Last Update01 May 25Fair value Increased 7.14%

AnalystConsensusTarget has decreased revenue growth from 40.3% to 33.9%, decreased profit margin from 8.3% to 2.3% and increased future PE multiple from 31.6x to 137.3x.

Read more...Key Takeaways

- The acquisition of G5 Infrared enables LightPath to transition into a solutions provider, potentially increasing revenue with expanded offerings and defense contracts.

- Strategic moves into security markets and supply chain disruptions position LightPath to boost growth and market share.

- LightPath faces integration and supply chain risks and margin pressures, while relying on new product adoption and managing rising operational costs for future profitability.

Catalysts

About LightPath Technologies- Designs, develops, manufactures, and distributes optical components and assemblies.

- The acquisition of G5 Infrared is expected to be highly accretive and transformational, enabling LightPath to transition from a component manufacturer to a solutions and subsystem provider, potentially increasing revenue through expanded product offerings and larger contracts.

- G5 Infrared's involvement in large defense programs, including programs of record expected to begin production, could significantly increase revenue by adding an established pipeline of defense contracts, providing reliable income streams from government projects.

- The strategic shift to higher average sales prices (ASPs) from selling optical components to higher-value systems and cameras suggests an increase in gross and net margins by moving up the value chain and offering more complex and profitable products.

- LightPath's expansion into Counter-UAS (Unmanned Aerial Systems) and perimeter security applications with G5 cameras is expected to drive growth in the fast-growing security market, potentially boosting revenue from both new and existing customers in these sectors.

- The company is capitalizing on new opportunities resulting from disrupted chinese material supply, specifically for germanium, positioning itself to capture market share with its BlackDiamond Optics, potentially increasing market penetration and revenue.

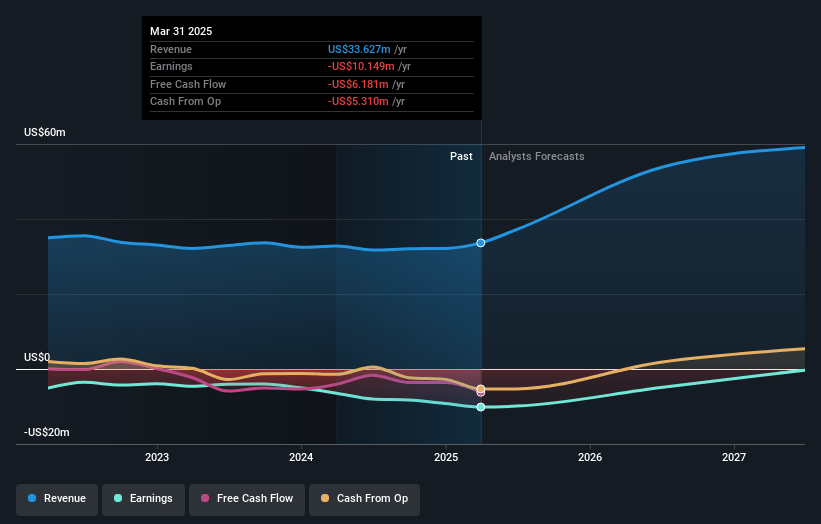

LightPath Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LightPath Technologies's revenue will grow by 33.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -28.6% today to 2.3% in 3 years time.

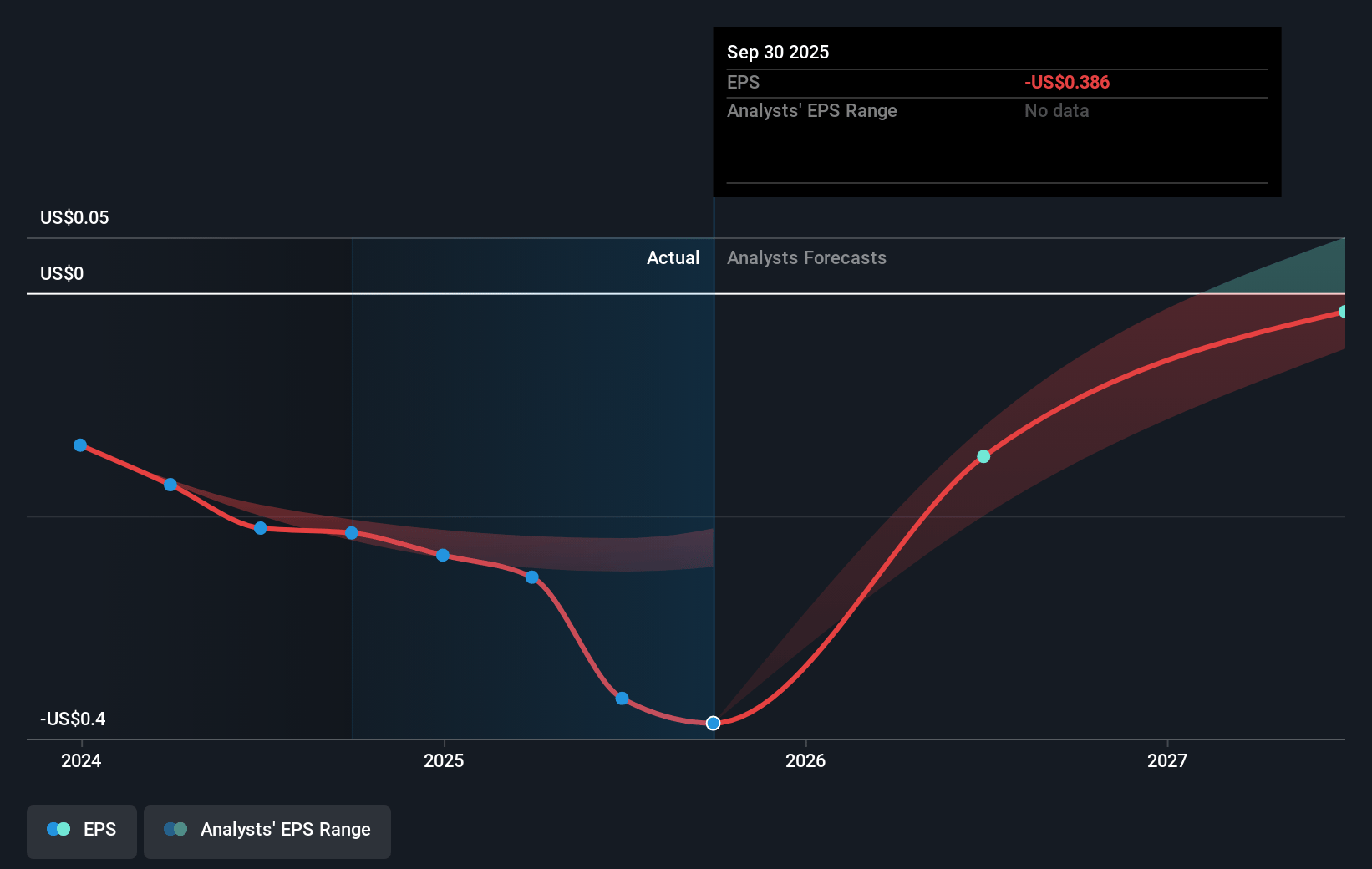

- Analysts expect earnings to reach $1.8 million (and earnings per share of $-0.36) by about May 2028, up from $-9.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 137.3x on those 2028 earnings, up from -10.4x today. This future PE is greater than the current PE for the US Electronic industry at 20.6x.

- Analysts expect the number of shares outstanding to grow by 3.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

LightPath Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on Chinese imports, particularly for materials such as zinc selenide, zinc sulfide, and germanium, presents a supply chain risk. Disruptions like the December export restrictions could affect LightPath's ability to deliver products on time, impacting both revenue and net margins.

- Despite strategic acquisitions, LightPath is still navigating the transition from a component manufacturer to a solutions and subsystem provider. Execution risks in successfully integrating new businesses, like G5 Infrared, and achieving synergistic growth could impact future earnings.

- LightPath's gross margins have decreased, partly due to supply chain issues and material costs. Sustained pressure on margins, if not addressed, may continue to affect net profitability.

- Significant operating expenses tied to legal, consulting fees, and acquisitions have increased, deteriorating the net loss. If such expenses continue to rise faster than revenue growth, this might negatively influence future earnings.

- LightPath's transition strategy includes significant dependency on the successful ramp-up and market acceptance of its new product lines such as MANTIS cameras. Any delay or failure in broad adoption could temper expected revenue growth from these high ASP products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.5 for LightPath Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.5, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $77.2 million, earnings will come to $1.8 million, and it would be trading on a PE ratio of 137.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of $2.39, the analyst price target of $4.5 is 46.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.