Narratives are currently in beta

Key Takeaways

- Expansion into enterprise and educational markets, along with new AI innovations, could significantly drive revenue growth and market share.

- Improved operational efficiencies and strategic upsell strategies indicate potential for enhanced profitability and increased average revenue per customer.

- Evolving digital marketing challenges, AI reliance, and economic pressures threaten Semrush's growth, market share, and client retention.

Catalysts

About Semrush Holdings- Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

- Semrush's expansion into the enterprise market with their new SEO product shows strong early adoption from major enterprises like Salesforce, HSBC, and Samsung, indicating a significant growth opportunity that could bolster future revenue.

- The acquisition of Third Door Media and its integration with over 200 universities suggests increased educational outreach and content creation capability, potentially driving higher average revenue per customer due to enhanced visibility and content marketing resources.

- Semrush's tripling of their total addressable market to $40 billion, combined with innovations in AI and its application across multiple marketing platforms, provides ample room for capturing market share and increasing revenue growth.

- The focus on cross-sell and upsell strategies, particularly with the robust growth in the number of customers paying over $10,000 and $50,000 annually, suggests an opportunity for further increased average revenue per customer and enhanced earnings growth.

- The improvement in financial metrics, such as non-GAAP operating margin growth and strong cash flow generation, indicates improved operational efficiencies and profitability, setting the stage for better net margins in the future.

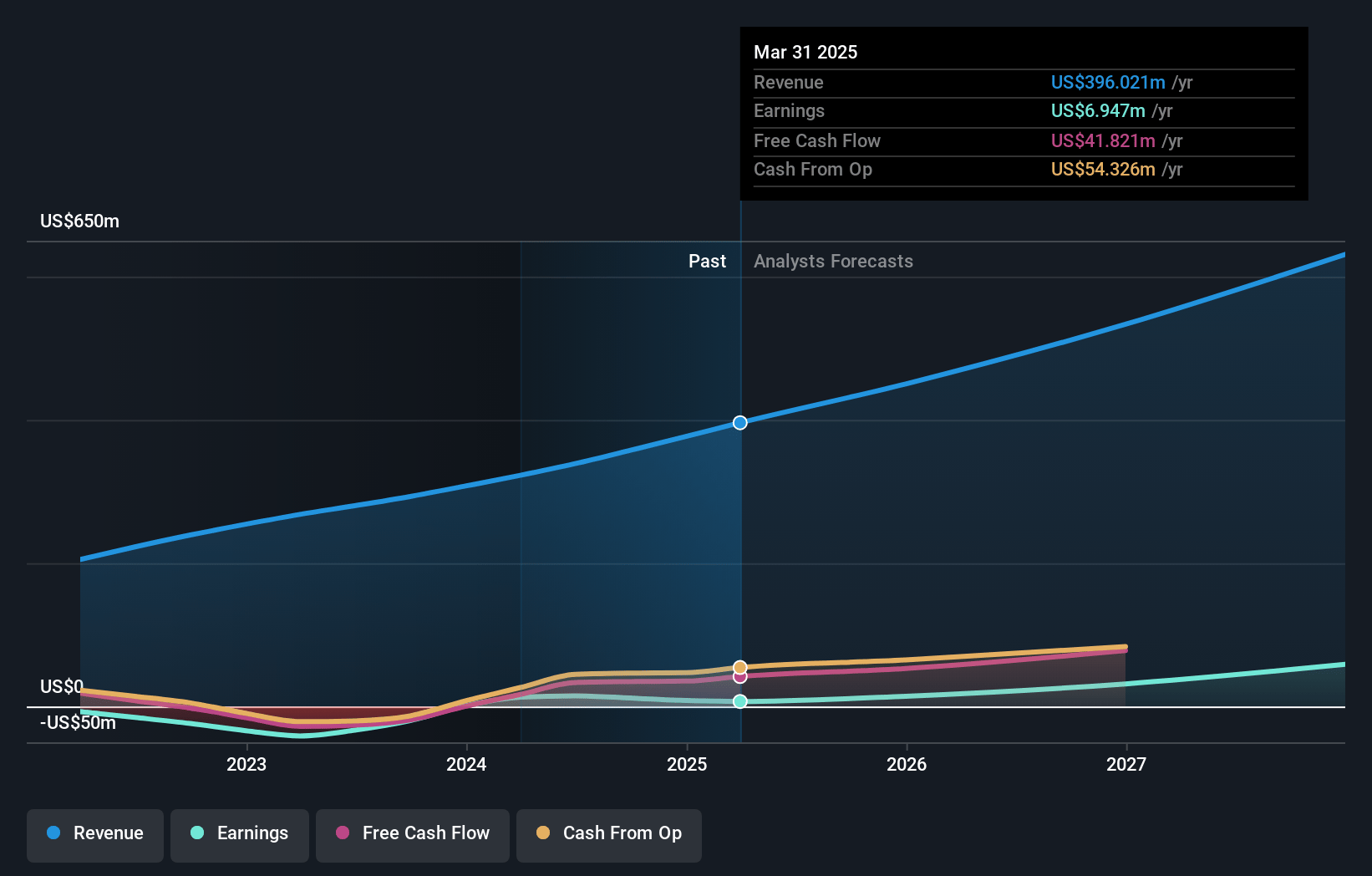

Semrush Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Semrush Holdings's revenue will grow by 19.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 10.7% in 3 years time.

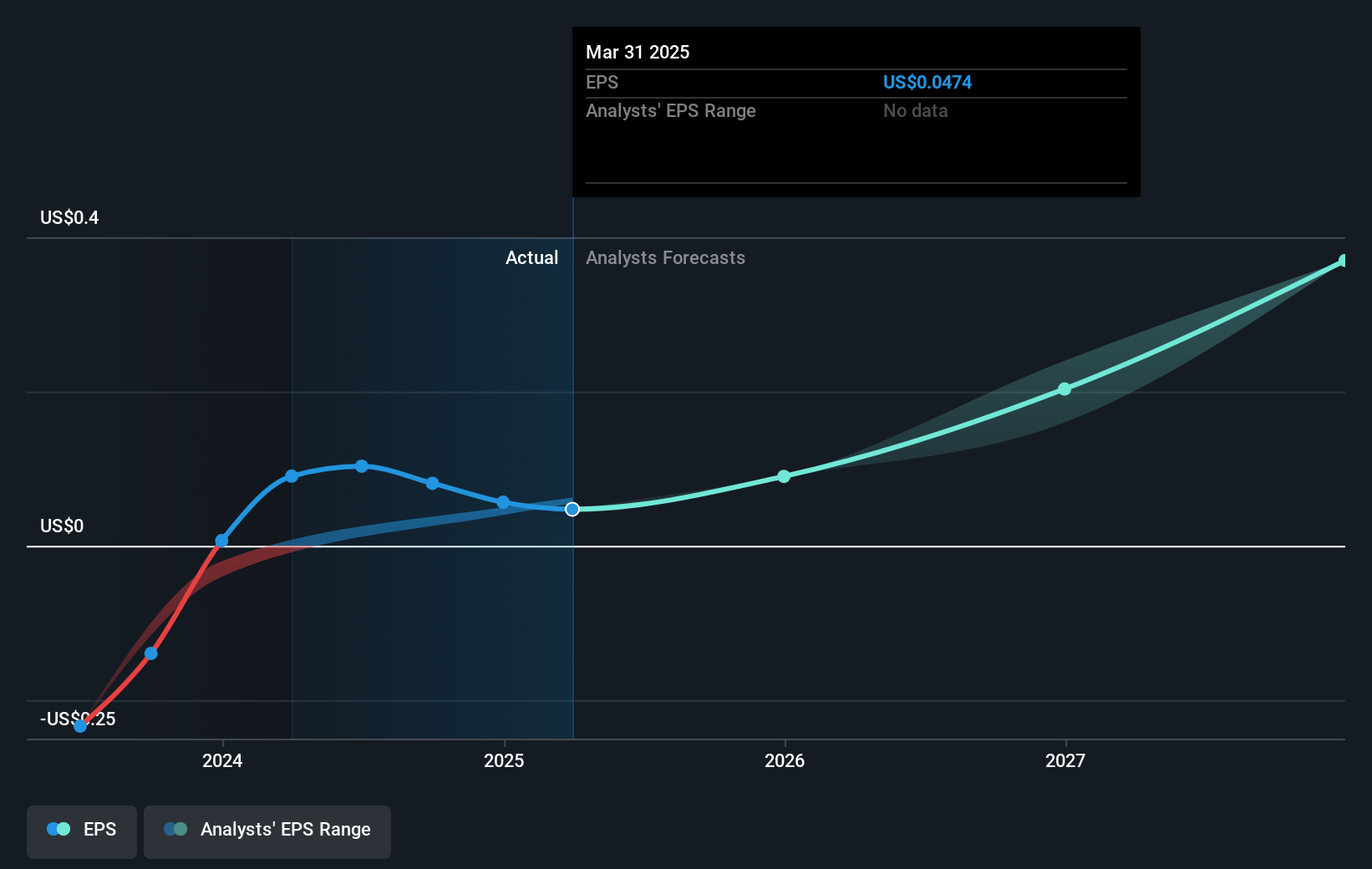

- Analysts expect earnings to reach $65.2 million (and earnings per share of $0.4) by about December 2027, up from $11.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.4x on those 2027 earnings, down from 153.6x today. This future PE is greater than the current PE for the US Software industry at 41.2x.

- Analysts expect the number of shares outstanding to grow by 3.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Semrush Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing complexity and evolving nature of search engine algorithms and digital marketing could create challenges for Semrush in maintaining product relevance and efficacy, potentially impacting revenue growth.

- Reliance on AI-based solutions presents risks, as inaccuracies or changes in AI technology could undermine customer trust and retention, affecting net revenue retention and earnings.

- The digital marketing landscape is highly competitive, with numerous point solutions and platforms; failure to fully integrate or surpass these alternatives could hinder market share growth and revenue prospects.

- Dependence on adding and retaining enterprise clients, who represent a significant portion of average ARR, means that any churn or slowdown in acquiring these large contracts could pressure revenue and long-term growth targets.

- Economic pressures or shifts in marketing spend by businesses and agencies could reduce demand for Semrush’s tools, impacting sales and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.67 for Semrush Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $609.0 million, earnings will come to $65.2 million, and it would be trading on a PE ratio of 53.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $12.32, the analyst's price target of $17.67 is 30.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives