Key Takeaways

- Transition to cloud and IP-based solutions, along with rising broadband infrastructure investments, is driving improved margins and expanding market opportunities.

- Expanding presence in high-growth regions and increased software and service mix reduce risks and support stronger revenue, profitability, and reinvestment capacity.

- Dependence on large customers, margin pressures from regional sales mix, supply chain risks, constrained cash flow, and slow cloud transition threaten revenue stability and competitiveness.

Catalysts

About Ribbon Communications- Provides communications technology in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

- Ongoing modernization of voice and data networks, particularly the large-scale migration away from legacy copper/TDM infrastructure towards IP and cloud-based solutions, is driving sustained demand for Ribbon's Cloud & Edge portfolio, directly supporting multi-year revenue growth and improved margin mix as more services transition to higher-margin software.

- Robust global investments in broadband infrastructure and increased data usage, including rural broadband in North America and fiber backbone expansions in Asia, are fueling growth in Ribbon's IP Optical business, expanding its total addressable market and supporting higher topline revenue and potential scale-driven margin expansion.

- The proliferation of AI-driven network initiatives and data center expansions (such as nationwide fiber projects and Fortune 500 contact center AI deployments) are accelerating IP traffic growth, positioning Ribbon's advanced transport and automation offerings as critical solutions, bolstering both recurring revenues and product pull-through.

- Strategic wins in emerging and fast-growing markets (India, Southeast Asia, Africa, Middle East), along with vendor consolidation and exclusion of certain competitors, are boosting Ribbon's customer base and diversification, reducing customer concentration risks and providing new avenues for revenue growth and increased operating leverage.

- Improved backlog growth (up 35% YoY) and shifting sales mix towards software and services in upcoming quarters are expected to drive higher consolidated gross margins and EBITDA, strengthening Ribbon's near-term earnings outlook and freeing up cash flow for strategic reinvestment.

Ribbon Communications Future Earnings and Revenue Growth

Assumptions

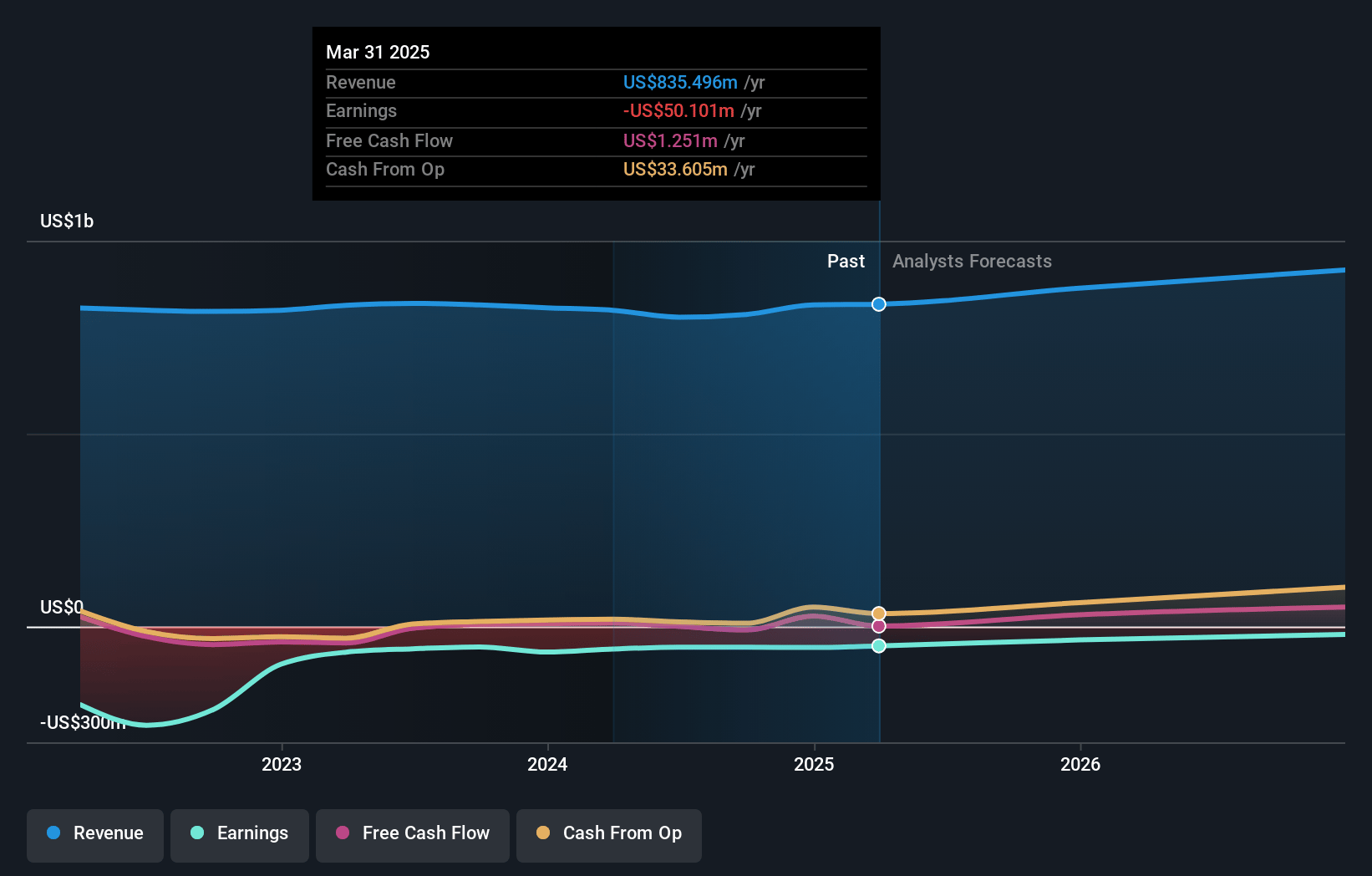

How have these above catalysts been quantified?- Analysts are assuming Ribbon Communications's revenue will grow by 6.0% annually over the next 3 years.

- Analysts are not forecasting that Ribbon Communications will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ribbon Communications's profit margin will increase from -6.0% to the average US Communications industry of 10.7% in 3 years.

