Key Takeaways

- Increased regulatory scrutiny and geopolitical risks are likely to raise costs, constrain growth, and limit Digi's ability to scale or maintain margins.

- Reliance on traditional hardware and lagging software growth exposes Digi to rapid technological change and intensifying competition, threatening future earnings and market share.

- Successful shift to a subscription-driven model, strategic acquisitions, and solution bundling are enhancing revenue stability, margin expansion, and long-term financial flexibility.

Catalysts

About Digi International- Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

- Intensifying global regulatory scrutiny and evolving data privacy mandates are likely to escalate compliance costs, extend product approval cycles, and constrain Digi's ability to introduce and scale new IoT solutions, reducing net margins and limiting top-line revenue growth over the long term.

- Rapid technological innovations in edge computing and artificial intelligence threaten to outpace Digi's existing hardware

- and software-based offerings, significantly increasing the risk of product obsolescence and impairing the company's ability to maintain its current revenue growth trajectory.

- Continued reliance on hardware revenue, as recurring software attach rates remain below 50 percent portfolio-wide, exposes Digi to persistent margin compression as connectivity hardware becomes increasingly commoditized, potentially weighing on earnings and gross margin expansion for years to come.

- Supply chain volatility, ongoing geopolitical instability, and the possibility of new reciprocal tariffs or trade barriers-especially in non-North American regions-could erode operational flexibility, drive up input costs, and reduce Digi's ability to consistently deliver competitively priced solutions, impacting both revenues and net margins.

- Escalating competition from aggressive low-cost manufacturers and global industry consolidation is set to accelerate price erosion and market share attrition for Digi, hindering the company's ability to achieve sustained operating leverage and threatening the durability of its long-term earnings power.

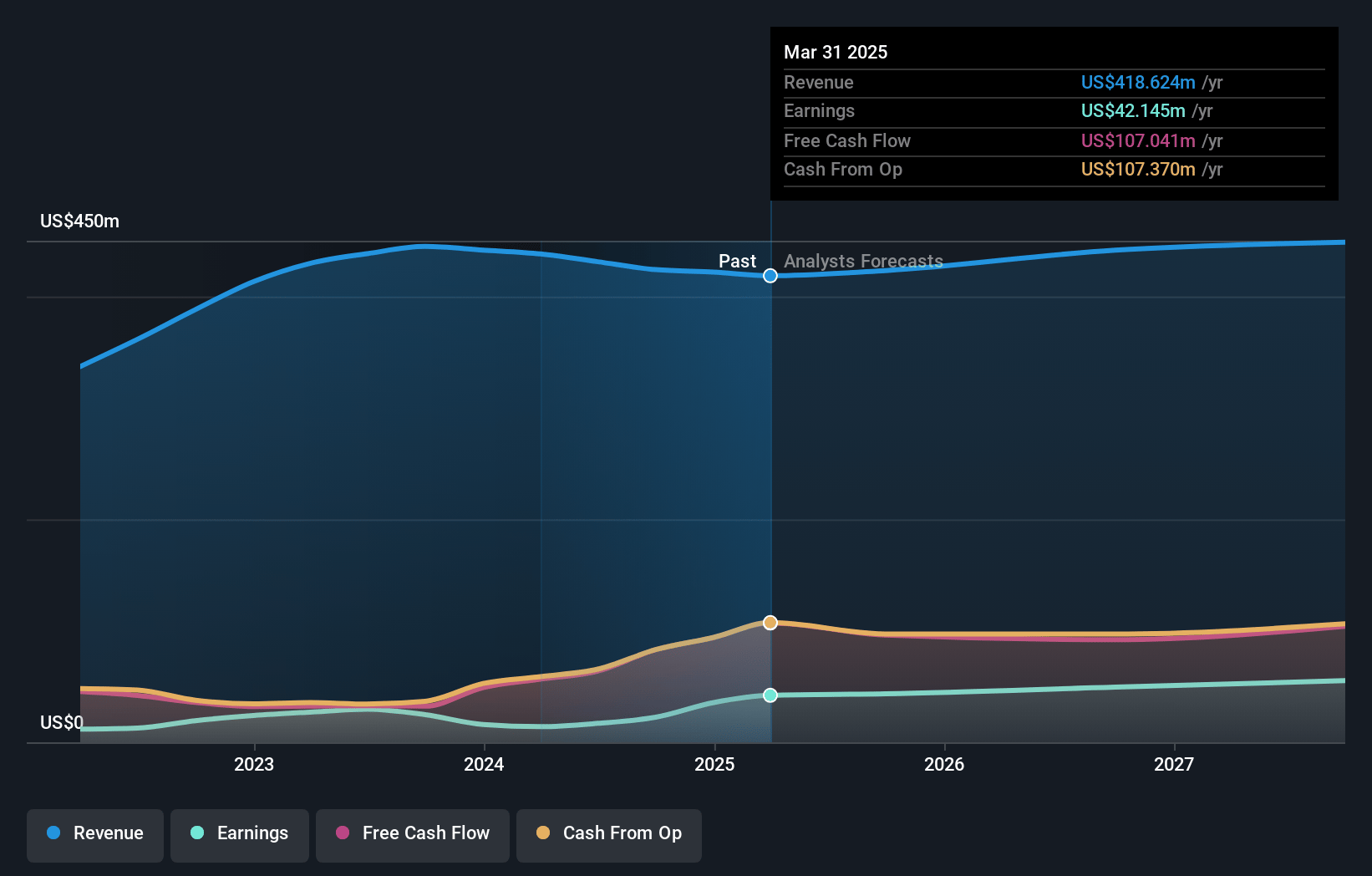

Digi International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Digi International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Digi International's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.1% today to 13.0% in 3 years time.

