Key Takeaways

- Accelerated cloud and AI adoption, regulatory trends, and decentralized data hubs are set to expand Seagate's addressable market and drive lasting revenue stability.

- Industry consolidation and technological leadership position Seagate for sustained margin growth and substantial outperformance in long-term earnings and cash flow.

- Seagate faces significant risks from SSD market shifts, customer concentration, regulatory pressures, underinvestment in innovation, and intense industry competition threatening long-term profitability.

Catalysts

About Seagate Technology Holdings- Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

- While analyst consensus expects HAMR-based Mozaic drives to drive solid revenue and margin growth, this may understate the potential for an accelerated transition of major cloud service providers, as large-scale AI and video workloads could push hyperscale adoption of HAMR well ahead of current expectations-creating a rapid step-change in average selling prices and gross margin expansion.

- Analysts broadly agree that mass capacity storage adoption will rise with cloud and AI build-outs, but the market may be underappreciating the scale and duration of this data growth tailwind; explosive, persistent demand from next-gen AI, edge, and video workloads could lead to a multi-year "super-cycle" in exabyte shipments, supporting sustained double-digit revenue growth and persistent operating leverage.

- The ongoing trend toward disaggregated cloud architectures, where compute and storage investment are decoupled, will likely channel increased and ongoing investment into high-capacity storage solutions, supporting secular business mix shifts toward the highest-margin segment and reinforcing durable gross margin expansion.

- Increasing regulatory requirements for data residency, privacy, and sovereignty are driving a proliferation of decentralized and regional data hubs worldwide, meaning Seagate's solutions are poised to be embedded in a far greater number and diversity of installations, materially widening the addressable market and enhancing revenue stability.

- Industry consolidation is reducing competitive pricing pressure and magnifying incumbents' bargaining power; combined with Seagate's unrivaled technology leadership and operational efficiency, this sets the stage for significant long-term cumulative earnings and free cash flow outperformance versus Street forecasts.

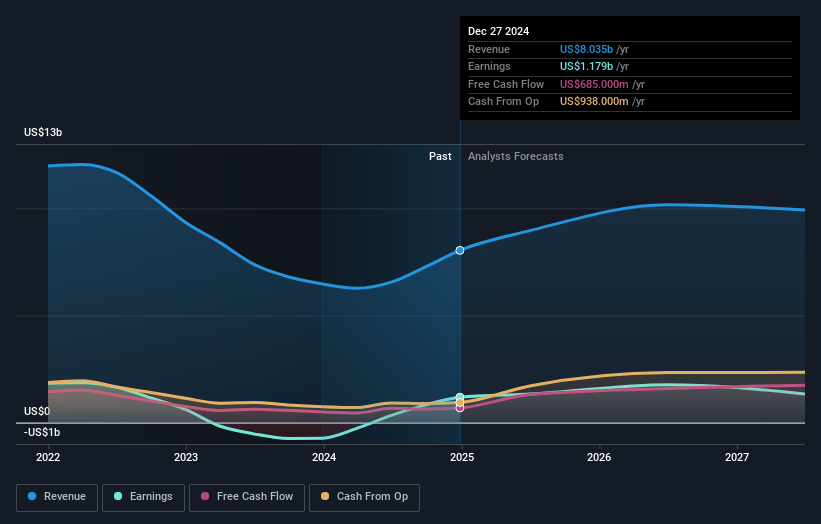

Seagate Technology Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Seagate Technology Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Seagate Technology Holdings's revenue will grow by 15.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.5% today to 19.5% in 3 years time.

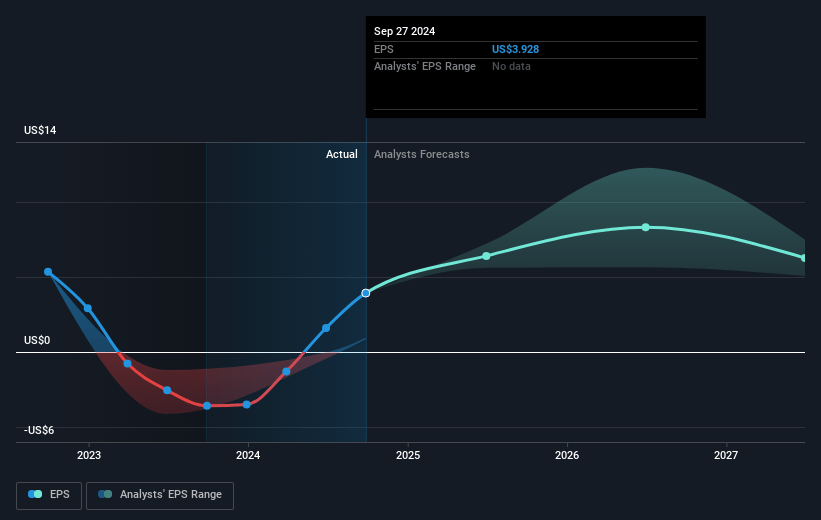

- The bullish analysts expect earnings to reach $2.6 billion (and earnings per share of $13.73) by about July 2028, up from $1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from 20.8x today. This future PE is greater than the current PE for the US Tech industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Seagate Technology Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid secular shift toward solid-state drive (SSD) technology and further falling SSD costs threaten Seagate's core HDD business, risking long-term declines in top-line revenue and overall market relevance as more storage workloads migrate to SSDs.

- Seagate remains heavily reliant on a small group of large cloud and hyperscale customers; increased vertical integration or a pivot by these major buyers toward alternative storage suppliers or in-house solutions could cause significant revenue volatility and compress gross margins.

- The growing importance of environmental, social, and governance (ESG) considerations, as well as stricter global regulations around electronics waste and energy consumption, place pressure on Seagate's HDDs, which are less energy efficient, raising compliance costs and potentially lowering net margins.

- Persistent underinvestment relative to competitors in advanced storage technologies, such as SSDs and next-generation memory, could undermine Seagate's ability to respond to industry-wide transitions, leading to erosion of long-term market share and sustained downward pressure on earnings.

- Intense competition from both established Asian manufacturers and new entrants in the SSD space, alongside industry-wide HDD to SSD conversion, puts downward pressure on pricing and limits Seagate's ability to sustain historical profitability levels, ultimately constraining future net income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Seagate Technology Holdings is $200.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Seagate Technology Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $68.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.1 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 8.3%.

- Given the current share price of $146.59, the bullish analyst price target of $200.0 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.