Last Update 20 Mar 25

Fair value Decreased 25%Key Takeaways

- Reached Cashflow profitability in 2023

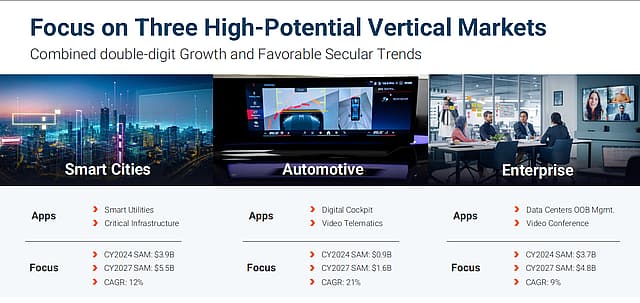

- Strong player in IOT driven by AI

- Founded 1989. Was around $60 during dot com bubble but has been stagnant since. Has the technology caught up with what Lantronix is good at?

- Low Debt and good cash flow.

- Investors relations presentation. https://cdn.lantronix.com/wp-content/uploads/pdf/Lantronix-Investor-Relations-Dec-Nov-2024.pdf?_gl=1*5mwp2x*_gcl_au*MTkwNTUxMzMyNy4xNzMyNzE2MDg2*_ga*MTMwMTcyNjE1MC4xNzMyNzE2MDg2*_ga_M2G6RLT5L3*MTczMjcxNjA4Ni4xLjEuMTczMjcxNjQ1OC4wLjAuMA..

Catalysts

- Are there any products or services that could move sales or earnings meaningfully?

- Are there any industry tailwinds this stock is benefitting or hindered from?

- AI is the big buzzword currently

Assumptions

Where do you think revenue will be in 5 years time? and why?

- Where do you think earnings will be in 5 years time? and why?

Have other thoughts on Lantronix?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user thorinsteady has a position in NasdaqCM:LTRX. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.