Narratives are currently in beta

Key Takeaways

- Tyler Technologies is enhancing recurring revenues and margins through a cloud-first strategy, focusing on SaaS transitions and cloud efficiencies in the public sector.

- Expansion into new markets and strategic cross-selling are pivotal for future growth, aiming to boost revenue and operational efficiency.

- The transition to SaaS contracts slows revenue recognition, faces competition, and risks from reliance on temporary ARPA funds, impacting margins and growth.

Catalysts

About Tyler Technologies- Provides integrated information management solutions and services for the public sector.

- Tyler Technologies' focus on a cloud-first strategy, evident from shifting clients from on-premise to SaaS solutions, highlights a growing recurring revenue base and potential for increased margins due to cloud efficiencies. This strategy is expected to enhance revenue growth and net margins.

- The increasing adoption of SaaS across their public sector clients, especially in underpenetrated markets like public safety, indicates a robust pipeline for future SaaS revenue growth, potentially enhancing revenue stability and net margins.

- Strategic efforts in cross-selling and upselling to an expansive installed base can drive significant revenue expansion, leveraging existing customer relationships to broaden product reach and impact earnings positively.

- Expansion into new markets and growth of the payments business are seen as critical drivers for Tyler's future revenue streams, indicating potential for higher revenue growth rates and improved earnings scalability.

- Cloud optimization and version consolidation initiatives are expected to further improve operational efficiencies and facilitate client migrations to the cloud, likely leading to operational margin improvements and higher earnings.

Tyler Technologies Future Earnings and Revenue Growth

Assumptions

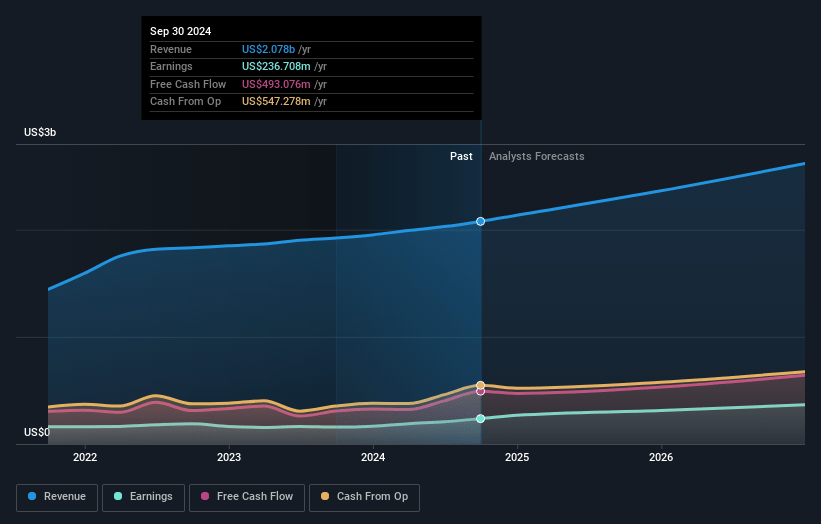

How have these above catalysts been quantified?- Analysts are assuming Tyler Technologies's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.4% today to 15.0% in 3 years time.

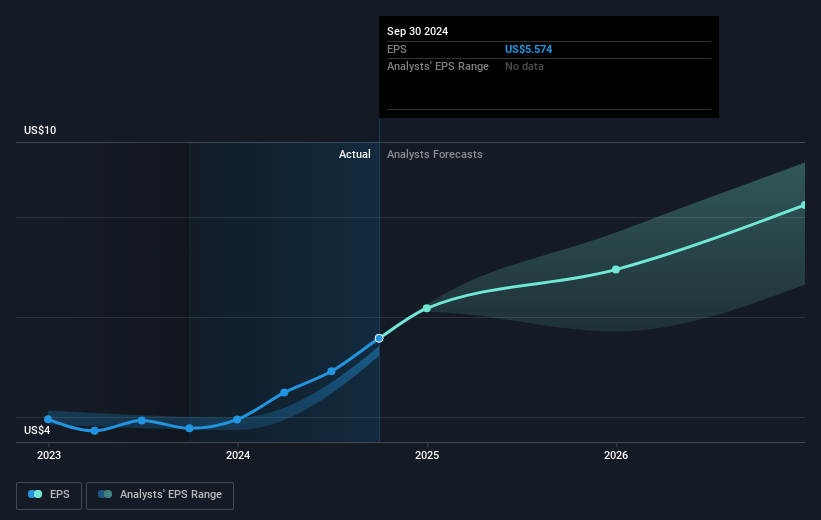

- Analysts expect earnings to reach $416.0 million (and earnings per share of $9.47) by about December 2027, up from $236.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 84.6x on those 2027 earnings, down from 113.0x today. This future PE is greater than the current PE for the US Software industry at 43.0x.

- Analysts expect the number of shares outstanding to grow by 0.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Tyler Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift from on-premise licenses to SaaS contracts, while driving growth, resulted in license revenues being below plan, which could impact top line revenue projections due to the slower recognition of SaaS revenues compared to upfront license fees.

- The potential for lumpiness in revenue recognition with SaaS contracts, due to timing-related delays between contract signing and revenue realization, could introduce variability and affect earnings expectations.

- There is a risk of increased competition from players like ServiceNow and Workday in certain markets, which could compress revenue growth and market share.

- Sensitivity of margins to merchant and interchange fees from payment businesses could compress net margins, especially due to these fees being included in both revenues and cost of revenues.

- Heavy reliance on ARPA funds for contracts like Kentucky Court of Justice creates unpredictability as these funds must be expended by 2026, potentially affecting future revenues and cash flow sustainability once these funds are fully utilized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $668.12 for Tyler Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $705.0, and the most bearish reporting a price target of just $575.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.8 billion, earnings will come to $416.0 million, and it would be trading on a PE ratio of 84.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $625.02, the analyst's price target of $668.12 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives