Narratives are currently in beta

Key Takeaways

- Investments in advanced security and modernization of RMM solutions are expected to boost revenue and net margins through improved efficiency and customer retention.

- Strategic focus on cloud backup and MSP market expansion presents significant growth opportunities, positively impacting revenue and stabilizing future net margins.

- Short-term revenue growth faces pressure from contract initiatives, pricing normalization, SaaS conversion challenges, and declining net retention, with relief expected post-2025.

Catalysts

About N-able- Provides cloud-based software solutions for managed service providers in the United States, the United Kingdom, and internationally.

- N-able is seeing strong demand for its fastest-growing product, Cove Data Protection, with significant growth opportunities in the cloud backup market projected to grow in double digits, which would positively impact revenue.

- The introduction of long-term contracts is aimed at increasing customer retention and promoting expansion over time, which could stabilize and potentially increase future net margins.

- The investment in advanced security solutions like XDR and MDR, combined with efficient service delivery, is expected to drive growth in the security segment, impacting both revenue and net margins positively.

- The strategic expansion into the rising MSP market projected to grow by 12% in 2024 provides N-able with a favorable backdrop for future revenue growth.

- The modernization of RMM solutions into a next-generation ecosystem (Ecoverse) aims to improve operational efficiency and customer stickiness, potentially enhancing net margins and contributing to overall earnings growth.

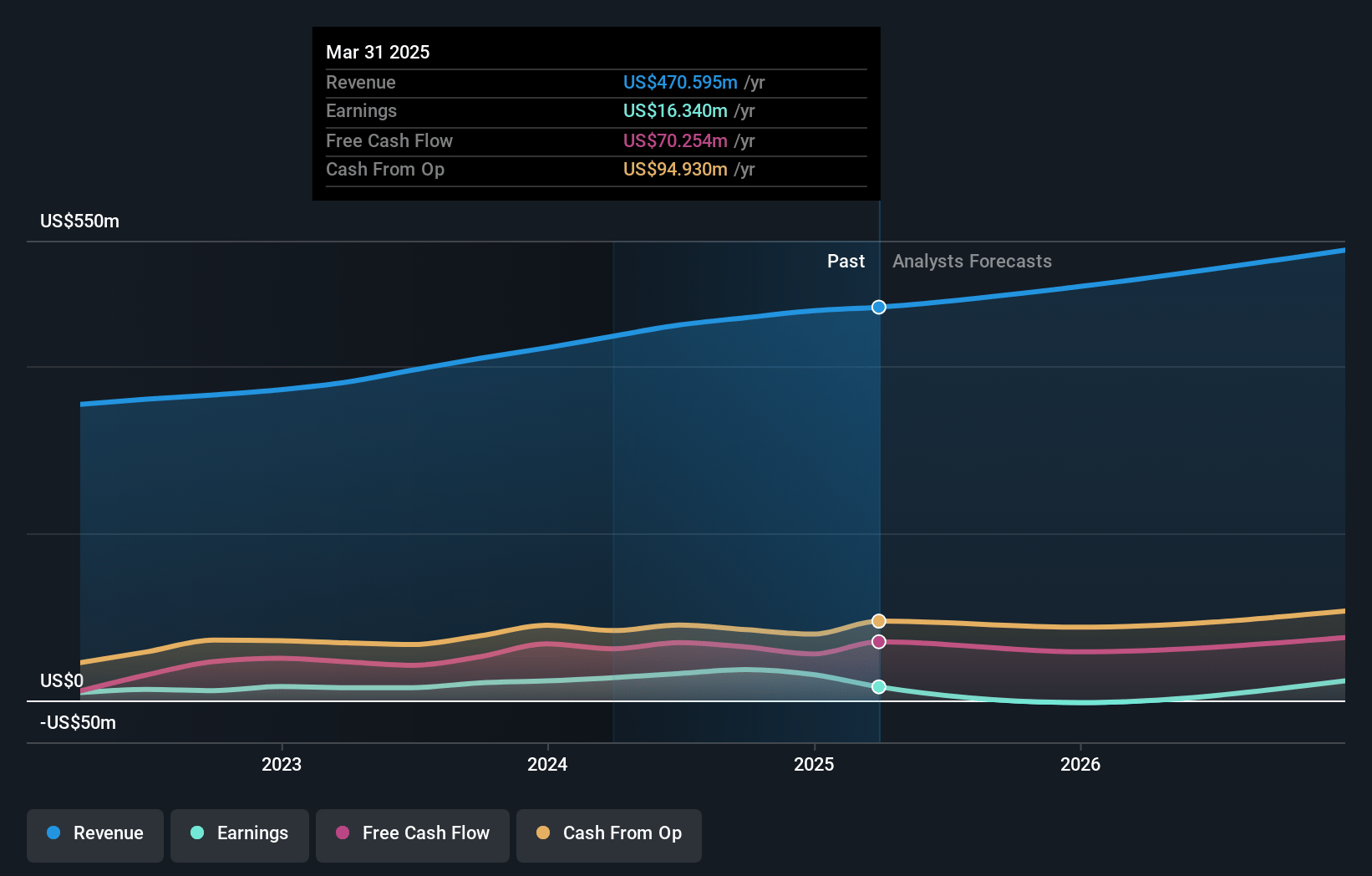

N-able Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming N-able's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.1% today to 7.3% in 3 years time.