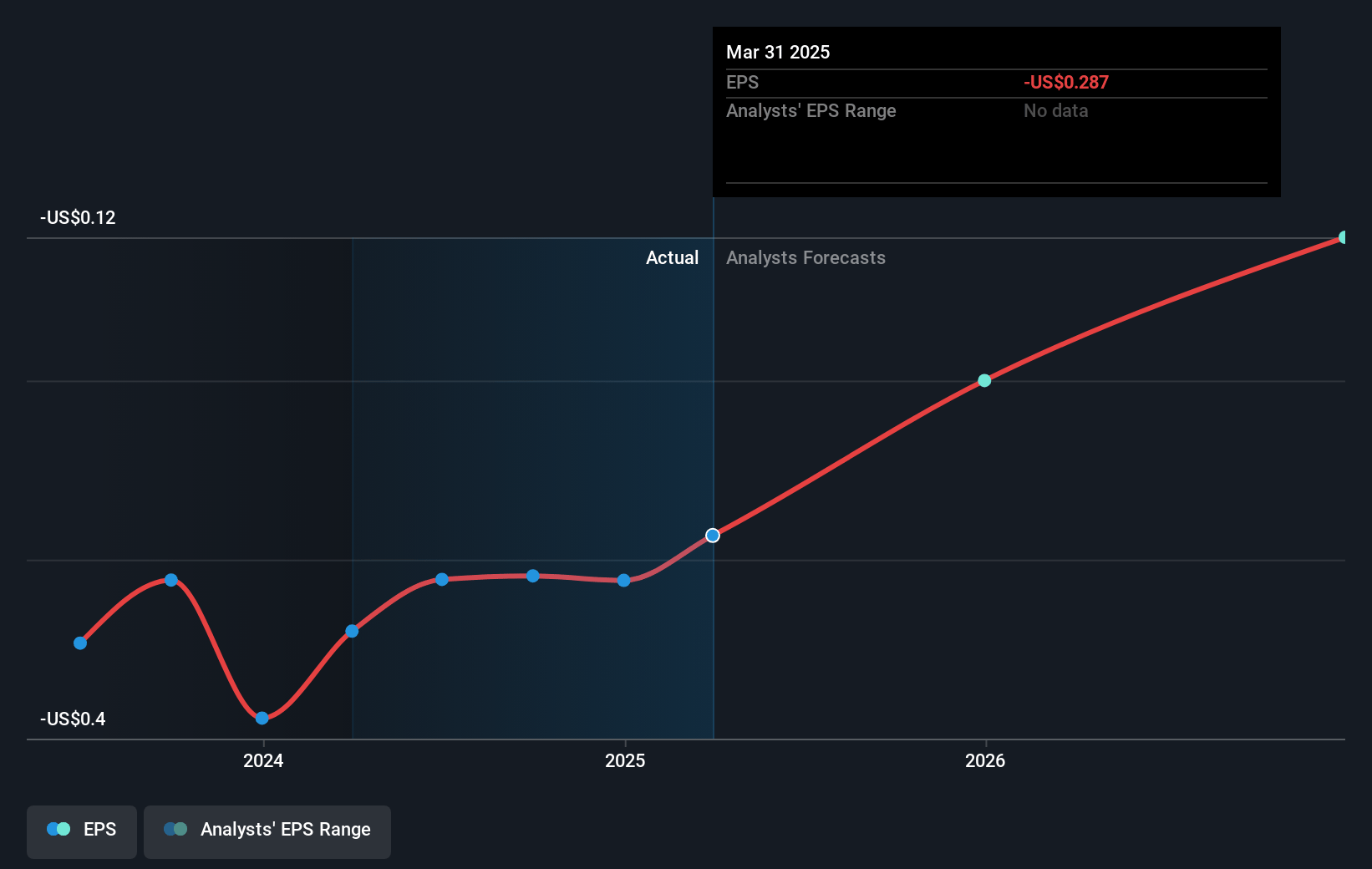

- If Ribbon Communications's profit margin were to converge on the industry average, you could expect earnings to reach $106.8 million (and earnings per share of $0.59) by about July 2028, up from $-50.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from -13.7x today. This future PE is lower than the current PE for the US Communications industry at 28.0x.

- Analysts expect the number of shares outstanding to grow by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.66%, as per the Simply Wall St company report.

Ribbon Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent customer concentration, especially reliance on large contracts with service providers like Verizon and major projects in India and the U.S., increases vulnerability to losing key accounts, which could materially impact revenue consistency and earnings stability.

- Lower-than-expected gross margins due to unfavorable product and regional sales mix, particularly the high proportion of lower-margin hardware and Professional Services revenue in India and Asia-Pacific, poses ongoing risks to net margins and long-term profitability.

- Ongoing exposure to global supply chain and tariff risks, including uncertainty regarding U.S. trade policies, rising manufacturing costs in Asia, and potential reciprocal tariffs, could lead to increased operating expenses and compressed margins, which would weigh on earnings and cash flow.

- Limited free cash flow and a persistent debt burden (net leverage at 2.4x) may constrain Ribbon's ability to invest aggressively in R&D, cloud-native innovation, or strategic M&A, thereby impacting long-term earnings growth and the ability to pivot quickly in a rapidly evolving telecom landscape.

- The accelerating migration of telecom operators to open, standards-based architectures and cloud-native or over-the-top (OTT) solutions threatens to erode Ribbon's addressable market and pricing power, while slow internal portfolio transition to cloud-native offerings could result in shrinking gross margins, higher R&D costs, and captured market share by more agile competitors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.0 for Ribbon Communications based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $994.2 million, earnings will come to $106.8 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $3.88, the analyst price target of $6.0 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.