Key Takeaways

- Strong subscription and software growth, driven by premium plans and AI features, is accelerating recurring high-margin revenue and expanding long-term profitability.

- Major product refresh, ecosystem partnerships, and ad platform initiatives position Arlo to boost market share, distribution reach, and user monetization.

- Heavy dependence on promotional pricing, US-centric growth, and hardware-driven subscriptions heightens vulnerability to margin pressures, competition, execution risks, and potential recurring revenue declines.

Catalysts

About Arlo Technologies- Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

- The rapid, ongoing increase in paid subscribers (51% YoY), combined with rising average revenue per user propelled by new premium service plans (Secure 5 and Secure 6), is accelerating high-margin, recurring subscription revenue growth and expanding annual recurring revenue, supporting future increases in top-line revenue and net margins.

- Arlo's focus on software, AI-driven features (advanced audio event detection, analytics, etc.), and continuous expansion of value-added cloud services leverages the broader trend of households and businesses adopting connected IoT security, underpinning sustainable ARPU expansion and margin improvement going forward.

- The upcoming largest-ever product portfolio refresh (launching 100+ SKUs), which brings a 20–35% reduction in bill of materials costs, positions Arlo to absorb supply chain/tariff pressures and win incremental market share, which will positively impact product gross margins and customer acquisition rates over the next several quarters.

- Broadening partnerships and ecosystem integrations with strategic players in the smart home market, including new insurance-related partnerships expected to be announced in the second half of the year, are set to drive further expansion in distribution channels and subscriber growth, supporting future revenue and gross profit.

- Early positive results from the new ad platform-which targets in-app upsells to drive service tier upgrades and device sales-provide a new lever to maximize user monetization and increase conversion rates, with expected incremental contribution to subscription and overall revenue and profitability.

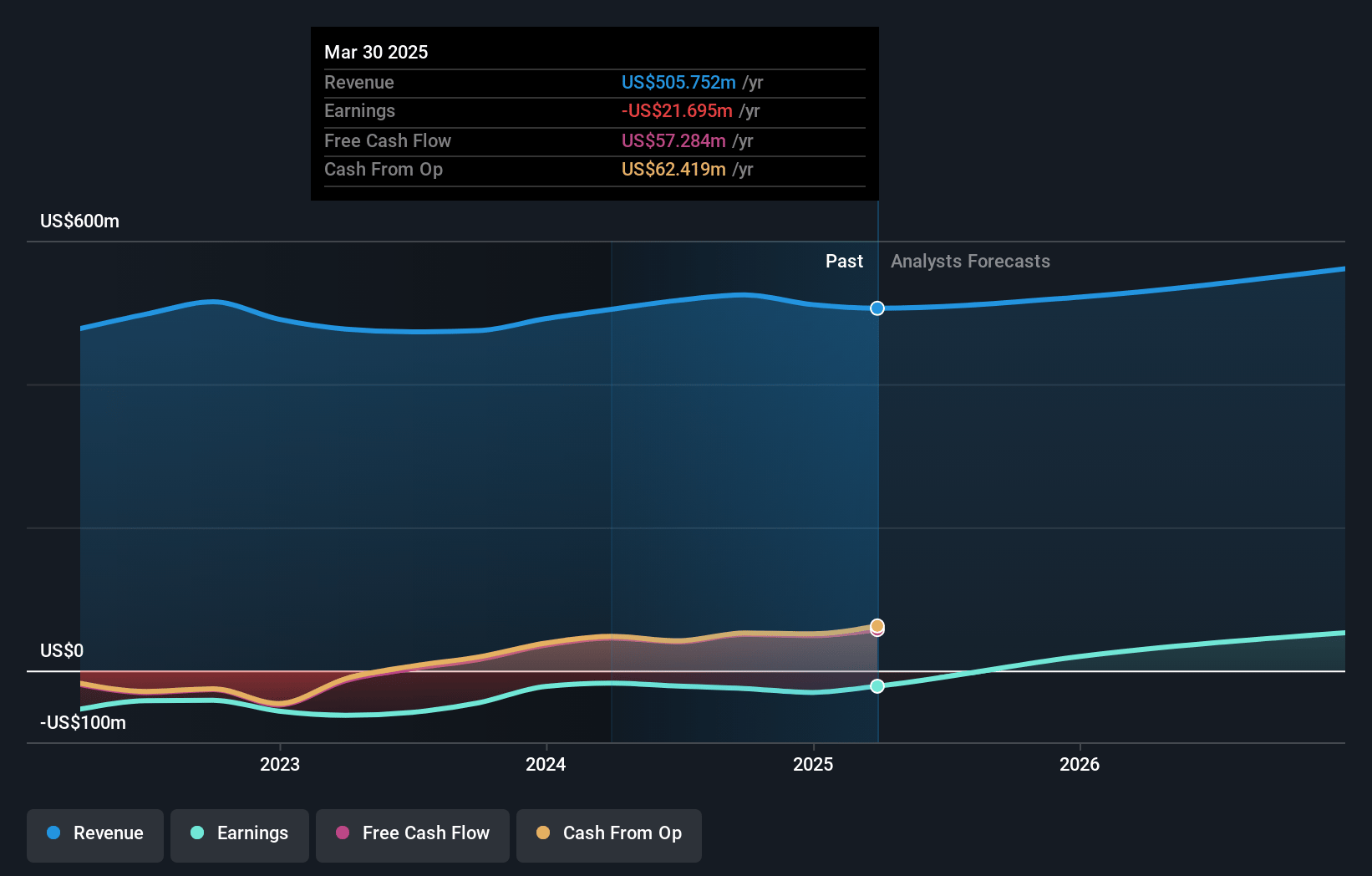

Arlo Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arlo Technologies's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.3% today to 25.4% in 3 years time.

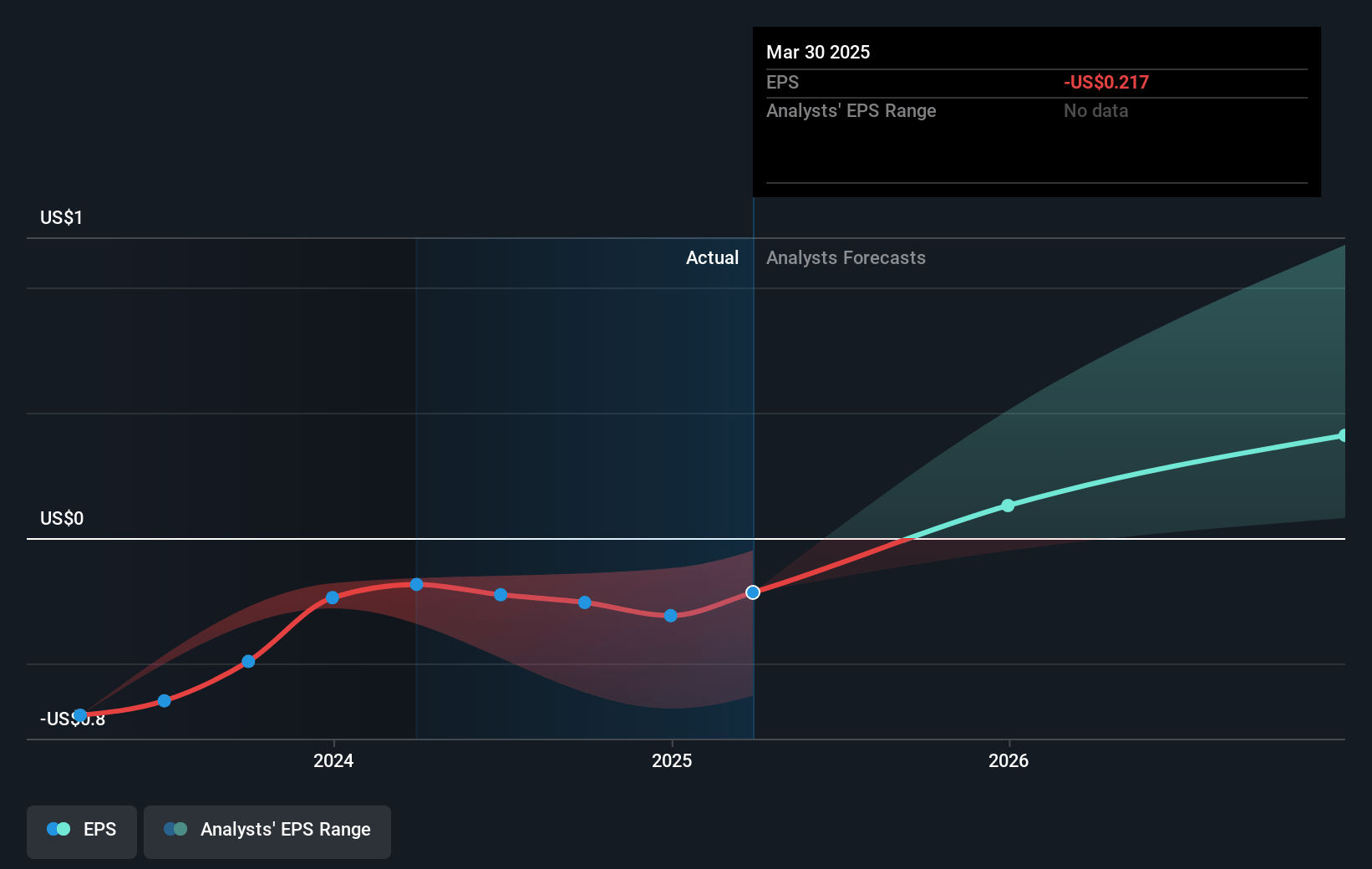

- Analysts expect earnings to reach $151.5 million (and earnings per share of $1.14) by about July 2028, up from $-21.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, up from -77.2x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to grow by 3.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Arlo Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained negative product gross margins due to ongoing aggressive promotional pricing and industry-wide ASP declines may erode profitability if ARPU expansion or subscription growth falters, directly impacting net margins and overall earnings.

- Heavy reliance on continued rapid subscriber growth and ARPU increases-with normalizing churn and conversion subject to negative swings as plans and prices evolve-could expose the company to significant downside risk in recurring revenue if growth slows or competitive dynamics shift.

- The company's international revenue is showing a decline as its subscriber base becomes more US-centric, making it more vulnerable to US-specific regulatory shifts, tariffs, or economic downturns, which could suppress future revenue growth and earnings stability.

- Arlo's hardware-based customer acquisition strategy, which tolerates losses on product sales to grow subscriptions, may become unsustainable if intensified competition, continued price wars, or rapid technological change shorten product life cycles and drive up customer acquisition costs, thereby pressuring both revenue and net margins.

- The significant upcoming product refresh, which involves more than 100 new SKUs, poses execution risks in supply chain, inventory management, and successful customer adoption; failure to meet cost reduction targets or ensure smooth rollout could lead to inventory write-downs, lost market share, and negative impacts to revenue and gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.0 for Arlo Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $596.1 million, earnings will come to $151.5 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $16.19, the analyst price target of $19.0 is 14.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.