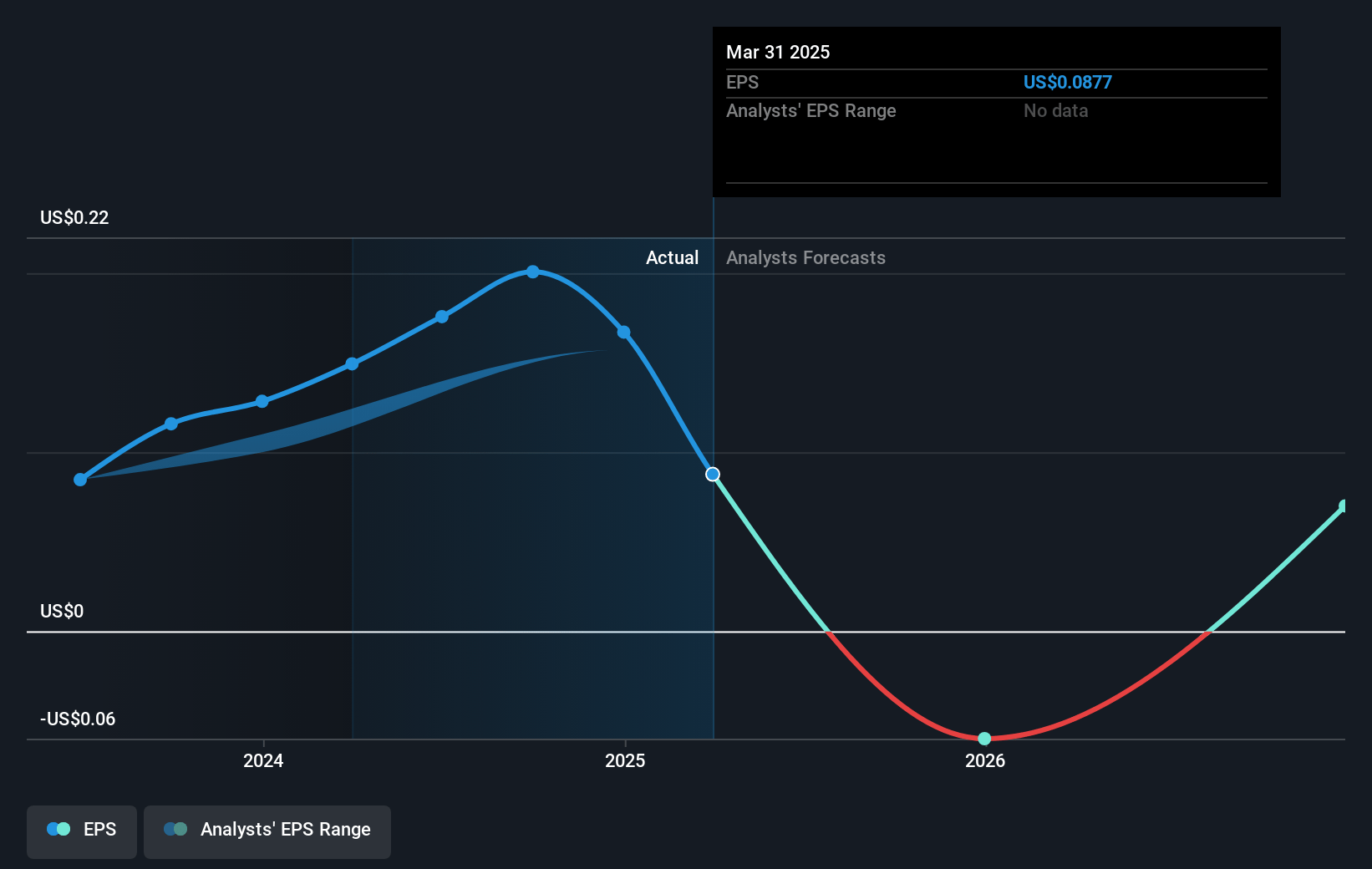

- Analysts expect earnings to reach $44.8 million (and earnings per share of $0.26) by about December 2027, up from $37.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $51.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.3x on those 2027 earnings, up from 48.4x today. This future PE is greater than the current PE for the US Software industry at 41.2x.

- Analysts expect the number of shares outstanding to decline by 2.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

N-able Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term contract initiative has generated a near-term headwind on financials as customers optimize their estate for entering these contracts, putting short-term pressure on revenue growth. This is expected to subside in the second half of 2025, affecting near-term revenue.

- Pricing headwinds due to higher-than-typical price increases in 2023 and subsequent reversion to more normalized pricing in 2024 could challenge revenue growth comparisons relative to the prior year, impacting overall earnings momentum in the near term.

- There is a demand to convert new customers to hosted and SaaS offerings over on-premise solutions. However, the lower-than-expected conversion rate of existing customers into long-term on-premise contracts has negatively impacted the revenue outlook, which may persist in the short term.

- The mix of SaaS customers continues to rise, which does not contribute to a material upfront revenue recognition effect compared to on-premise, affecting immediate revenue growth rates as recognized under ASC 606.

- Estate optimization related to long-term contract conversions has led to a temporary decline in net retention rates, which may impact revenue and net margins until this effect dissipates by the second half of 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.64 for N-able based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.5, and the most bearish reporting a price target of just $11.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $613.0 million, earnings will come to $44.8 million, and it would be trading on a PE ratio of 65.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $9.65, the analyst's price target of $13.64 is 29.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives