Last Update 05 Dec 25

Fair value Increased 0.48%WDC: AI Storage Demand Will Sustain Tight Supply And Margin Upside

Analysts nudged our Western Digital fair value estimate modestly higher, from $180.57 to $181.43, citing a wave of sharply higher Street price targets that reflect stronger than expected exabyte shipments, tighter HDD and NAND supply, improving pricing, and conviction that AI driven storage demand will support structurally higher growth and margins.

Analyst Commentary

Street research has turned meaningfully more constructive on Western Digital, with a series of higher price targets reflecting a stronger fundamental and cyclical backdrop across both HDD and NAND. Bullish analysts cite better visibility into AI driven storage demand, tighter supply conditions, and improving pricing power as key drivers of earnings and multiple expansion.

At the same time, some caution remains around the durability of the current upcycle, the conservatism of management guidance, and execution risks tied to technology transitions and large multiyear deals.

Bullish Takeaways

- Bullish analysts see upside to revenue and EPS forecasts as exabyte shipments outpace prior expectations and pricing trends improve in both HDD and NAND, supporting higher valuation multiples.

- Several target hikes are underpinned by the view that AI infrastructure buildouts, cloud spending, and data retention needs will sustain structurally higher nearline HDD demand and gross margins through mid decade.

- Commentary highlights Western Digital's product and technology positioning, including leadership in hybrid SMR capacities, progress on higher capacity platforms, and accretive HDD economics that could extend the earnings re rating cycle.

- Supply chain checks pointing to tight capacity, extended lead times, and rising drive prices reinforce the case that the current storage cycle is stronger for longer, with potential for further estimate revisions as contracts roll through at higher pricing.

Bearish Takeaways

- Bearish analysts, where they exist, characterize some estimates as still conservative, reflecting concern that management guidance may be embedding flat to slightly lower pricing quarter over quarter, which could cap near term upside if demand or pricing moderates.

- There is lingering skepticism about the sustainability of elevated gross margins once supply normalizes, particularly if competitors accelerate capacity additions or discounting to capture AI storage workloads.

- Execution risk around long duration supply agreements and next generation technologies, such as HAMR and advanced SMR roadmaps, could pressure valuation if qualification timelines slip or if customers shift mix faster than Western Digital can adapt.

- Some cautious views within the broader hardware coverage universe suggest that, despite favorable AI tailwinds, the group may remain volatile, with Western Digital exposed to macro, capex, and pricing swings that could introduce earnings variability against rising expectations.

What's in the News

- Unveiled next generation AI and HPC storage solutions and expanded strategic partnerships at Supercomputing 2025, including broader access to UltraSMR technology, higher density Ultrastar platforms, and an enlarged Open Composable Compatibility Lab ecosystem to reduce integration risk and vendor lock in (Key Developments).

- Opened an expanded 25,600 square foot System Integration and Test Lab to speed qualification of high capacity HDDs and support over 2,000 customer systems with end to end testing for AI and cloud workloads (Key Developments).

- Completed a major share repurchase tranche, buying back 9.2 million shares for approximately $702 million, or about 2.66% of shares outstanding, under the May 13, 2025 authorization (Key Developments).

- Raised its quarterly cash dividend by 25% to $0.125 per share, payable December 18, 2025 to shareholders of record as of December 4, 2025 (Key Developments).

- Issued fiscal second quarter 2026 guidance targeting approximately $2.9 billion in revenue at the midpoint, plus or minus $100 million (Key Developments).

Valuation Changes

- Fair Value Estimate increased slightly to $181.43 from $180.57, reflecting modestly stronger growth assumptions and improved storage cycle dynamics.

- Discount Rate edged down marginally to 8.43% from 8.44%, indicating a slightly lower perceived risk profile or cost of capital.

- Revenue Growth rose modestly to 13.36% from 13.15%, incorporating higher exabyte shipments and firmer pricing expectations.

- Net Profit Margin dipped slightly to 24.89% from 25.03%, suggesting a small normalization in long term profitability assumptions.

- Future P/E nudged higher to 20.41x from 20.32x, consistent with a marginally more constructive outlook on earnings durability and multiple support.

Key Takeaways

- Deep partnerships with hyperscalers and innovative drive technologies position the company to capture strong, sustained market and margin expansion from AI-driven storage demand.

- Improved financial health and platform solutions enable ongoing investment, expanded market reach, and greater shareholder returns.

- Dependence on few cloud customers, market shifts, trade uncertainty, and emerging storage technologies threaten long-term growth, margin stability, and revenue diversification.

Catalysts

About Western Digital- Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the Americas, Asia, Europe, the Middle East, and Africa.

- The explosive increase in unstructured data generated by AI applications, Agentic AI, and cloud-based services across industries is driving unprecedented storage needs. Western Digital's deep integration with leading hyperscalers (e.g., all top 5 with firm POs/LTAs covering the next 12–18 months) positions the company to benefit from secular demand, directly fueling higher long-term revenue growth.

- Higher adoption of Western Digital's larger capacity, high-value ePMR and UltraSMR drives-with rapid qualification and ramp cycles-demonstrates customer trust and enables both pricing power and favorable product mix, leading to structurally higher gross margins and improved net margins over time.

- The company's next-generation roadmap (final ePMR and upcoming HAMR drives) allows for sustained aerial density improvements and cost efficiencies, supporting continued profitability and margin expansion as data requirements grow.

- Platform solutions, targeting a new class of native AI/neo-cloud companies lacking in-house storage teams, open up incremental markets and new revenue streams, broadening Western Digital's addressable market and supporting topline growth.

- Ongoing balance sheet improvements, significant debt reduction, and robust free cash flow generation increase financial flexibility; this supports both continued R&D investment to capitalize on long-term demand trends and shareholder returns (dividends, buybacks), ultimately enhancing EPS and return on equity.

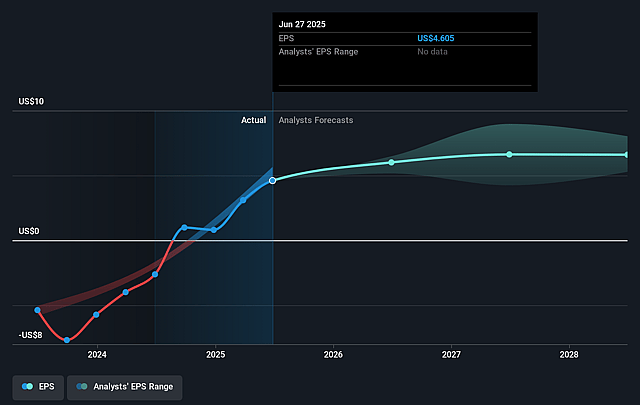

Western Digital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Western Digital's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.8% today to 18.1% in 3 years time.

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $6.6) by about September 2028, up from $1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.4 billion in earnings, and the most bearish expecting $1.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, down from 20.5x today. This future PE is lower than the current PE for the US Tech industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

Western Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a small number of hyperscale/cloud customers (90%+ of revenue) exposes Western Digital to significant concentration risk-any shift to in-house custom storage or alternative technologies by these customers could materially impact long-term revenue and earnings.

- Persistent decline in consumer and flat client segment revenues (down 12% and up only 2% YoY respectively) signals growing dependence on the cyclical cloud/datacenter market, posing risks to diversified topline growth and long-term revenue stability.

- Ongoing global tariff uncertainty and potential for abrupt changes in trade policy increase operational complexity and could drive higher costs or sudden demand disruptions, leading to lower net margins and earnings volatility.

- Secular shift towards cloud-native architectures and alternative storage technologies (including increased adoption of SSDs, custom storage solutions by hyperscalers, or emerging memory types) could eventually outpace HDD/UltraSMR advancements, threatening Western Digital's long-term relevance and affecting revenue growth.

- Mix-driven gross margin improvements depend on successful ramp-up and customer adoption of new technologies (e.g., UltraSMR, HAMR); slower-than-anticipated transitions or failure in manufacturing yields and reliability could compress margins and dampen earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $89.143 for Western Digital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $62.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.9 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $94.54, the analyst price target of $89.14 is 6.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Western Digital?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.