Key Takeaways

- Increased demand for service assurance and cybersecurity products, along with AI investments, could drive revenue growth and improve margins.

- Partnerships and strategic financial actions, like debt repayment and share buybacks, could enhance market presence and improve earnings per share.

- Customer order shifts may artificially boost short-term revenue, while mixed performance across segments and reliance on a key customer pose growth and stability challenges.

Catalysts

About NetScout Systems- Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

- The company is seeing increased demand for its service assurance and cybersecurity product lines, which could drive future revenue growth as they address customer needs at the edge of the network and in the cybersecurity landscape.

- NetScout's new edge solutions in service assurance are gaining traction, particularly as enterprises advance their digital transformations, potentially boosting revenue in the enterprise customer vertical.

- Investments in AI and machine learning within cybersecurity products, such as adaptive DDoS solutions, position NetScout to capitalize on growing threats and cybersecurity spending, potentially increasing both revenue and margins.

- The company's participation in major industry events and partnerships with firms like Palo Alto Networks could expand its market presence and drive future top-line growth.

- The anticipation of repaying debt and potential share repurchases could enhance earnings per share (EPS) by reducing interest expenses and lowering the share count.

NetScout Systems Future Earnings and Revenue Growth

Assumptions

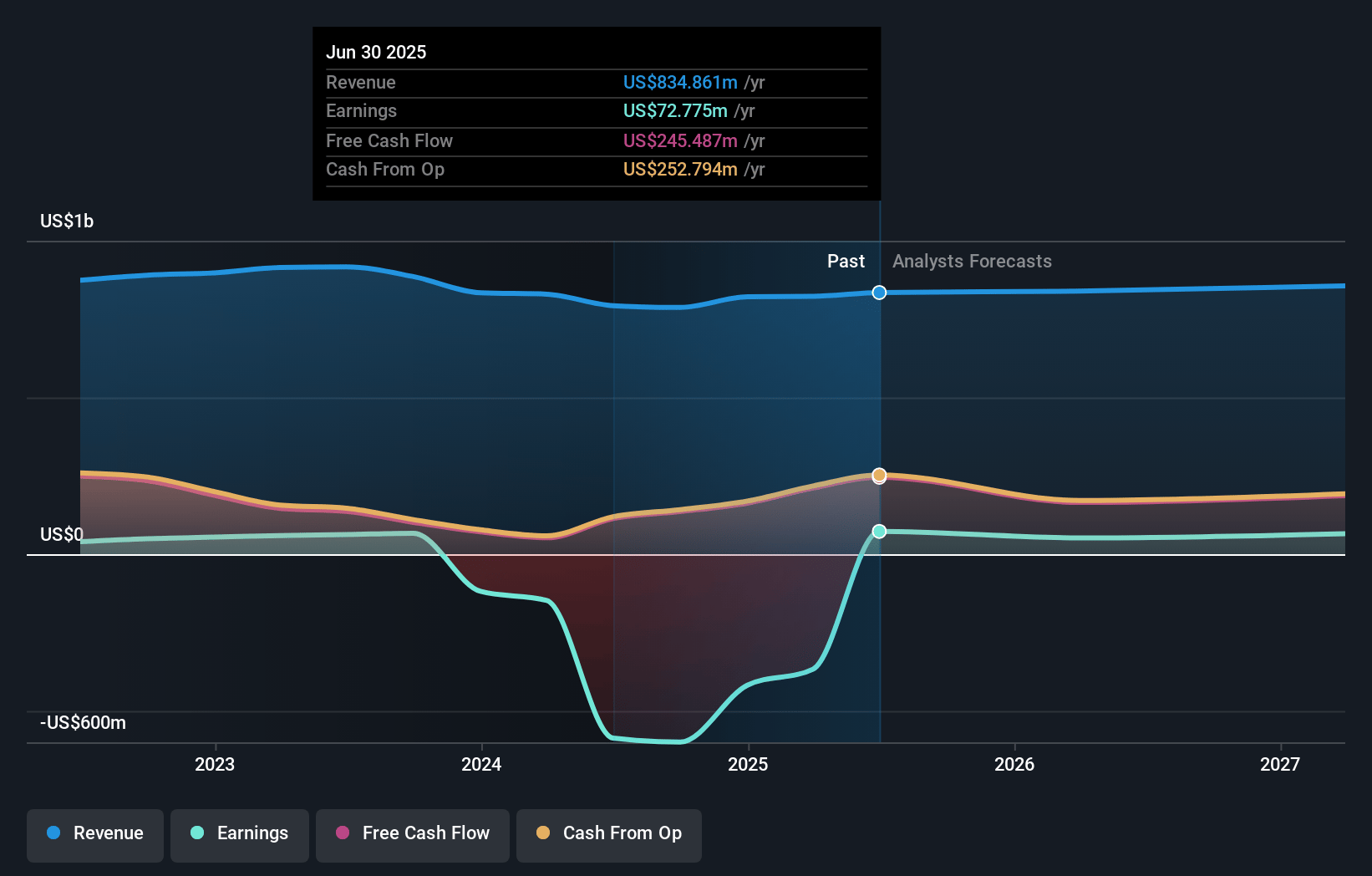

How have these above catalysts been quantified?- Analysts are assuming NetScout Systems's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -44.6% today to 17.6% in 3 years time.

- Analysts expect earnings to reach $152.7 million (and earnings per share of $2.18) by about July 2028, up from $-366.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from -4.4x today. This future PE is lower than the current PE for the US Communications industry at 28.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

NetScout Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of customer orders into the third quarter, which were initially expected in the fourth quarter, might artificially boost reported revenues and earnings, leading to potential volatility in future revenue recognition. This shift could temporarily inflate current results while possibly creating a discrepancy in subsequent quarters, impacting revenue stability.

- The company's service assurance revenue for the first nine months of fiscal year 2025 decreased by approximately 5%, affected by previously disclosed backlog issues and divestiture-related headwinds. This decline indicates potential challenges in maintaining stable growth, which could negatively impact overall revenue and earnings.

- Despite growth in cybersecurity revenue, the overall enterprise and service provider customer verticals exhibited mixed performance, including a 7.2% decline in service provider revenue. These uneven growth patterns in key customer segments may affect future revenue streams and challenge NetScout's ability to sustain consistent earnings growth.

- A high degree of reliance on a single customer, which represented 10% or more of total revenue, introduces concentration risk. Any potential loss or reduction in business from this major customer could significantly affect total revenue and profitability.

- The timing and composition of bookings have led to fluctuations in Days Sales Outstanding (DSO), which at the end of the third quarter was lower than the same period the prior year. While this indicates some improvement, the variability in DSO metrics may signify potential issues with cash flow management, affecting financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.225 for NetScout Systems based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $867.7 million, earnings will come to $152.7 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $22.83, the analyst price target of $22.22 is 2.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.