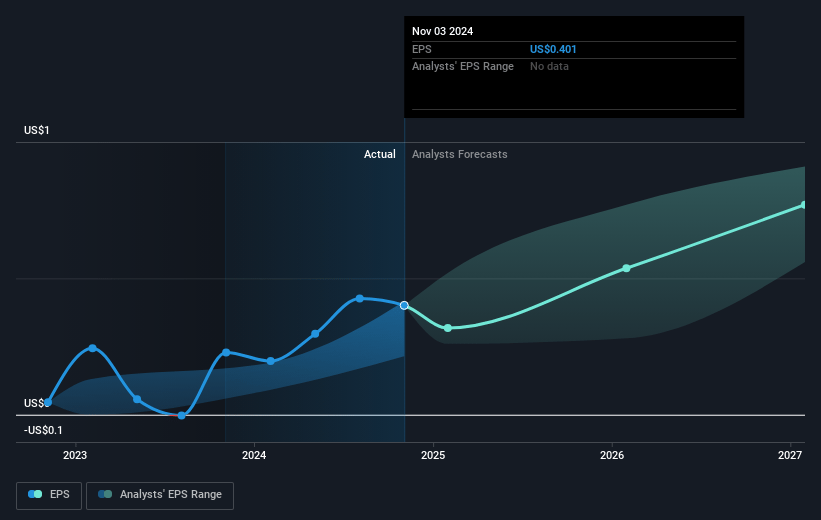

- Analysts expect earnings to reach $472.5 million (and earnings per share of $0.93) by about January 2028, up from $129.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $553.8 million in earnings, and the most bearish expecting $260.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 95.6x on those 2028 earnings, down from 158.2x today. This future PE is greater than the current PE for the US Tech industry at 23.8x.

- Analysts expect the number of shares outstanding to grow by 16.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Pure Storage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty related to forward-looking statements and the acknowledgment of potential risks and uncertainties may indicate unpredictability in the company's future revenues and earnings, as actual results could differ materially from projections.

- Increased operating investments are expected to impact Pure Storage's operating margin in FY '26, which could limit margin expansion and affect net margins in the short term.

- The heavy reliance on a single large hyperscale customer for future growth creates significant risk if expectations for design wins and deployments are not met, potentially impacting revenue projections.

- The shift of Evergreen//One opportunities to traditional sales, influenced by current market conditions, might lead to inconsistencies in recurring revenue from subscription services over time.

- Continued flattening of IT spending and a competitive market environment may place added pressure on revenue growth and operating budgets, affecting overall earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $71.78 for Pure Storage based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $93.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $472.5 million, and it would be trading on a PE ratio of 95.6x, assuming you use a discount rate of 7.3%.

- Given the current share price of $62.93, the analyst's price target of $71.78 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives