Key Takeaways

- Manufacturing changes and optimized inventories aim to boost gross margins, improving financial efficiency and future earnings.

- Software upgrades and 4RF acquisition offer revenue growth and cross-selling opportunities, enhancing earnings and market position.

- Declining global market and increased operating expenses challenge Aviat Networks' profitability and growth, amid risks tied to recent acquisitions and cash flow management.

Catalysts

About Aviat Networks- Provides microwave networking and wireless access networking solutions in North America, Africa, the Middle East, Europe, Latin America, and the Asia Pacific.

- Aviat Networks is transferring the manufacturing of Pasolink products to its own contract manufacturer, which is expected to reduce costs and improve gross margins over time. This relocation aims to enhance order management and inventory efficiency, positively impacting future earnings and profitability.

- The company has identified a $50 million upgrade opportunity by transitioning existing Pasolink customers to its network management software, ProVision Plus, over the next five years. This move is projected to increase software revenue, potentially boosting net margins given the typically higher margin nature of software compared to hardware.

- Aviat's acquisition of 4RF provides significant cross-selling opportunities as only about 10% of their combined private network customers are overlapping. The successful integration and cross-selling of 4RF’s products, such as the Aprisa 5G router, are likely to increase revenue and improve earnings in the private 5G business segment.

- The company sees a long upgrade cycle in public safety networks and expects a significant investment cycle in grid and utility infrastructure modernization, which could drive increased demand for its products in these sectors, potentially boosting revenue and earnings.

- The planned build-up and subsequent reduction of Pasolink product inventory over the next 18 months are expected to optimize costs and eventually enhance gross margins, improving financial efficiency and potentially leading to better net margins in future quarters.

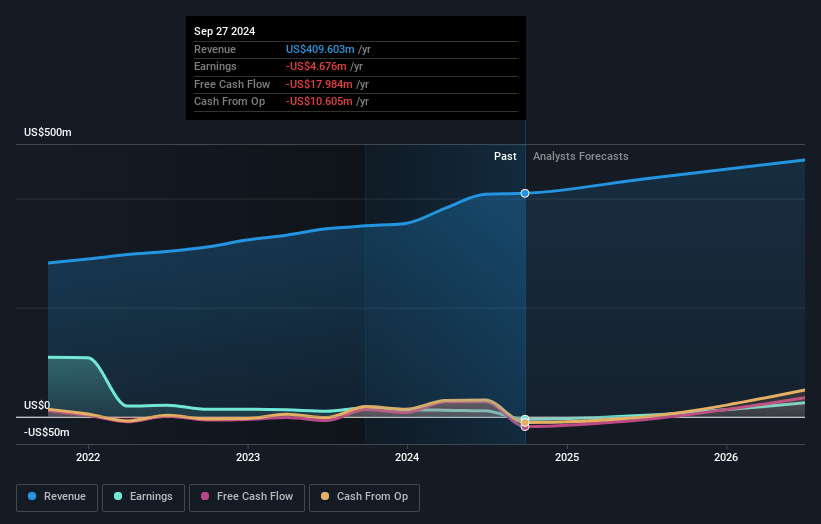

Aviat Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aviat Networks's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.1% today to 10.1% in 3 years time.

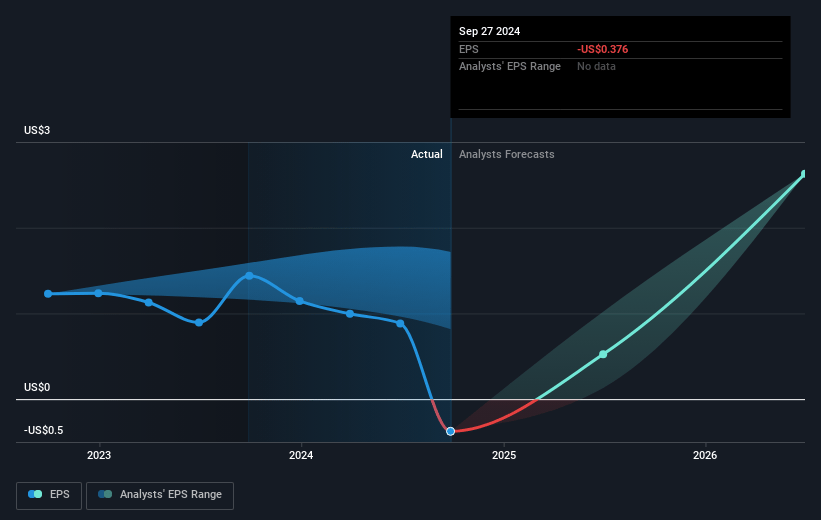

- Analysts expect earnings to reach $52.4 million (and earnings per share of $5.89) by about January 2028, up from $-4.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, up from -49.9x today. This future PE is lower than the current PE for the US Communications industry at 25.2x.

- Analysts expect the number of shares outstanding to decline by 11.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

Aviat Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Aviat Networks experienced a contraction in the global microwave market for the fourth consecutive quarter, driven primarily by declines in mobile network CapEx, which could negatively impact future revenues and market share.

- Gross margins declined significantly due to lower overall volumes and a shift away from higher-margin North American projects, indicating potential challenges in maintaining profitability.

- The company's reliance on successful integration and revenue generation from recent acquisitions like Pasolink and 4RF introduces the risk of increased operating expenses and execution challenges, potentially affecting net margins and earnings.

- The transition of Pasolink product manufacturing from NEC involves building substantial inventory, which could impact cash flow and financial stability if not managed properly.

- Elevated operating expenses related to acquisitions and higher R&D spending are pressuring financial performance, with an adjusted EBITDA loss reported, signaling potential risks to future earnings improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.5 for Aviat Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $518.1 million, earnings will come to $52.4 million, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of $18.38, the analyst's price target of $34.5 is 46.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

NA

NateF

Community Contributor

AVNW Market Outlook

Aviat Networks, Inc. (NASDAQ: AVNW) specializes in wireless transport solutions and has demonstrated notable growth and strategic initiatives that may appeal to value investors seeking growth over the next 1-3 years.

View narrativeUS$91.56

FV

75.3% undervalued intrinsic discount7.94%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

about 2 months ago author updated this narrative