Last Update07 May 25Fair value Increased 18%

AnalystHighTarget has decreased revenue growth from 7.5% to 5.3% and increased future PE multiple from 19.3x to 23.4x.

Read more...Key Takeaways

- Expansion into high-margin authentication markets and strategic acquisitions are boosting recurring revenue streams, supporting top-line growth and margin enhancement.

- Investments in proprietary technology and operational integration are increasing earnings resilience, margin improvement, and leadership in secure authentication solutions.

- Overdependence on declining cash-based markets, combined with slow innovation and integration risks, threatens Crane NXT’s growth, margin stability, and future market relevance.

Catalysts

About Crane NXT- Operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers’ important assets.

- Expansion of anti-counterfeiting and authentication solutions into fast-growing non-currency markets, evidenced by early wins such as the micro-optics luxury goods contract, opens a large, underpenetrated addressable market and creates high-margin, recurring revenue streams, supporting both top-line growth and margin expansion.

- Accelerating global concerns over counterfeiting, regulatory pressure for more robust identity and payment verification, and the rising need for next-generation secure authentication across financial institutions, luxury goods, and governments are set to sustain high demand and multi-year investment cycles, directly increasing revenue visibility and backlog.

- Strategic deployment of proprietary micro-optics and digital authentication platforms into both existing and new channels (including through recent acquisitions) positions Crane NXT as the technology leader for central banks’ banknote redesign initiatives globally, driving higher content-per-note and recurring long-term contracts, which enhance net margins over time.

- Continued disciplined investment in R&D and M&A, including the integration of OpSec, TruTag Smart Packaging, and the pending De La Rue Authentication acquisition, is transforming Crane NXT’s portfolio toward higher recurring contract revenue and reduced exposure to declining cash-centric markets, resulting in more resilient earnings growth.

- Early actions to optimize operating leverage, improve cost structure, and deploy the Crane Business System across acquired businesses are set to drive margin improvement from integration synergies, while persistent free cash flow generation and a robust M&A pipeline enable further EPS accretion and optionality for value-creating capital deployment.

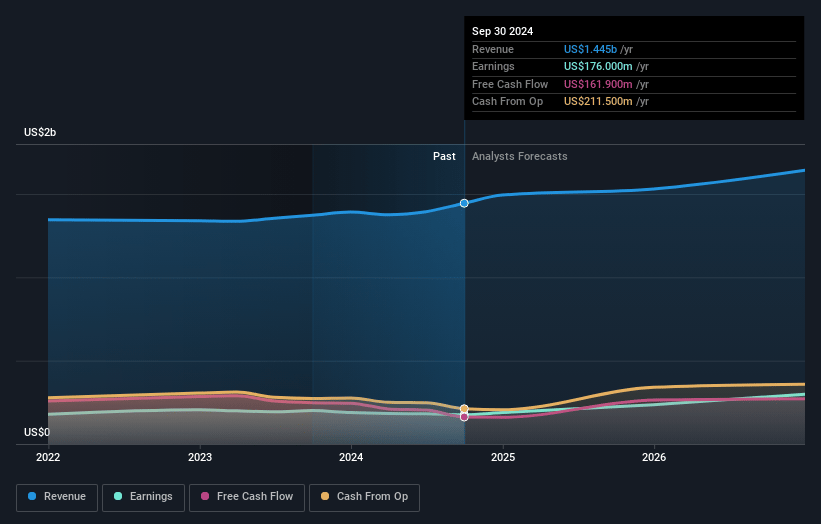

Crane NXT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Crane NXT compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Crane NXT's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.4% today to 17.6% in 3 years time.

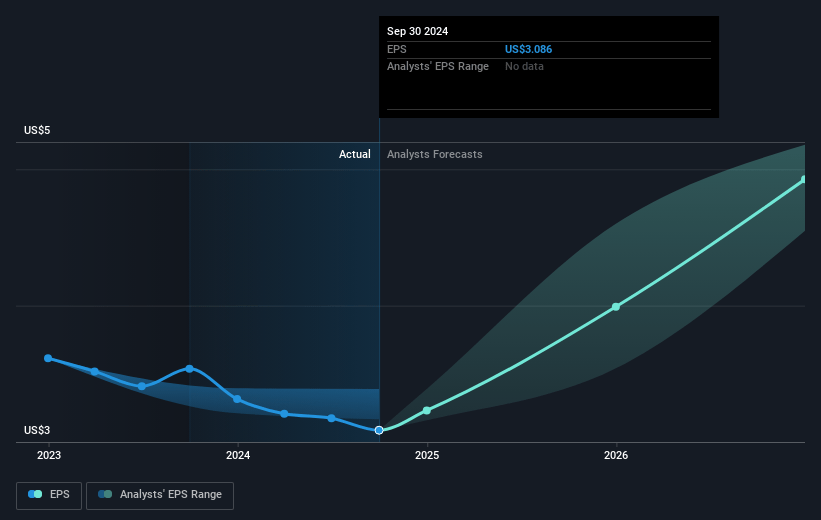

- The bullish analysts expect earnings to reach $306.6 million (and earnings per share of $5.21) by about May 2028, up from $184.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, up from 14.8x today. This future PE is greater than the current PE for the US Electronic industry at 20.0x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.93%, as per the Simply Wall St company report.

Crane NXT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift towards digital payments, cashless transactions, and Central Bank Digital Currencies is reducing long-term demand for cash-centric products, putting consistent downward pressure on Crane NXT’s core revenues and shrinking its addressable markets over time.

- The company’s persistent reliance on legacy cash-handling businesses—despite ongoing acquisitions aimed at diversification—means an overexposure to declining markets, which could lead to lower long-term growth and unpredictable future cash flows.

- Heightened customer concentration in government and financial sectors for currency and security products leaves Crane NXT acutely vulnerable to regulatory changes, federal budget constraints, and central bank order cycles, which can create sustained revenue volatility and challenge earnings predictability.

- Slower innovation and potentially lagging technology investments relative to emerging digital authentication solutions could result in market share erosion and margin compression, as customers increasingly pivot to more advanced or software-based offerings.

- Ongoing margin dilution from recent and future M&A transactions, coupled with lower operating leverage in acquired businesses like OpSec, exposes Crane NXT to persistently lower net margins and the risk that integrations do not achieve anticipated synergies or required returns on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Crane NXT is $100.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Crane NXT's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $306.6 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 7.9%.

- Given the current share price of $47.61, the bullish analyst price target of $100.0 is 52.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.