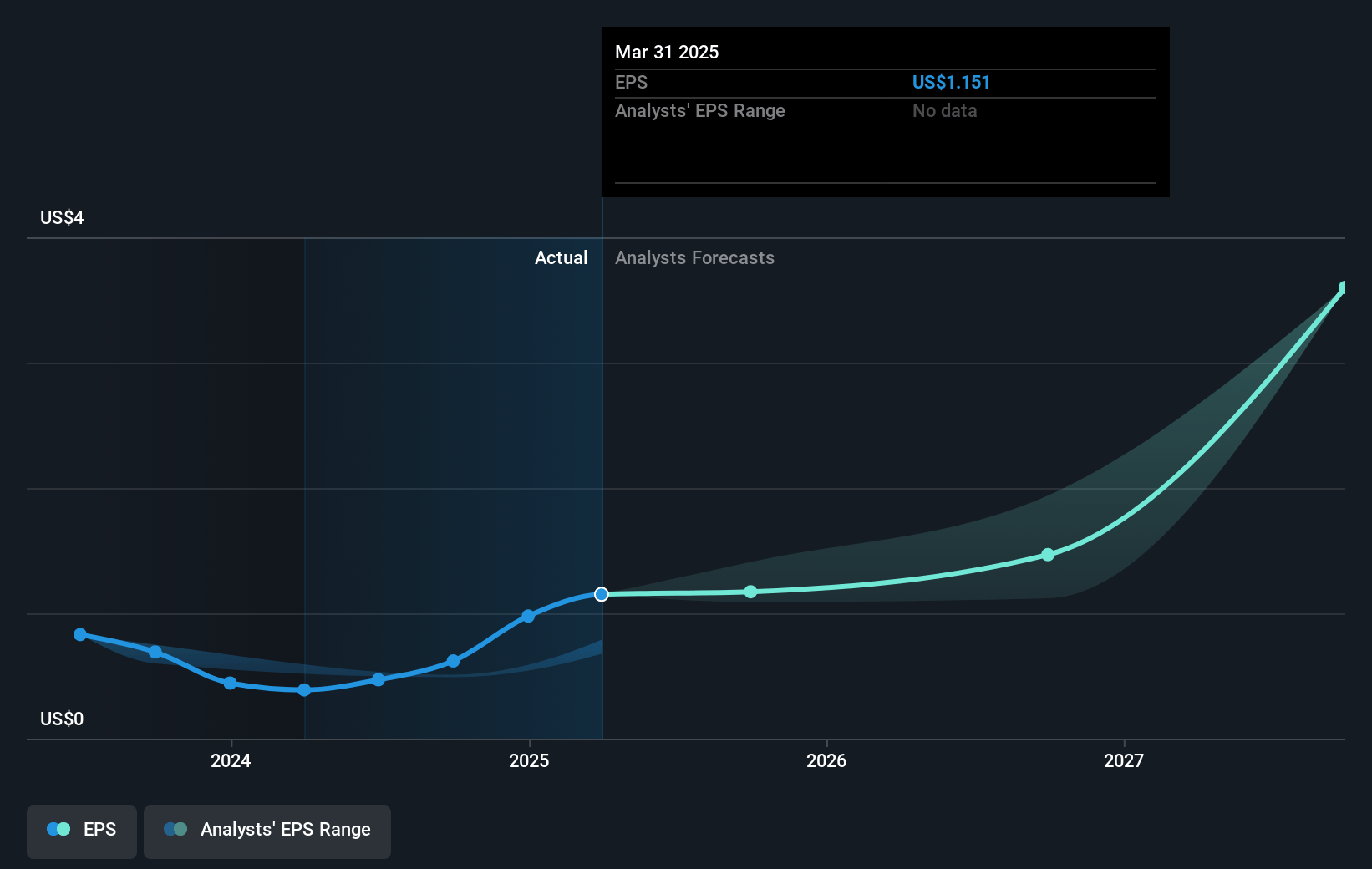

- The bearish analysts expect earnings to reach $59.8 million (and earnings per share of $4.44) by about July 2028, up from $42.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, down from 29.6x today. This future PE is lower than the current PE for the US Communications industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Digi International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating annual recurring revenue, which grew 12% year-over-year to reach a record level and now represents 29% of revenues, signals a successful shift toward a subscription-based business model that supports improved revenue visibility, higher margins, and more stable long-term earnings.

- The company's solution-oriented approach, which bundles hardware with software and managed services, has driven higher attach rates and strong adoption from both channel partners and direct customers, potentially expanding gross margins and underpinning sustainable revenue growth.

- Continued improvements in free cash flow, ability to pay down debt ahead of plan, and an anticipated transition to a net cash positive position will enhance financial flexibility, lower interest expense, and support both acquisitions and organic growth, likely benefiting earnings and balance sheet strength.

- Ongoing strategic acquisitions, supported by improved balance sheet health, enable Digi International to enter new market verticals and capture cross-selling opportunities, which can accelerate topline revenue and operating leverage over time.

- Customers are receiving recently refreshed and upgraded solutions, like Ventus and SmartSense, favorably, and the expansion of recurring models to larger portions of the product portfolio suggests the company can continue to grow ARR and improve net margins through higher-value, sticky offerings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Digi International is $30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Digi International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $459.9 million, earnings will come to $59.8 million, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of $33.71, the bearish analyst price target of $30.0 is 12.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives