Narratives are currently in beta

Key Takeaways

- Declining sales in transportation and medical sectors and slow industrial recovery could impact short-term revenue and margins.

- Reduced R&D spending and acquisition-related debt may hinder innovation and slightly dilute short-term EPS, affecting long-term growth.

- Successful diversification, aerospace growth, operational improvements, and strategic acquisitions boost CTS's revenue consistency, profitability, and earnings stability.

Catalysts

About CTS- Manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia.

- The transportation sector shows softened demand and declining sales, partially due to competition in China and market softness in commercial vehicle products, which is expected to continue through the remainder of 2024. This could negatively impact future revenue in this segment.

- Near-term inventory adjustments in the medical market are expected to lead to reduced demand in the fourth quarter, which could affect short-term revenue growth from this segment.

- Within the industrial market, recovery is slow and tempered by inventory burn-down and exposure to OEMs in China. Ongoing market challenges could limit revenue growth and net margins as the company navigates these hurdles.

- R&D spending has declined over the year, with further reductions potentially due to the timing of customer reimbursements. A continued decrease might hamper future innovation and product development, affecting long-term earnings growth.

- Increased focus on diversification through acquisitions, like SyQwest, is a strategic priority, but the integration process and associated debt increase could slightly dilute EPS in the short term, impacting near-term earnings.

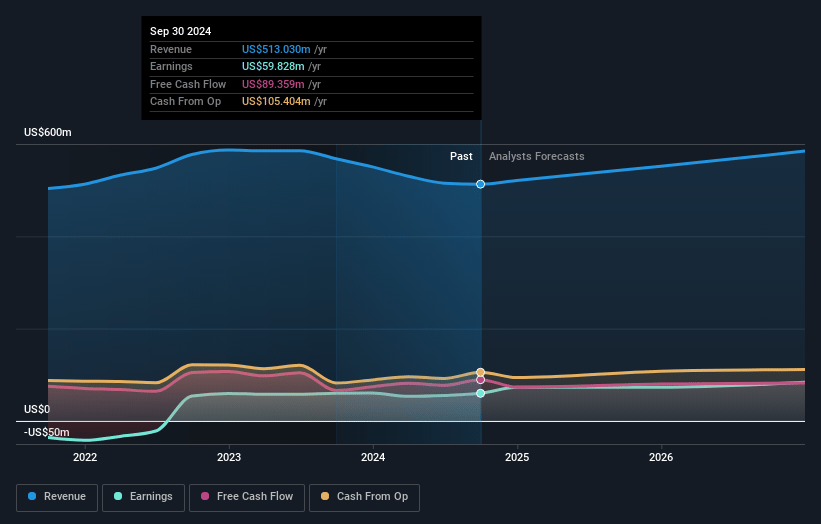

CTS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CTS's revenue will grow by 5.9% annually over the next 3 years.

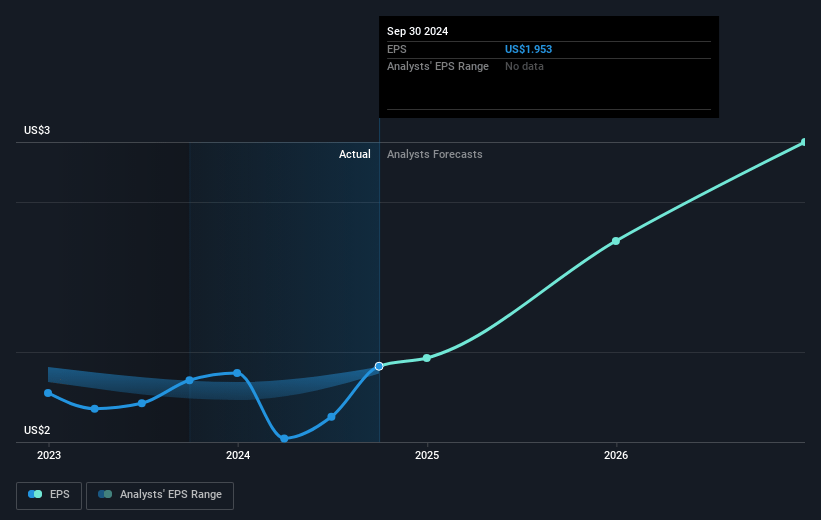

- Analysts assume that profit margins will increase from 11.7% today to 14.8% in 3 years time.

- Analysts expect earnings to reach $90.1 million (and earnings per share of $3.02) by about December 2027, up from $59.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.4x on those 2027 earnings, down from 28.0x today. This future PE is lower than the current PE for the US Electronic industry at 26.0x.

- Analysts expect the number of shares outstanding to decline by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.25%, as per the Simply Wall St company report.

CTS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CTS's successful execution of its diversification strategy, with over 52% of revenue now from diversified markets, could mitigate risks associated with single-market downturns, positively impacting revenue consistency and growth.

- The company has shown significant growth in aerospace and defense bookings, up 92% year-over-year, and expects continued momentum with a strong backlog and new customer wins, which could bolster revenue and net margins in those sectors.

- CTS has achieved a substantial 416 basis point expansion in adjusted gross margins, aided by foreign exchange favorability and operational improvements, which suggests enhanced operational efficiency and cost management, likely supporting earnings stability.

- The acquisition of SyQwest is contributing positively to sales and is expected to be accretive to gross margins and EBITDA, indicating potential growth in earnings and supporting longer-term profitability in the defense market.

- Increasing interest and wins in electrification and premium vehicle applications, such as eBrake and sensor technology, could counterbalance softness in the transportation sector, ultimately benefiting CTS's revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.0 for CTS based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $610.0 million, earnings will come to $90.1 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $55.67, the analyst's price target of $49.0 is 13.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives