Key Takeaways

- Substantial broadband funding and rising demand for high-speed connectivity are projected to drive sustained revenue growth and margin expansion for Clearfield.

- Diversified manufacturing, innovative labor-saving products, and a robust customer base enhance operational resilience and position the company for improved earnings leverage.

- Clearfield faces margin pressure from tariffs, customer concentration risks, regulatory uncertainties in fiber funding, segment underperformance, and persistent supply chain vulnerabilities.

Catalysts

About Clearfield- Manufactures and sells various fiber connectivity products in the United States and internationally.

- Anticipated acceleration in revenue growth starting in fiscal 2026 from substantial U.S. government broadband funding (BEAD and E-ACAM programs) as administrative delays clear, with management expecting these programs to materially impact Clearfield's topline results and support long-term revenue growth.

- Growing market need for high-speed fiber connectivity-driven by ongoing increases in streaming, remote work, IoT, and cloud adoption-is directly supporting end-market demand for Clearfield's proprietary, labor-saving connected home deployments and FieldSmart solutions, which should expand revenue and support higher gross margins through premium, differentiated products.

- Proactive manufacturing and supply chain diversification, including U.S. and Mexico dual-sourcing, strategic relocation of production to Estonia, and global supplier relationships, is expected to buffer margin pressure from tariffs and trade disruptions, improving operational resilience and supporting gross and net margin stability.

- Clearfield's introduction of innovative, labor-reducing deployment kits and modular fiber solutions continues to win industry recognition and increases customer adoption, which enhances differentiation, pricing power, and positions the company for margin expansion as labor shortage trends persist.

- Strength in large regional and diversified customer bases, combined with normalized inventory levels and recovering industry ordering patterns, points to sustained demand, improved overhead utilization, and increased earnings leverage as industry spending rebounds.

Clearfield Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clearfield's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.0% today to 15.8% in 3 years time.

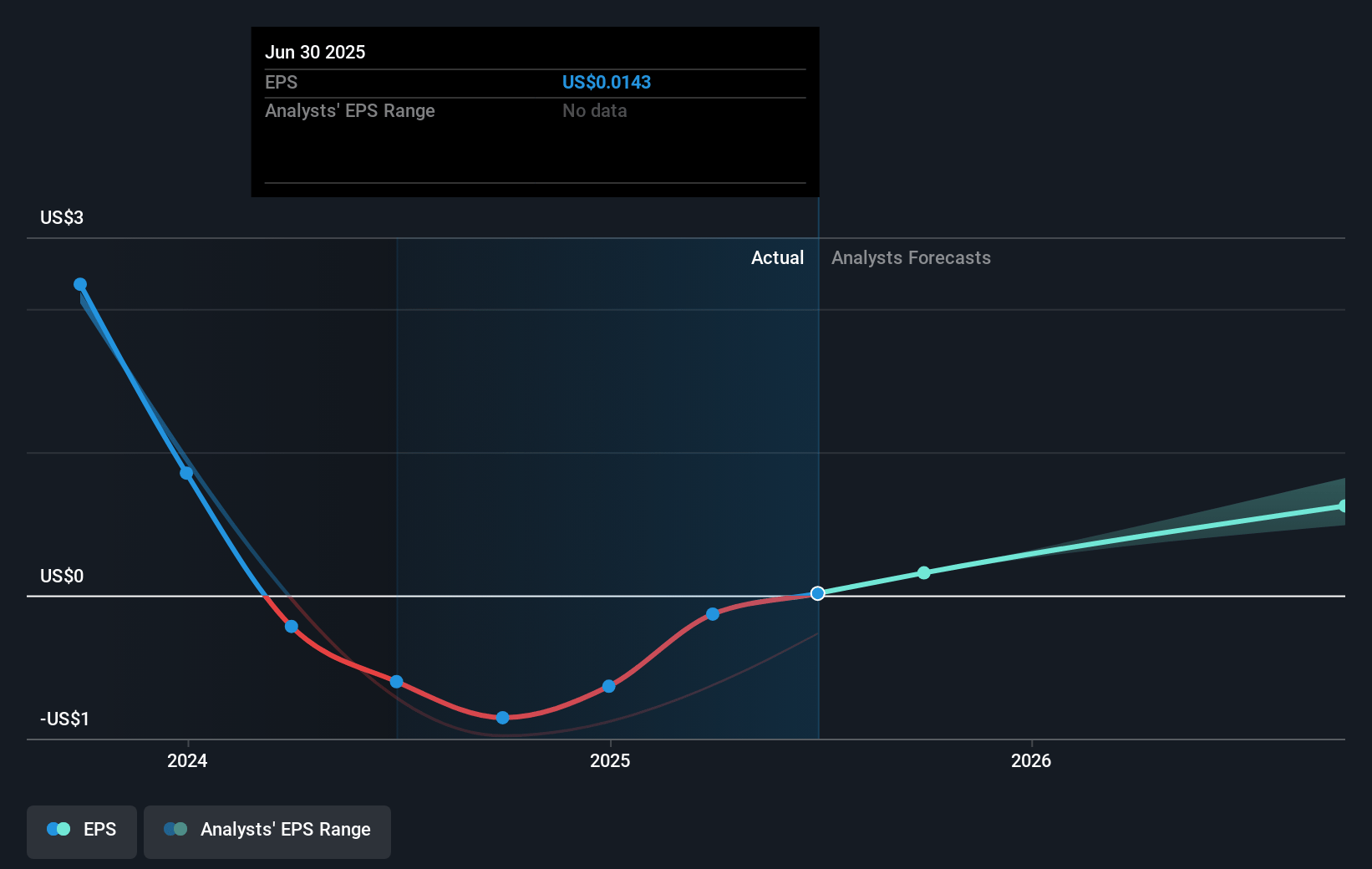

- Analysts expect earnings to reach $37.5 million (and earnings per share of $2.6) by about July 2028, up from $-1.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from -308.6x today. This future PE is lower than the current PE for the US Communications industry at 28.0x.

- Analysts expect the number of shares outstanding to decline by 2.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Clearfield Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company highlighted that recent and evolving tariff policies are expected to increase costs for Clearfield, and while they believe current mitigation efforts are sufficient, there is still risk that future changes in trade and tariff dynamics could compress gross margins and dampen net earnings if higher costs cannot be fully passed on to customers.

- Clearfield's revenue growth in the recent quarter was partly supported by at least one large regional customer pulling forward approximately $3 million in orders, and with one regional becoming a 10% customer; this customer concentration increases vulnerability to revenue volatility if any major customer reduces or delays spending due to industry cyclicality or subsidy uncertainties.

- The company is relying on administrative programs such as BEAD and E-ACAM for long-term growth, but both have experienced delays and regulatory uncertainty; any prolonged funding delays, reductions, or political shifts away from fiber-focused investment could materially limit industry growth and impact Clearfield's top-line expansion.

- The Nestor segment is experiencing declining sales year-over-year and is in a transition period aimed at improving margins through product mix and cost structure changes; continued underperformance or challenges in European operations could constrain overall revenue growth and profitability, especially if higher-margin goals are not met.

- Although Clearfield emphasizes supply chain resilience and production diversification, ongoing reliance on certain geographies (like Asia) for components, as well as the need for rapid manufacturing pivots, could expose the company to future global supply chain disruptions or rising protectionism, putting gross margin and operational flexibility at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.0 for Clearfield based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $237.9 million, earnings will come to $37.5 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $41.34, the analyst price target of $46.0 is 10.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.