Narratives are currently in beta

Key Takeaways

- Strategic integration of AI and partnerships enhances operational efficiency, reduces costs, driving profitability and market presence growth.

- New products and refined strategies are expected to boost revenue growth and competitive advantage in new markets.

- Mixed customer additions and storage revenue headwinds may challenge growth, while reliance on large deals and international expansion remains crucial amidst potential operational distractions.

Catalysts

About Snowflake- Provides a cloud-based data platform for various organizations in the United States and internationally.

- Snowflake's launch of AI features such as Cortex, with over 1,000 use cases and growing adoption, suggests potential future growth in product revenue due to increasing enterprise demand for AI-driven data insights.

- The company's strategic shift towards integrating AI to enhance operational efficiency and cost management is expected to positively impact net margins as it reduces overall costs and increases profitability.

- Snowflake's partnership with AWS and collaboration with other cloud partners to work on data interoperability can lead to significant consumption revenue increase, as shown by a $3.9 billion booking in a year, escalating its market presence.

- New product introductions, like Iceberg and the upcoming Unistore, coupled with a refined go-to-market strategy, are likely to drive both revenue growth and competitive advantage in newer markets.

- Ongoing focus on product cohesiveness and the simplification of deployment processes suggest further enhancement in operating margins and overall earnings stability through improved customer retention and satisfaction.

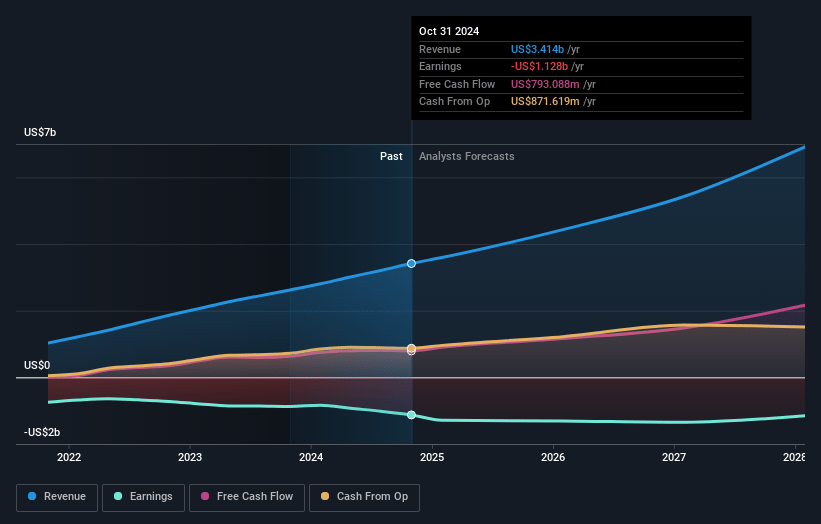

Snowflake Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Snowflake's revenue will grow by 24.2% annually over the next 3 years.

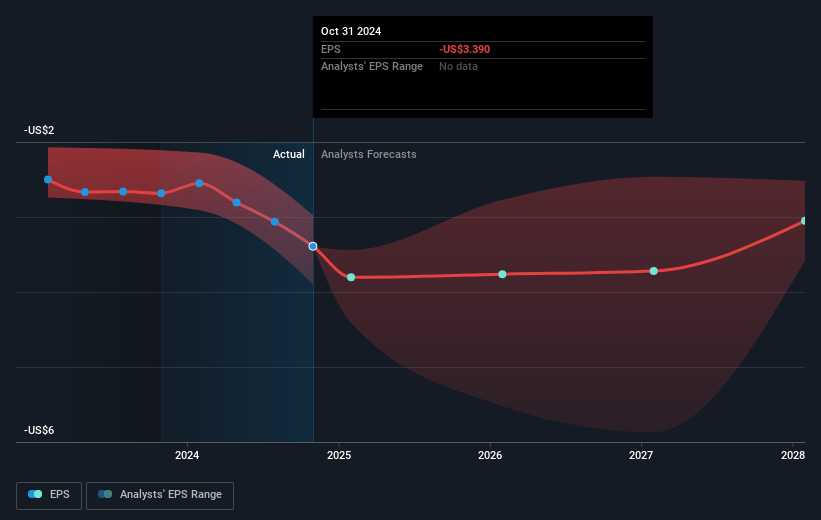

- Analysts are not forecasting that Snowflake will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Snowflake's profit margin will increase from -33.0% to the average US IT industry of 9.4% in 3 years.

- If Snowflake's profit margin were to converge on the industry average, you could expect earnings to reach $615.6 million (and earnings per share of $1.94) by about February 2028, up from $-1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 120.8x on those 2028 earnings, up from -54.6x today. This future PE is greater than the current PE for the US IT industry at 44.9x.

- Analysts expect the number of shares outstanding to decline by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Snowflake Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The pace of customer additions is mixed, and historical trends suggest that net additions may not significantly improve until fiscal 2026, which could impact revenue growth.

- There are storage revenue headwinds due to some customers moving to Iceberg formats, which, despite being offset by new data engineering features, may still pressure net margins.

- Large deals over $50 million and additional reliance on big contracts for growth could create volatility in bookings, potentially affecting overall revenue stability.

- The international expansion remains crucial, and any challenges or delays in scaling operations in Europe or APJ (Asia-Pacific Japan) could hinder revenue growth from these emerging markets.

- The focus on performance management and internal efficiency might divert attention from achieving broader top-line growth or impact the morale of key personnel, possibly affecting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $188.369 for Snowflake based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.5 billion, earnings will come to $615.6 million, and it would be trading on a PE ratio of 120.8x, assuming you use a discount rate of 7.5%.

- Given the current share price of $186.37, the analyst price target of $188.37 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives