Narratives are currently in beta

Key Takeaways

- Digital transformation and Show Control investments may boost revenue, operational efficiency, and expand gross margins through new software offerings and value-added services.

- Continued demand in the Live Events segment and strategic cost reductions could increase revenue and operating margins, enhancing competitiveness.

- Declining order volumes and backlog, coupled with revenue volatility and cost pressures, may threaten future revenue expectations and margins at Daktronics.

Catalysts

About Daktronics- Designs, manufactures, and sells electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial, and transportation applications in the United States and internationally.

- Daktronics is actively leveraging a digital transformation roadmap which includes launching enterprise performance management tools and upgrades to service systems set to go live in the second half of FY 2025, potentially driving future revenue growth and operational efficiency, subsequently improving net margins.

- The company's continued significant installations, such as the Miami Heat's innovative video displays, and contracts with sports facilities suggest ongoing demand in the Live Events segment, which is expected to sustain and potentially increase sales revenue.

- Investments in Show Control capabilities and cloud services are intended to boost Daktronics' software offerings, possibly creating new revenue streams and supporting gross margin expansion by enhancing customer value through recurring revenue.

- Strategic focus on enhancing and lowering structural and product costs might increase competitiveness in the market, leading to expanded operating margins over time.

- Daktronics plans to execute on share repurchases to offset stock dilution from convertible notes, which could enhance earnings per share (EPS) as the conversions occur.

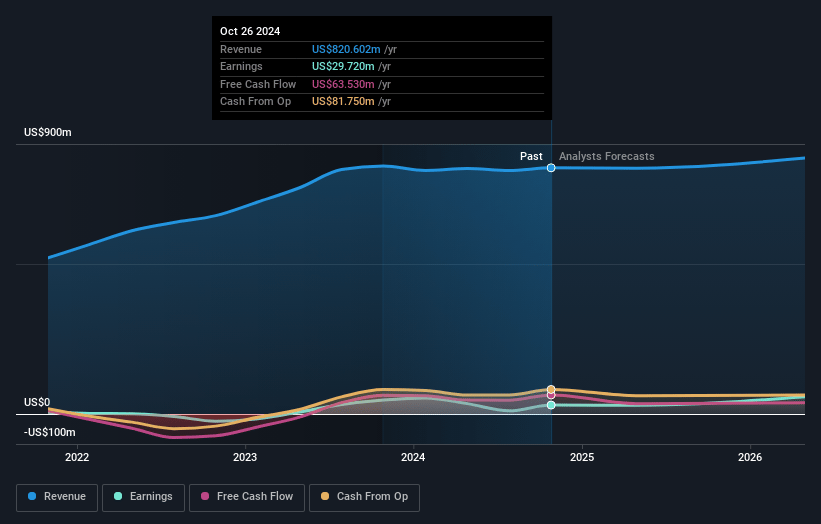

Daktronics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Daktronics's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 9.3% in 3 years time.

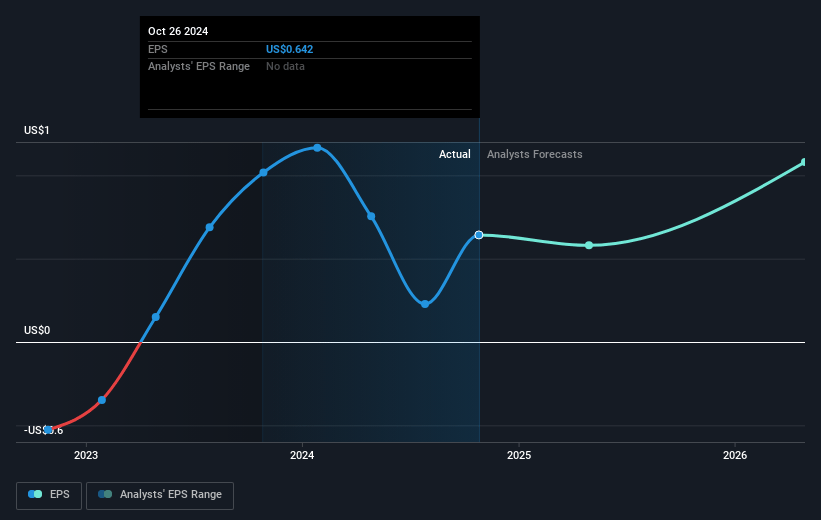

- Analysts expect earnings to reach $81.0 million (and earnings per share of $1.38) by about January 2028, up from $29.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 27.9x today. This future PE is lower than the current PE for the US Electronic industry at 26.1x.

- Analysts expect the number of shares outstanding to grow by 7.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.28%, as per the Simply Wall St company report.

Daktronics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The order volume for the quarter declined in key business units such as Live Events, Transportation, and International, which could impact future revenues if this trend continues.

- The backlog is declining as planned due to the seasonality and completion of fall sports installations, which may lower future revenue expectations.

- Variability in period-to-period order and sales volumes due to large and complex installations can create revenue volatility, impacting earnings stability.

- Gross profit as a percentage of net sales decreased slightly year-over-year, potentially indicating future pressure on net margins if cost management does not offset these reductions.

- Tariff changes and regulatory uncertainties with a new administration could lead to increased costs for components, influencing net margins and possibly reducing profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.0 for Daktronics based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $868.5 million, earnings will come to $81.0 million, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of $17.66, the analyst's price target of $24.0 is 26.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives