Narratives are currently in beta

Key Takeaways

- Dell's strategic focus on AI servers and specialized workloads is set to enhance revenues and margins through premium offerings.

- Growth in AI, renewed server demand, and upcoming PC refresh cycles highlight significant revenue and profit potential.

- Rising competition in pricing, inventory challenges, and AI market reliance pose risks to Dell's margins, revenue consistency, and profitability.

Catalysts

About Dell Technologies- Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

- Dell Technologies has significant growth potential in AI servers, with a 5-quarter pipeline that has grown more than 50% sequentially. This is expected to drive future revenue and earnings as demand for AI infrastructure surges.

- The company's expansion in specialized AI workloads, like the GB200 NVL72 server racks, positions it to capitalize on high-value engineering and customized solutions, which could lead to enhanced net margins through premium offerings.

- Dell anticipates mid-2020s growth in ISG revenues, driven by AI and the recovering traditional server market, which is already seeing improved demand. This is likely to positively impact both top-line revenue and operating income.

- Upcoming PC refresh cycles, due to an aging installed base and Windows 10 end-of-life, present additional revenue growth opportunities. This could also improve net margins by increasing the average selling price of new AI-optimized PCs.

- Strategic emphasis on other technology areas surrounding AI servers, such as networking, storage, and cooling, presents additional profit pools. These developments can support revenue and margin expansion by offering complete, value-added technology solutions.

Dell Technologies Future Earnings and Revenue Growth

Assumptions

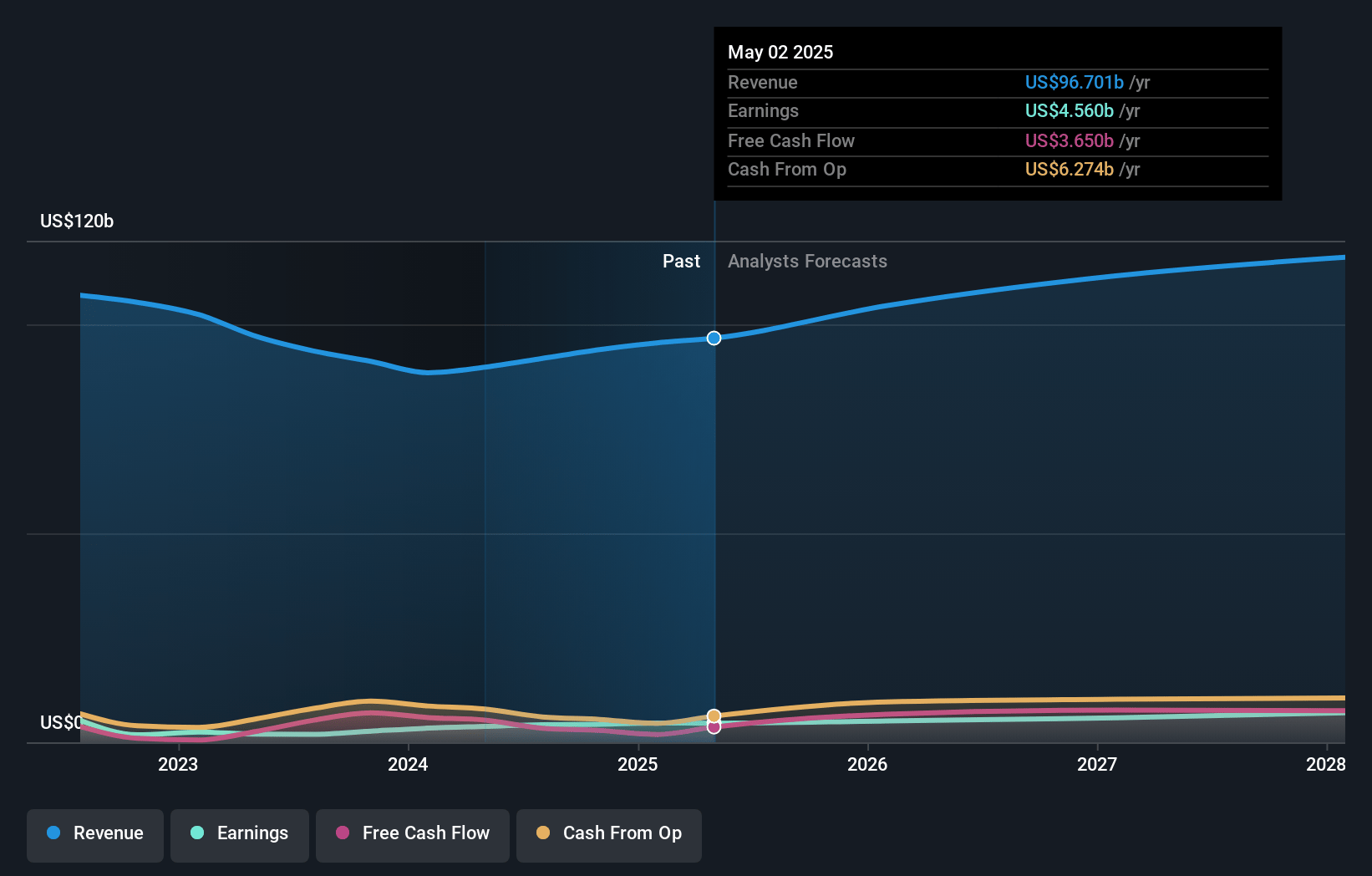

How have these above catalysts been quantified?- Analysts are assuming Dell Technologies's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 5.4% in 3 years time.

