Key Takeaways

- Strong contract wins and international expansion drive growth, but exposure to unpredictable procurement cycles and policy shifts introduces earnings volatility and revenue risk.

- Reliance on proprietary solutions and monitoring tech faces threats from more open identity systems, privacy regulation, and rapid tech change, risking margin compression and lost market share.

- Heavy dependence on government contracts, shareholder dilution, regulatory risks, and intensifying competition undermine SuperCom's growth, profitability, and ability to maintain market leadership.

Catalysts

About SuperCom- Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

- While SuperCom continues to benefit from a growing global focus on digital transformation in government and the increasing adoption of electronic monitoring and identification technologies-trends which have helped deliver strong multiyear contract wins and top-line revenue growth-the company remains heavily exposed to slow and unpredictable government procurement cycles, which could delay the realization of new revenue streams and introduce continued earnings volatility.

- Despite robust recurring revenues from long-term contracts and a high win rate in competitive tenders, SuperCom's dependence on centralized, proprietary monitoring and tracking solutions leaves it vulnerable to the gradual rise of decentralized digital identity paradigms and the commoditization of location-tracking hardware, both of which threaten to erode pricing power and suppress future net margins.

- Although SuperCom is accelerating its international expansion and seeing meaningful success displacing incumbent providers in Europe and the US, the company faces significant compliance risks and possible margin compression due to ever-tightening global privacy regulations and increasing costs associated with data security-factors that could meaningfully impact profitability and operational flexibility over the long run.

- While investments in proprietary technology and integration of AI-driven analytics have given SuperCom a temporary edge in securing new projects and supporting margin expansion, the rapid rate of technological innovation in the security and monitoring sector means the company will require sustained, significant R&D expenditures just to maintain differentiation, and any misstep could result in loss of market share or margin contraction, negatively impacting long-term earnings.

- Even as governments continue to mandate electronic monitoring for offender rehabilitation and public safety-bolstering SuperCom's addressable market-heightened public scrutiny around surveillance and data collection, and potential shifts in policy away from electronic monitoring to alternative rehabilitative solutions, could limit the company's project pipeline growth and exert downward pressure on revenue visibility.

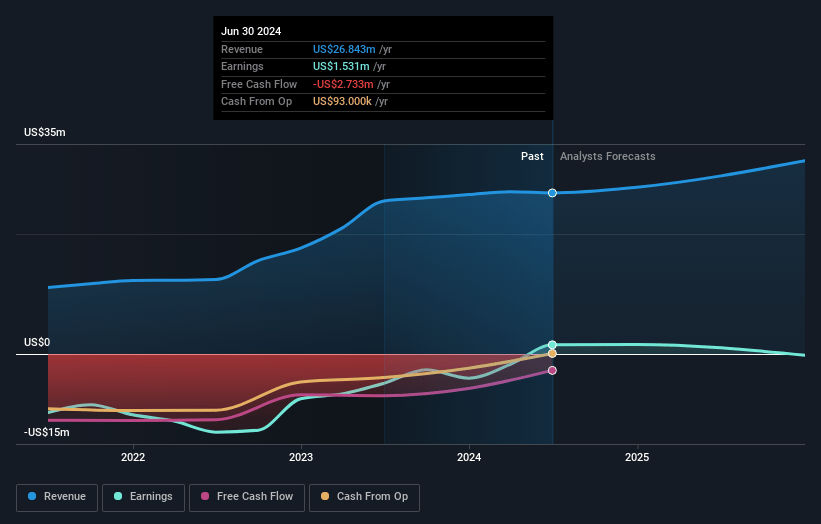

SuperCom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SuperCom compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SuperCom's revenue will grow by 12.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.8% today to 8.7% in 3 years time.

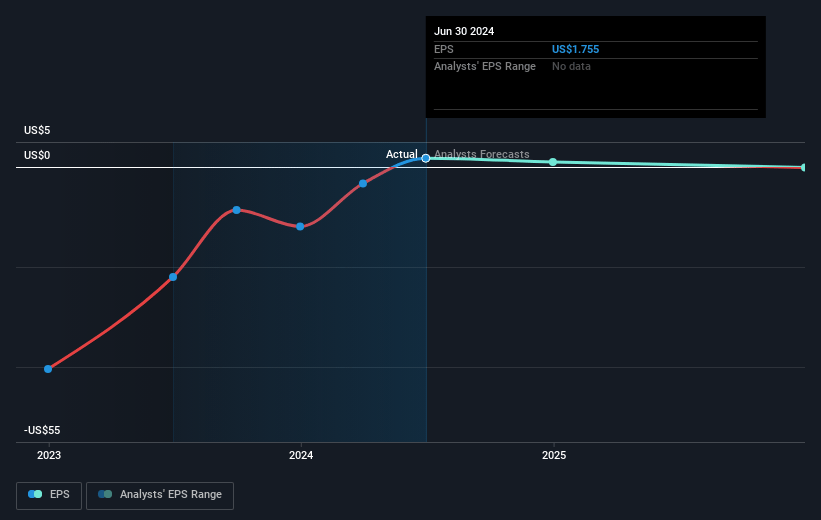

- The bearish analysts expect earnings to reach $3.5 million (and earnings per share of $0.71) by about June 2028, down from $4.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Electronic industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.0%, as per the Simply Wall St company report.

SuperCom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SuperCom's continued reliance on large multiyear government contracts exposes it to significant revenue volatility, as shifts in political priorities or procurement cycles-particularly in the fragmented and unpredictable US market-can delay deployments, slow new contract wins, and disrupt earnings consistency.

- The company's history of raising new capital through equity issuances and debt reduction via debt-to-equity swaps risks future shareholder dilution and may restrain reinvestment capacity; this pattern could limit improvements to net margins and long-term shareholder returns.

- Rapid technological change and increasing competition from established, better-capitalized players in the electronic monitoring industry threaten SuperCom's ability to sustain its technological edge and pricing power, which could pressure margins and reduce future revenue growth if innovation does not keep pace.

- Rising concerns about privacy, data security, and regulatory scrutiny-especially in the EU and US-may increase SuperCom's compliance costs and limit its data-driven service offerings, ultimately impacting both gross and net margins.

- Any adverse shifts in criminal justice policy or public sentiment against offender electronic monitoring and surveillance solutions, particularly where local governments re-evaluate non-custodial sentencing or technology-driven supervision, could shrink the overall addressable market and reduce topline revenue over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SuperCom is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SuperCom's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $39.7 million, earnings will come to $3.5 million, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 12.0%.

- Given the current share price of $9.41, the bearish analyst price target of $10.0 is 5.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.