Narratives are currently in beta

Key Takeaways

- Heavy reliance on mortgage revenue poses risk due to macroeconomic uncertainties, potentially impacting overall revenue if volumes decline.

- Investment in strategic initiatives could affect short-term earnings if revenue growth lags or investments don't meet expectations.

- FICO's growth in revenue, strategic partnerships, and leadership in decision intelligence are set to strengthen its market position and earnings potential.

Catalysts

About Fair Isaac- Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- The company's reliance on mortgage revenue, which accounted for 47% of its B2B revenue, poses a risk given uncertain macroeconomic conditions. This reliance could negatively impact overall revenue if mortgage volumes decline.

- With FICO increasing its mortgage royalty fee to $4.95 for 2025, there may be resistance from partners, potentially impacting revenue or volume growth in future periods if clients opt for alternative solutions.

- The company's B2C segment saw a decline in revenue, driven by decreased sales on myFICO.com. Continued challenges in growing the B2C segment could affect overall earnings as this impacts diversification and top-line growth.

- Despite strong growth in ARR and SaaS software, the company's professional services revenue declined. Continued decline in this high-margin segment could pressure net margins and earnings.

- FICO's heavy investment in its platform and strategic initiatives, while necessary for long-term growth, could impact short-term earnings or net margins if revenue growth does not keep pace or if investments do not yield expected returns.

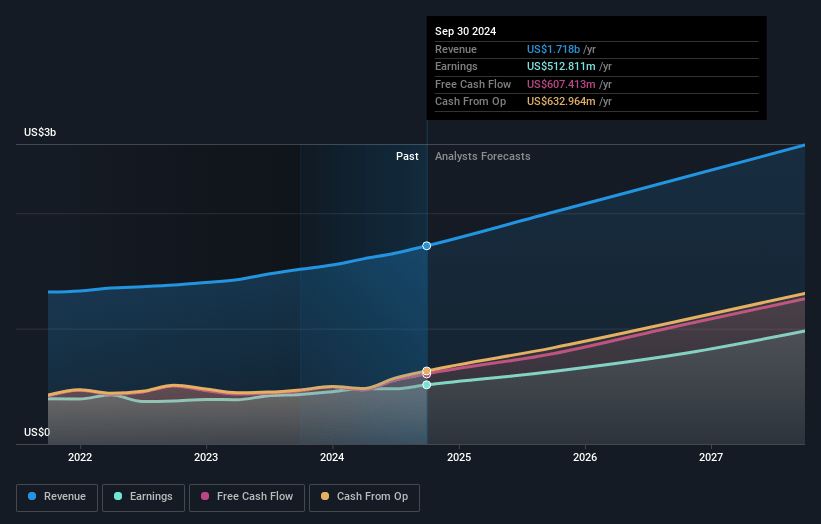

Fair Isaac Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fair Isaac's revenue will grow by 15.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.9% today to 37.4% in 3 years time.

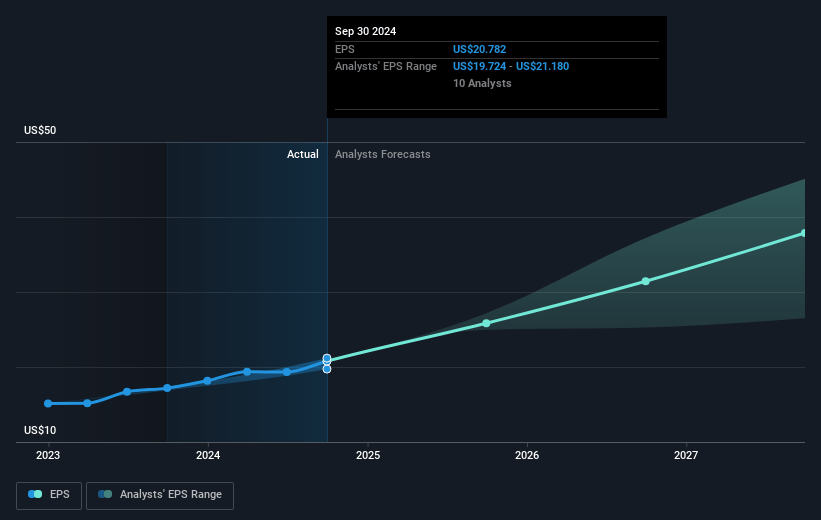

- Analysts expect earnings to reach $980.7 million (and earnings per share of $37.88) by about November 2027, up from $512.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $869 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 64.3x on those 2027 earnings, down from 111.5x today. This future PE is greater than the current PE for the US Software industry at 41.2x.

- Analysts expect the number of shares outstanding to grow by 2.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

Fair Isaac Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- FICO's consistent increase in revenues, as shown by the 16% growth in the fourth quarter and 13% growth for the full fiscal year, suggests a robust performance that may continue, positively impacting future revenue and earnings.

- The company's strong growth in free cash flow, up 31% year-over-year, and high levels of cash available for share repurchases could support share price stability or growth, as it allows for reinvestment and shareholder returns, which can boost earnings per share.

- FICO's strategic pricing adjustment for its mortgage score, set at $4.95 per score for 2025, and the company's belief in the value provided relative to cost, indicate potential for sustained revenue growth in the mortgage segment, contributing positively to net margins.

- The firm's partnerships, such as those with Tata Consultancy Services and iSON Xperiences, to leverage its platform for real-time decision making across different industries, could expand FICO's software segment, potentially leading to higher revenue and margins.

- Recognition by IDC as a leader in the Decision Intelligence Platform market validates FICO's strategic focus on innovation and platform capabilities, which could drive long-term growth and maintain strong net earnings through increased customer adoption and retention.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2063.01 for Fair Isaac based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $2500.0, and the most bearish reporting a price target of just $1194.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.6 billion, earnings will come to $980.7 million, and it would be trading on a PE ratio of 64.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $2348.1, the analyst's price target of $2063.01 is 13.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives