Key Takeaways

- Geopolitical tensions and supply chain issues may hinder IBM's revenue growth and technology spending by clients.

- IBM's reliance on acquisitions for growth presents integration risks and could affect profit margins if new entities underperform.

- IBM's robust cash flow, software growth, AI investments, and upcoming innovations signal strong potential for sustained revenue and profitability enhancement.

Catalysts

About International Business Machines- Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

- The ongoing geopolitical tensions, interest rate volatility, and supply chain vulnerabilities are significant headwinds for IBM. These factors could negatively impact IBM's revenue growth as they cause businesses to be more cautious with their technology spending.

- IBM's Consulting business has been affected by clients reprioritizing their spending away from on-prem customized services and towards AI and digital transformations. This shift might lead to lower-than-expected revenue growth in Consulting in the near term, impacting overall revenue and potentially compressing net margins due to continued investment in capabilities to align with client priorities.

- While the Red Hat segment is experiencing strong growth, IBM's overall Software growth is partly driven by acquisitions. The reliance on M&A for growth might lead to integration challenges and potential dilution effects on earnings, which could constrain net profit margins if the acquired entities do not perform as expected.

- The launch and success of IBM's next mainframe cycle, the z17, scheduled for mid-2025, is crucial. If client demand for the new infrastructure falls short of expectations due to changing technology preferences or economic factors, it could severely affect Infrastructure revenue and profitability.

- IBM's significant investment in generative AI and related software and consulting solutions are crucial for future growth. However, these investments are costly, and if the adoption of IBM's AI offerings is slower than anticipated, it could lead to higher R&D expenses and compress net margins, resulting in less favorable earnings growth.

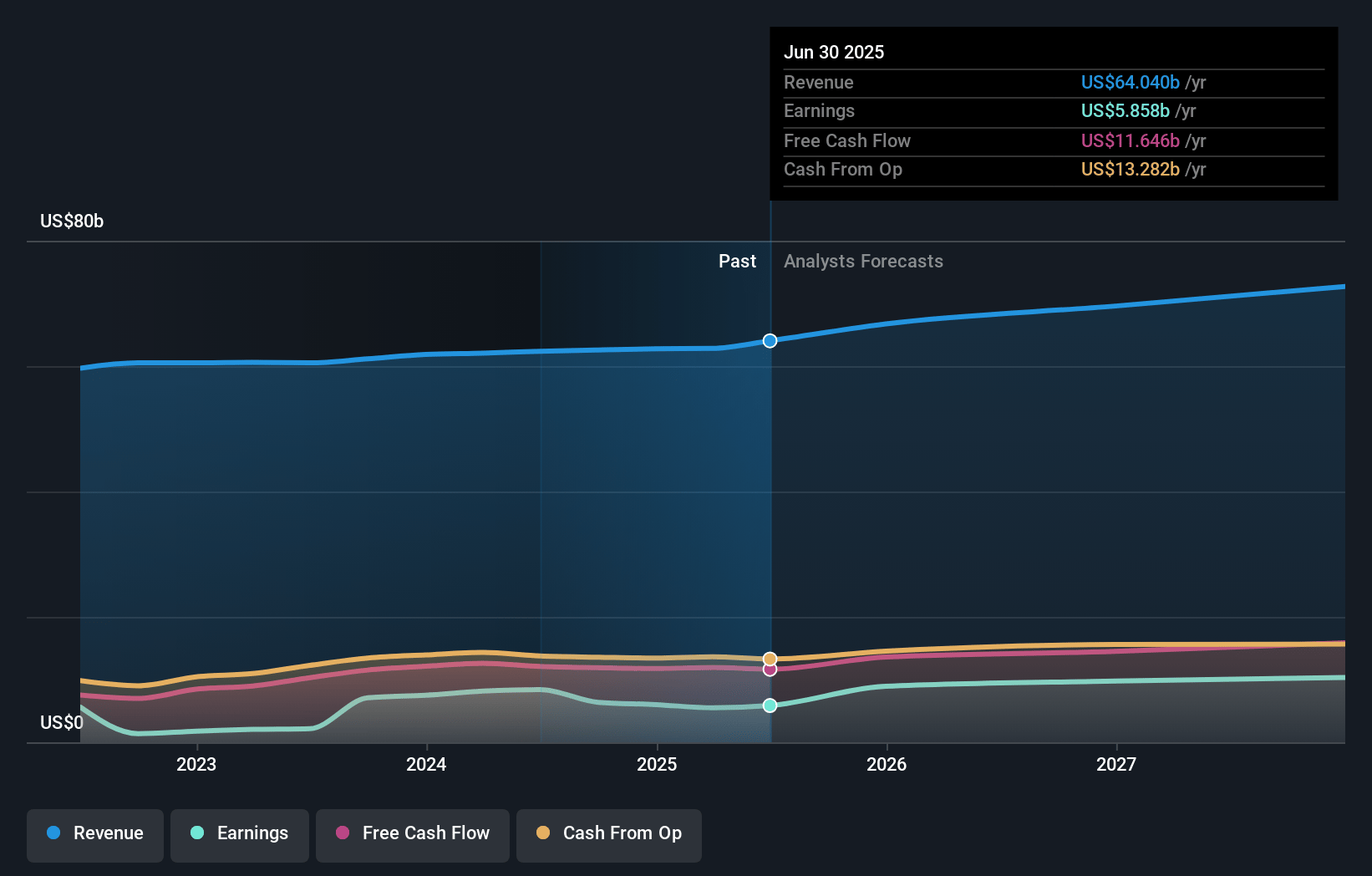

International Business Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on International Business Machines compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming International Business Machines's revenue will grow by 2.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.6% today to 13.8% in 3 years time.

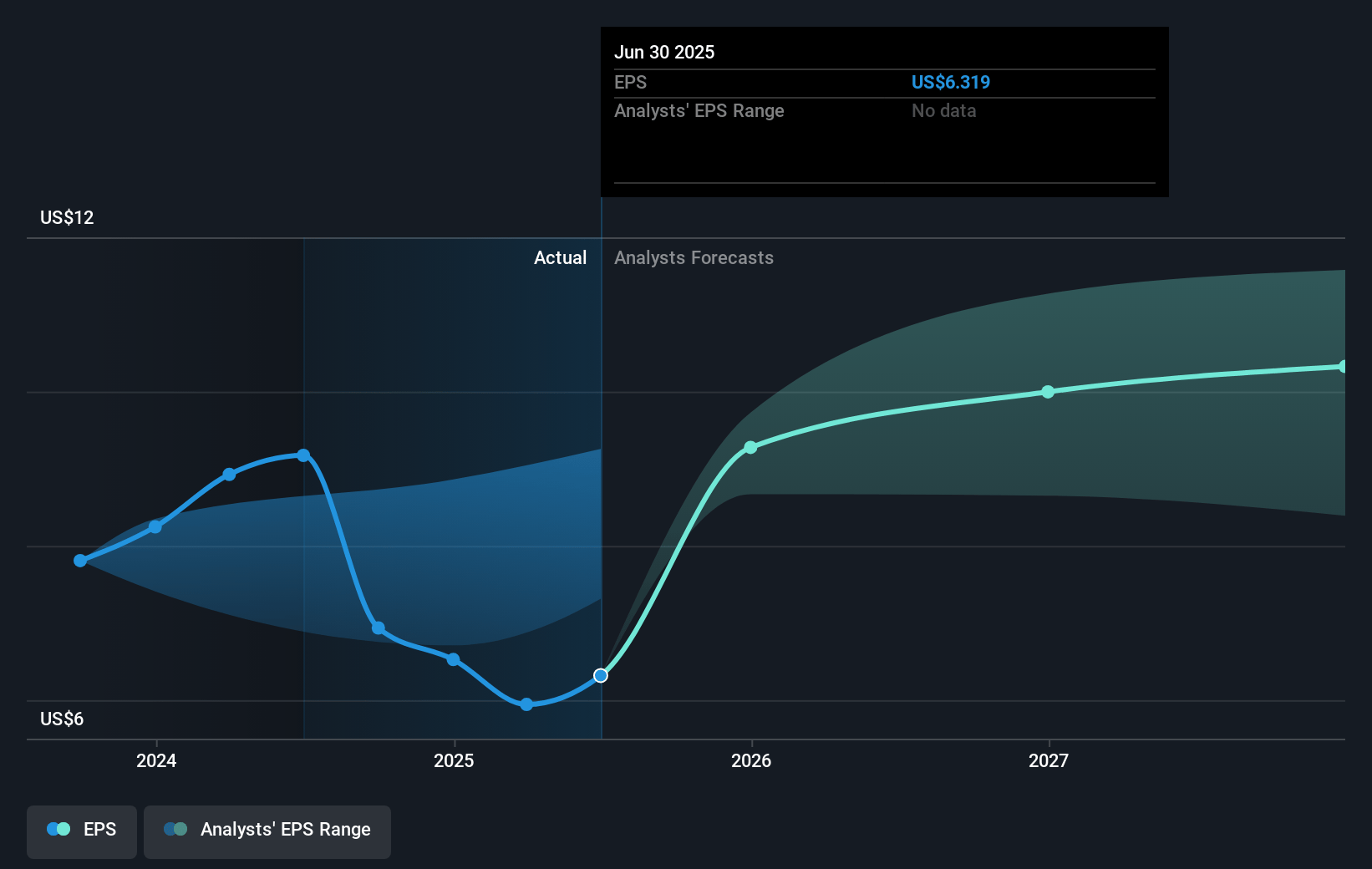

- The bearish analysts expect earnings to reach $9.5 billion (and earnings per share of $9.91) by about April 2028, up from $6.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.6x on those 2028 earnings, down from 36.3x today. This future PE is lower than the current PE for the US IT industry at 30.3x.

- Analysts expect the number of shares outstanding to grow by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

International Business Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IBM achieved $12.7 billion in free cash flow, marking its highest level of cash flow generation in many years, which indicates strong profitability and could support future earnings growth.

- The company's software segment showed momentum with a 9% growth rate in 2024, driven by Red Hat's double-digit performance, suggesting potential for sustained or increasing revenue.

- IBM is investing in generative AI technologies, with consulting signings related to AI contributing to strong booking growth, which may bolster future revenue streams and earnings.

- The infrastructure segment highlighted customer reliance on the successful z16 program, and the upcoming launch of z17 could enhance future revenues if customer adoption remains strong.

- With partnerships and innovations, IBM continues to enhance its portfolio, suggesting potential growth in revenue, margins, and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for International Business Machines is $214.7, which represents one standard deviation below the consensus price target of $254.04. This valuation is based on what can be assumed as the expectations of International Business Machines's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $320.0, and the most bearish reporting a price target of just $160.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $68.4 billion, earnings will come to $9.5 billion, and it would be trading on a PE ratio of 27.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $235.31, the bearish analyst price target of $214.7 is 9.6% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:IBM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives