Key Takeaways

- Synergies from acquisitions, agile supply chain shifts, and direct-to-consumer growth position Turtle Beach for sustained margin expansion and market share gains.

- Innovation in premium peripherals and early moves into immersive technologies support higher revenues, stronger brand loyalty, and durable long-term earnings growth.

- Heavy dependence on market catalysts, margin pressures, and increasing competition threaten Turtle Beach's revenue stability, product differentiation, and long-term pricing power.

Catalysts

About Turtle Beach- Operates as an audio technology company in North America, Europe, the Middle East, and the Asia Pacific.

- Analyst consensus sees the PDP acquisition as an incremental growth driver, but this substantially underestimates the magnitude of platform synergy and cross-selling potential across an expanded accessory portfolio, which over a multi-year horizon could unlock well above-trend revenue growth and structurally enhance long-term net margins via scale.

- Analysts broadly expect margin improvement from cost synergies and supply chain moves, but do not fully appreciate how Turtle Beach's agility in shifting nearly all U.S. production out of China positions it to seize market share from slower-moving competitors, potentially leading to outsized gross margin and earnings gains as tariff headwinds dissipate and industry volatility settles.

- The acceleration in esports and gaming content creation is fueling rising demand for premium peripherals, positioning Turtle Beach's innovative, next-generation headsets and controllers to capture expanding market share among highly engaged, higher-spend consumer segments, which should drive sustained ASP and revenue growth above industry averages.

- Turtle Beach's increasing presence in fast-growing immersive tech categories, such as simulation hardware and AR/VR audio solutions, provides early-mover advantages in high-margin, incremental markets, setting up a multi-year runway for strong top-line expansion and further margin accretive opportunities.

- The rapid buildout of direct-to-consumer and global e-commerce channels will not only drive higher margin sales and improve pricing control, but also deepen customer engagement and brand loyalty, creating a durable foundation for enhanced revenue visibility, reduced channel risk, and robust long-term earnings power.

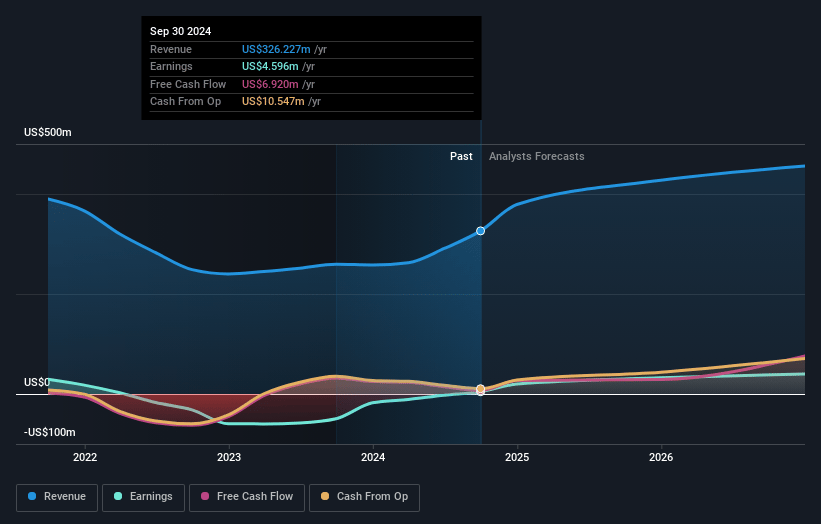

Turtle Beach Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Turtle Beach compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Turtle Beach's revenue will grow by 6.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 8.9% in 3 years time.

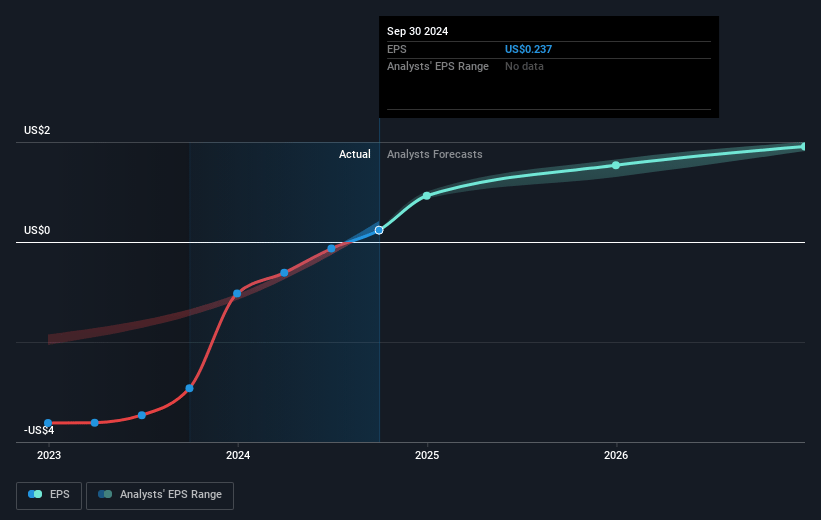

- The bullish analysts expect earnings to reach $41.1 million (and earnings per share of $1.95) by about July 2028, up from $15.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, down from 16.9x today. This future PE is lower than the current PE for the US Tech industry at 19.4x.

- Analysts expect the number of shares outstanding to decline by 2.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.39%, as per the Simply Wall St company report.

Turtle Beach Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The gaming accessories market, especially headsets and third-party controllers, experienced over a 20% year-over-year decline in Q1, with management now forecasting a full-year decline of 10% to 12%; this secular softness in the core market puts direct pressure on Turtle Beach's future revenues and revenue growth potential.

- There is a high reliance on blockbuster title releases and console refreshes (such as Grand Theft Auto VI and Nintendo Switch 2) to drive demand, leading to substantial volatility in earnings and revenue, since any delay or underperformance of these catalysts significantly disrupts the company's financial performance and growth visibility.

- Management highlighted ongoing margin pressures from industry-wide tariffs and the need to pass through selective price increases, which risks reduced competitiveness in a market already facing commoditization and ASP (average selling price) compression, ultimately threatening future gross margins and net margins.

- The company's acquisition-driven expansion (notably the PDP acquisition) exposes it to integration risks and has yet to demonstrate outperformance over market trends, suggesting persistent difficulty in product differentiation and diversification, which may dilute focus and raise operating costs relative to stagnant revenues.

- Despite recent improvements in operational efficiency, Turtle Beach operates in a highly competitive landscape with increasing rivalry from low-cost manufacturers and first-party hardware expansions by platform holders, which could structurally erode its market share and limit long-term pricing power, negatively affecting both revenues and overall earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Turtle Beach is $22.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Turtle Beach's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $461.6 million, earnings will come to $41.1 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $12.91, the bullish analyst price target of $22.0 is 41.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.