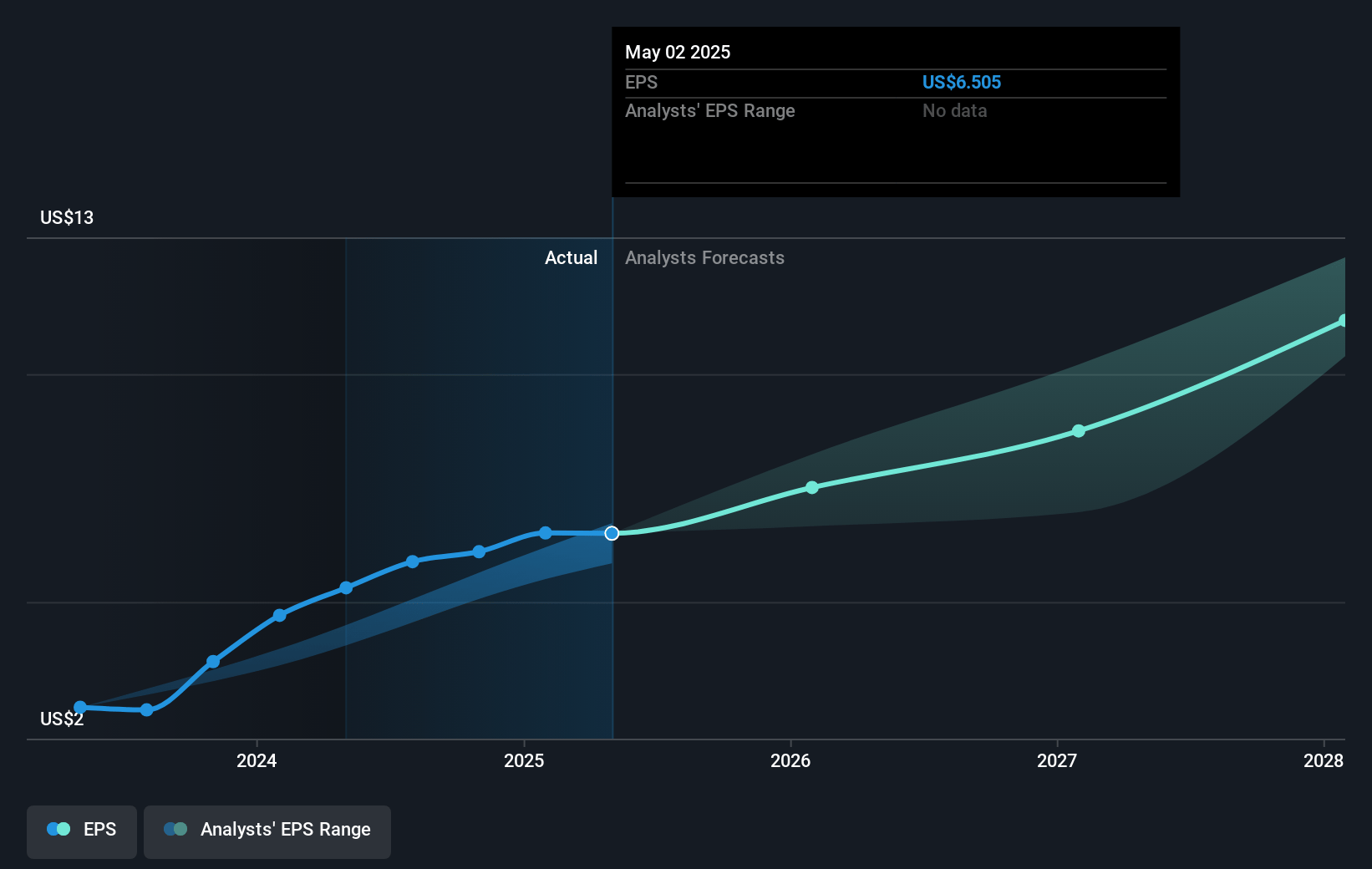

- Analysts expect earnings to reach $6.3 billion (and earnings per share of $9.05) by about November 2027, up from $4.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.4 billion in earnings, and the most bearish expecting $4.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2027 earnings, down from 25.1x today. This future PE is lower than the current PE for the US Tech industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Dell Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing competitive pricing environment, especially in the Consumer Solutions Group (CSG), suggests tighter margins or potential revenue declines in consumer segments. This impacts net margins.

- Demand for enterprise-grade PCs and storage is shifting forward, leading to slower-than-expected refresh cycles which can affect near-term revenue and earnings potential.

- Elevated inventory levels related to AI products, combined with demand variability, could result in increased holding costs and impact operating margins and cash flow.

- Heavy reliance on AI server momentum introduces risk if the AI demand cycle experiences temporary slowdowns or shifts towards new generations like Blackwell, affecting revenue consistency.

- Uncertainty in the component supply chain for key AI technologies (e.g., Blackwell GPUs) could delay shipments and impact revenue recognition and profitability projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $146.22 for Dell Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $106.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $115.0 billion, earnings will come to $6.3 billion, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $141.74, the analyst's price target of $146.22 is 3.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives