Key Takeaways

- Acceleration toward cloud-native and SaaS platforms boosts recurring revenue, margin expansion, and creates a more resilient, predictable business model as legacy hardware fades.

- Integration of payments and hardware-agnostic solutions enhances cross-selling, customer retention, and market share as digital transformation and unified commerce demand rises.

- Ongoing hardware declines, rising costs, high investment needs, and execution risks in cloud transition threaten revenue stability and competitive positioning as industry pressures intensify.

Catalysts

About NCR Voyix- Provides digital commerce solutions for retail stores and restaurants in the United States, the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- The company is accelerating the rollout of its cloud-native Voyix Commerce Platform and suite of integrated applications, allowing customers to transform their physical locations into digital experience channels and leverage real-time data and AI-driven analytics. This platform shift positions NCR Voyix to capture a growing share of digital transformation spending, driving increased subscription-based and recurring software revenues, which should expand margins and enhance long-term earnings quality.

- The transition away from legacy hardware and one-time software/license revenue toward higher-margin, multi-year SaaS and payments contracts is expected to lift recurring revenue as a percentage of total sales (already at 66%) and improve net margins over time, directly addressing a key investor concern and establishing a more resilient, predictable revenue base.

- Integration of end-to-end payments acceptance and processing (leveraging the WorldPay partnership) into both retail and restaurant solutions creates significant cross-selling and customer stickiness opportunities; NCR Voyix is positioned to capture additional market share as businesses seek unified commerce and payment platforms, directly contributing to future revenue growth and supporting premium pricing.

- The company's solutions are increasingly hardware-agnostic and designed for integration with competitors' devices, lowering barriers to adoption and expanding NCR Voyix's addressable market as retailers and restaurants modernize to meet the rising demand for automation, omni-channel commerce, and data privacy/compliance-all of which are becoming industry standards.

- Strong market position, successful renewal/expansion of major enterprise and global customer contracts (e.g., Morrisons, Raising Cane's, Buffalo Wild Wings, Isetan Mitsukoshi) and ongoing innovation in AI-powered and cloud solutions, combined with execution of cost reduction initiatives, are expected to drive both top-line growth and EBITDA margin expansion in the coming years.

NCR Voyix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NCR Voyix's revenue will decrease by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.1% today to 13.7% in 3 years time.

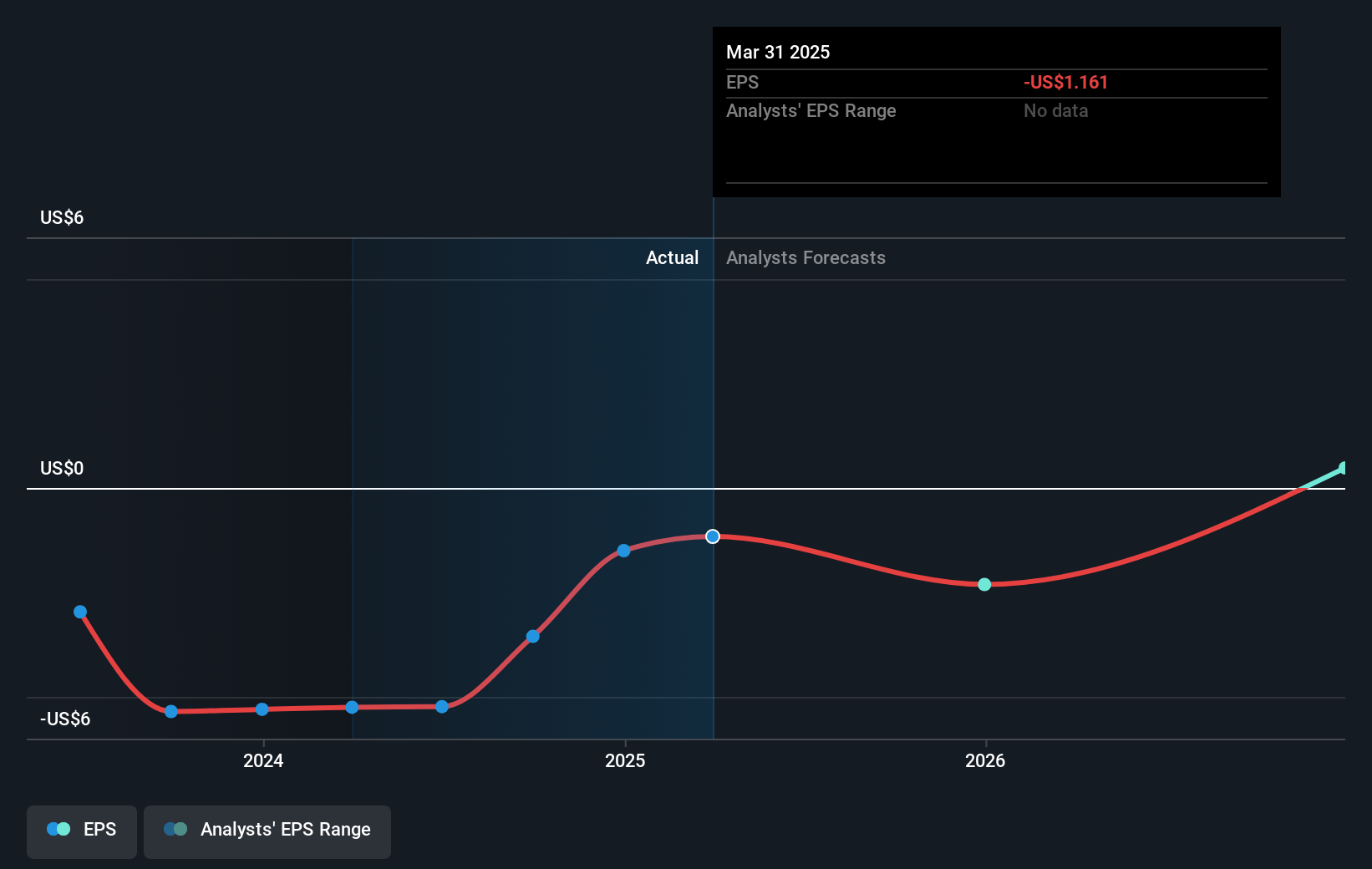

- Analysts expect earnings to reach $268.9 million (and earnings per share of $-5.17) by about July 2028, up from $-167.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from -11.3x today. This future PE is lower than the current PE for the US Software industry at 43.1x.

- Analysts expect the number of shares outstanding to decline by 5.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.86%, as per the Simply Wall St company report.

NCR Voyix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged hardware revenue and margin declines continue to impact overall company financials, as both restaurant and retail segments are experiencing significant drops in hardware and installation sales, threatening total revenue and gross profit as the transition to subscription-based software may not offset the legacy hardware decline fast enough.

- High exposure to tariffs and supply chain uncertainty, especially given recent and potential future tariff surcharges from China-based suppliers for hardware parts, may add $8–20 million in costs through the year, increasing COGS and pressuring net margins and earnings recovery.

- Continued restructuring and transformation costs (now expected to exceed initial estimates at $65 million), alongside heavy investment requirements for platform rollout and product development, could weigh on free cash flow and limit financial flexibility for organic growth or strategic M&A.

- The competitive landscape is intensifying, with NCR Voyix's core markets (retail, restaurant tech, payments) facing growing pressure from cloud-native software providers, fintechs, and other large incumbents; slow rollout or inability to scale SaaS and cloud-based offerings could undermine efforts to defend or expand recurring revenue and adversely impact future cash flows.

- While the move to the Voyix Commerce Platform and integration of WorldPay are strategic, execution risk remains high: customer transitions from legacy software, the ability to cross-sell new solutions, and successful upselling in a consolidating industry will be critical-for any shortfalls or delays could disrupt revenue stabilization, compress margins, and increase churn, affecting both top and bottom lines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.25 for NCR Voyix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $268.9 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 9.9%.

- Given the current share price of $13.67, the analyst price target of $15.25 is 10.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.