Key Takeaways

- HPE's focus on edge-to-cloud solutions and AI financing is set to drive future revenue growth through enhanced competitive positioning and recurring revenue streams.

- Strategic innovations in AI and networking are expected to bolster HPE's market opportunities, potentially improving future earnings through advanced product differentiation.

- Reliance on AI and Hybrid Cloud for growth introduces volatility and execution risks amid competitive pressures and declining gross margins.

Catalysts

About Hewlett Packard Enterprise- Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

- The anticipated close of the Juniper Networks acquisition in early 2025 is expected to enhance HPE’s portfolio, providing customers with comprehensive edge-to-cloud solutions, which could drive revenue growth and improve competitive positioning.

- Strong demand for HPE GreenLake and AI financing suggests a continued shift towards recurring revenue streams, which is likely to positively impact long-term earnings due to higher margins associated with these services.

- The transition to software-defined storage, particularly the rapid adoption of HPE Alletra MP, is expected to increase the mix of high-margin recurring revenue, thereby potentially improving net margins over time.

- Increasing enterprise adoption of AI, driven by HPE’s Private Cloud AI offerings and collaborations with partners such as Deloitte, is positioned as a significant growth driver in 2025, potentially boosting both revenue and profitability.

- The focus on developing new AI and networking innovations, like the Slingshot direct liquid-cooled networking fabric, positions HPE to capture new market opportunities in AI and hybrid cloud, which could enhance future earnings through advanced product differentiation.

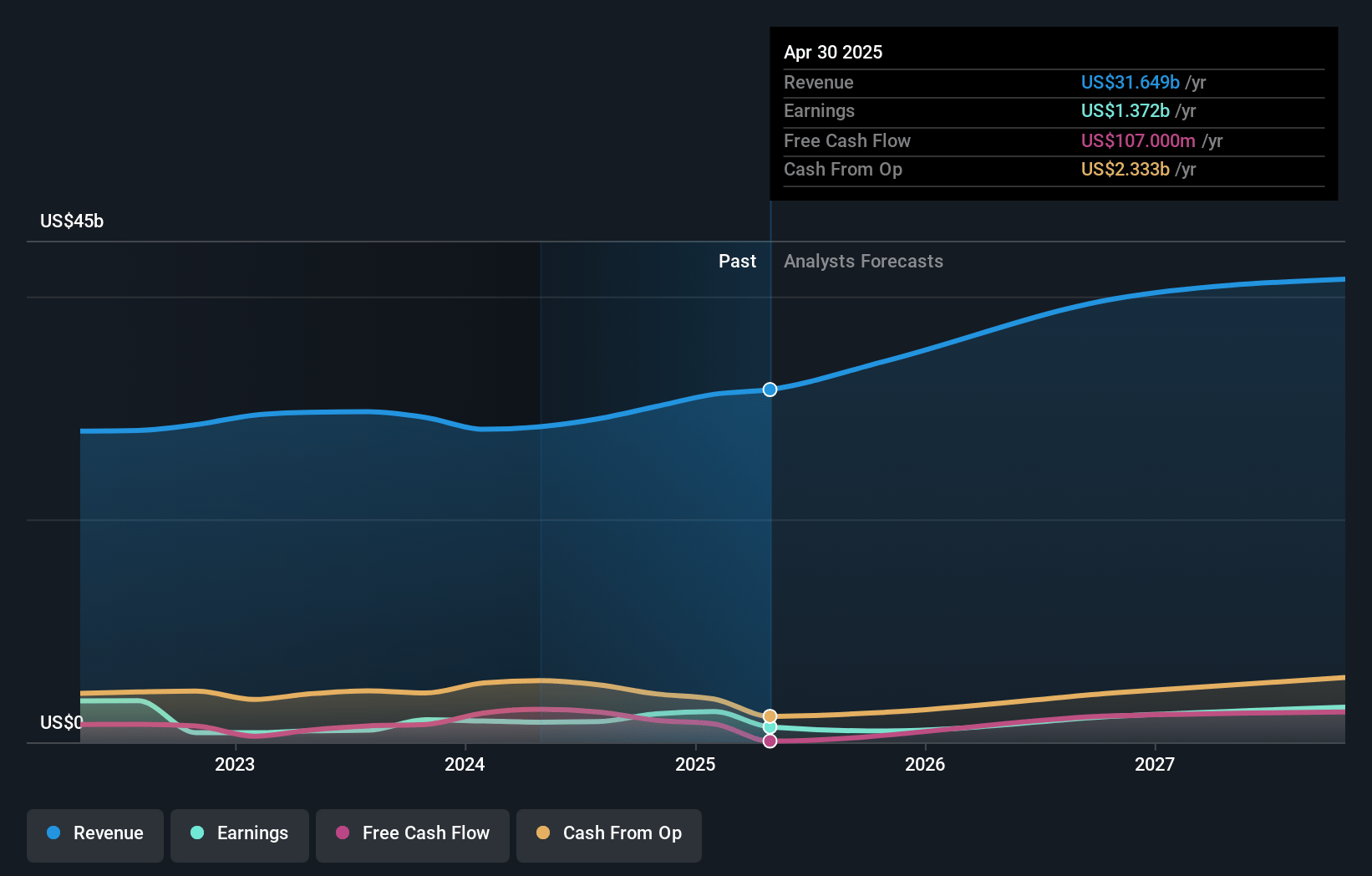

Hewlett Packard Enterprise Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hewlett Packard Enterprise's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.5% today to 7.8% in 3 years time.

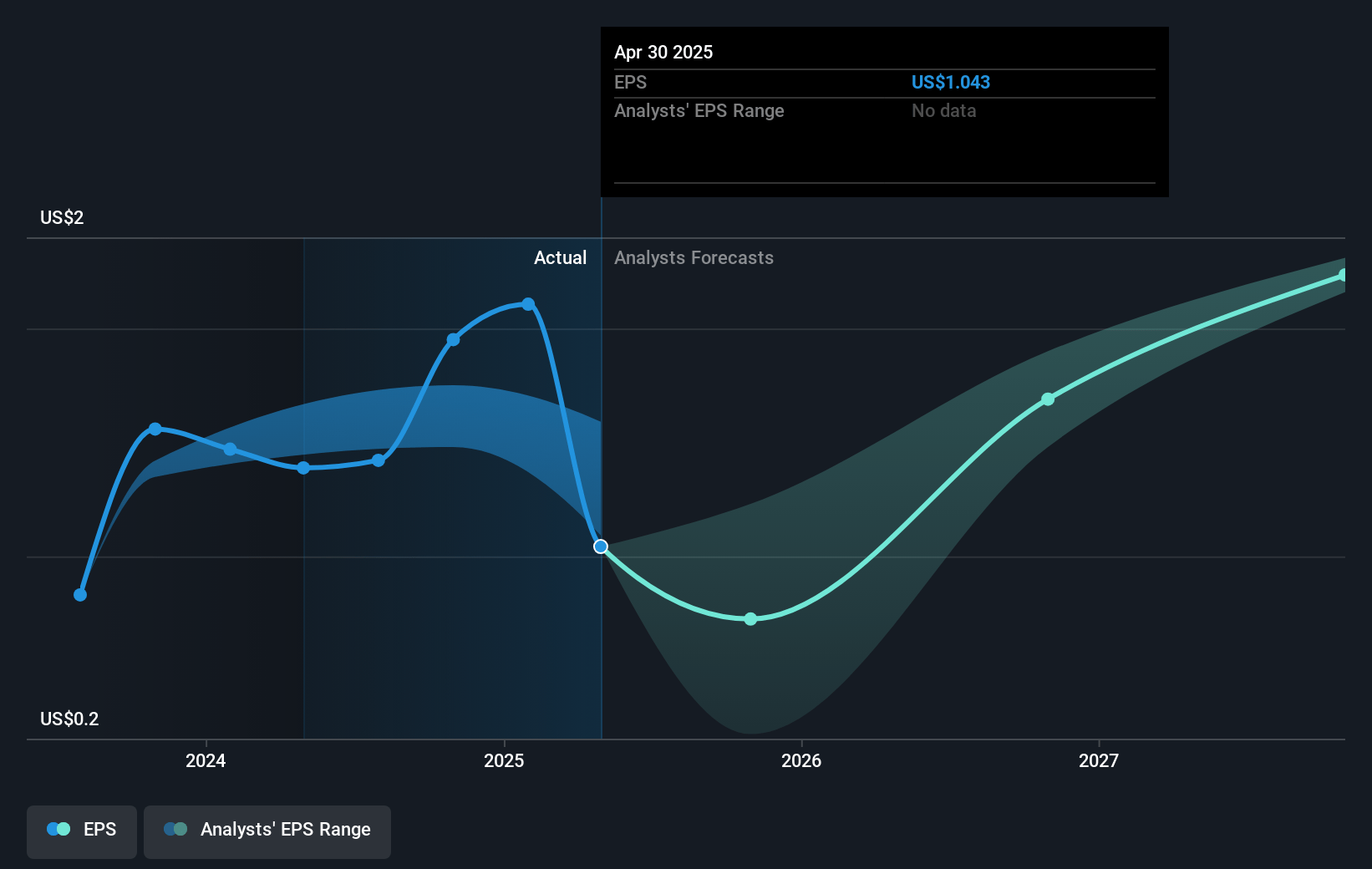

- Analysts expect earnings to reach $2.7 billion (and earnings per share of $2.0) by about January 2028, up from $2.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.1 billion in earnings, and the most bearish expecting $2.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from 11.1x today. This future PE is lower than the current PE for the US Tech industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 1.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.9%, as per the Simply Wall St company report.

Hewlett Packard Enterprise Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The AI systems orders can be lumpy and unpredictable, with substantial debooking of orders (e.g., $700 million due to customer risk), which introduces volatility and uncertainty in revenue forecasts.

- Gross margins have been declining, down 390 basis points year-over-year, largely due to lower Intelligent Edge contributions and a shift to lower-margin AI system sales, impacting overall profitability.

- The expansion into AI systems is highly competitive and may face pricing pressures, potentially squeezing gross margins and impacting overall earnings.

- The heavy reliance on AI and Hybrid Cloud solutions for future growth means that any downturn in IT spending or slower adoption of these technologies could adversely affect revenue growth projections.

- There are execution risks associated with the pending acquisition of Juniper Networks, including integration challenges and regulatory approvals, which could affect financial outcomes if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.48 for Hewlett Packard Enterprise based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $35.0 billion, earnings will come to $2.7 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $21.46, the analyst's price target of $24.48 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives