Last Update 11 Jan 26

NTGR: Proposed TP-Link Ban Will Support Future Share And Product Demand

Analysts have adjusted their price targets for NETGEAR to reflect updated assumptions on profit margins and a higher forward P/E multiple, resulting in a revised fair value estimate of US$39.00.

What's in the News

- The U.S. Commerce Department has proposed banning sales of TP-Link products, citing national security concerns related to ties to China, and NETGEAR was named among competing networking vendors in the same space (Washington Post).

- NETGEAR launched the Nighthawk 5G M7 Portable WiFi 7 Hotspot with a new mobile app and eSIM Marketplace, targeting travelers, remote workers, and families with WiFi 7 speeds up to 3.6 Gbps for up to 32 devices and global coverage in more than 140 countries.

- The company reported that from June 30, 2025 to September 28, 2025, it repurchased 814,811 shares for US$20 million, completing a total buyback of 3,973,315 shares for US$80.15 million under the program announced on October 27, 2021.

- NETGEAR provided earnings guidance for the fourth quarter ending December 31, 2025, expecting net revenue in a range of US$170 million to US$185 million.

- NETGEAR announced that the Nighthawk 5G M7 Portable WiFi 7 Hotspot with eSIM marketplace is available for pre order at US$499.99 MSRP, with worldwide shipping and retail rollout planned to start on January 27, 2026.

Valuation Changes

- Fair Value Estimate was held steady at US$39.00 per share, indicating no change in the overall valuation outcome.

- Discount Rate was adjusted very slightly from 8.22% to 8.22%, reflecting a minimal tweak to the required return assumption.

- Revenue Growth was kept effectively unchanged at about 4.31%, suggesting no material revision to top line expectations in the model.

- Net Profit Margin was reduced from about 9.96% to about 8.28%, pointing to more conservative assumptions on future profitability.

- Future P/E was raised from about 16.87x to about 20.31x, implying a higher valuation multiple applied to expected earnings.

Key Takeaways

- Shift toward enterprise networking, cloud-managed solutions, and services is enhancing high-margin, recurring revenue streams and supporting sustained margin improvement.

- Expanded premium home networking portfolio and strengthened cybersecurity positioning are enabling greater market share in both consumer and enterprise segments.

- Intensifying competition, commoditization, and supply constraints threaten NETGEAR's pricing power, growth prospects, and margins across both consumer and business segments.

Catalysts

About NETGEAR- Provides connectivity solutions the Americas; Europe, the Middle East, Africa; and the Asia Pacific.

- NETGEAR's investments in expanding its ProAV and SMB/cloud-managed networking business (notably through NFB, the Exium acquisition, and professional services) directly align with the increasing global demand for robust enterprise and hybrid work solutions. These efforts are driving higher-margin revenue streams and recurring revenue potential, likely to bolster both revenue growth and improve net margins over time.

- The continued proliferation of connected devices and adoption of advanced wireless standards (WiFi 7, mesh systems) are increasing demand for high-performance home networking; NETGEAR's broadened product portfolio-especially the introduction of mid

- and high-end mesh offerings like Orbi 370-positions the company to capture share in both premium and mainstream segments, supporting future top-line growth and margin expansion.

- Heightened focus on cybersecurity and regulatory/compliance trends, combined with intensified scrutiny of Chinese networking competitors, strengthens NETGEAR's market positioning as a trusted, independent US-based supplier. This increases its potential to gain share in enterprise, government, and retail channels, directly supporting revenue growth and stabilizing gross margins.

- The company's ongoing operational optimization-including streamlined supply chain management, leaner inventory, in-sourcing of software development, and organizational restructuring-has already led to record gross margins and provides a foundation for sustainable margin improvement, enhanced earnings quality, and improved operating leverage as growth resumes.

- Scaling of subscription-based services-including expanded software/AV services and integration of security solutions-gives NETGEAR more exposure to high-margin, recurring revenue streams. This transition from reliant hardware sales to service-based models is set to drive both net margin expansion and revenue stability over the longer term.

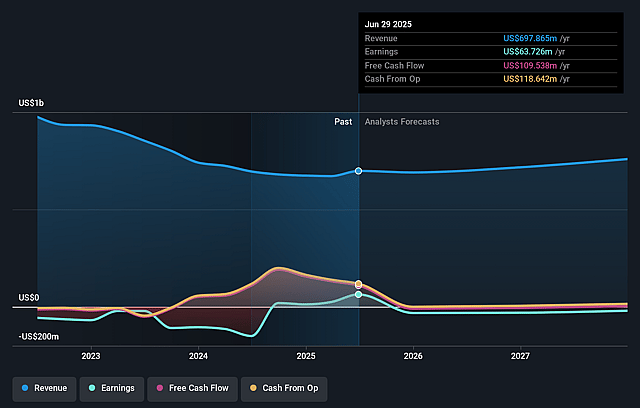

NETGEAR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NETGEAR's revenue will grow by 4.0% annually over the next 3 years.

- Analysts are not forecasting that NETGEAR will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NETGEAR's profit margin will increase from 9.1% to the average US Communications industry of 7.9% in 3 years.

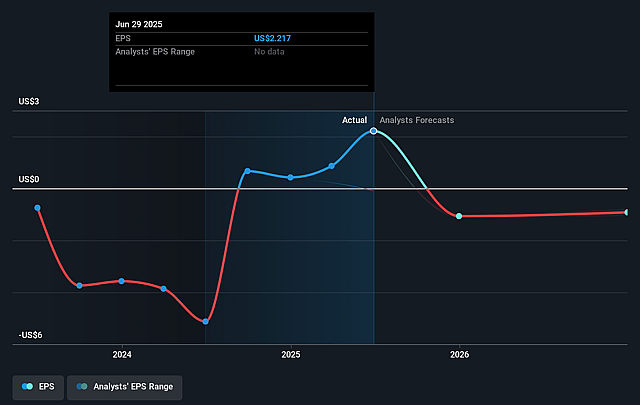

- If NETGEAR's profit margin were to converge on the industry average, you could expect earnings to reach $62.4 million (and earnings per share of $2.15) by about September 2028, down from $63.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 12.4x today. This future PE is lower than the current PE for the US Communications industry at 25.6x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

NETGEAR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The intense price competition in the U.S. retail home networking market-especially from low-cost players like TP-Link-has resulted in a "dog fight" for market share, declining average selling prices, and oscillating share gains/losses, which could continue to pressure NETGEAR's consumer revenue and gross margins over the long term.

- The rapid commoditization of home networking hardware, highlighted by the need to aggressively expand into "good, better, best" low-end mesh products, risks further eroding brand differentiation and pricing power, threatening sustainable ASPs and profitability in the core consumer segment.

- NETGEAR's future growth case relies heavily on scaling high-margin, recurring services revenue (particularly in NFB and home networking), but these initiatives are still nascent and face execution risk; slow adoption or under-penetration of premium, subscription, or services offerings could constrain expected earnings and margin expansion.

- Persistent supply constraints and component shortages, as repeatedly emphasized for ProAV Managed Switch products, have resulted in growing sales backlogs-if not resolved, these bottlenecks could prevent NETGEAR from capturing full top-line growth, while prolonged inefficiencies may increase inventory risk and compress earnings.

- Despite successes in diversification, NETGEAR remains exposed to industry trends favoring cloud-managed networking and integrated smart home ecosystems-if customers shift away from on-premise hardware toward competitors' end-to-end ecosystems (or towards cloud-based solutions), NETGEAR's addressable market, revenues, and margins could face secular pressure over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.0 for NETGEAR based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $785.3 million, earnings will come to $62.4 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $27.29, the analyst price target of $32.0 is 14.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NETGEAR?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.