Catalysts

About Dynatrace

Dynatrace provides an AI powered observability platform that helps enterprises monitor, analyze and automate their cloud and software environments.

What are the underlying business or industry changes driving this perspective?

- The shift toward complex cloud and AI native workloads is increasing the need for precise, real time observability, which aligns closely with Dynatrace's unified platform and may support continued growth in ARR and subscription revenue.

- The move from reactive monitoring toward autonomous, self healing operations creates a larger role for AI driven observability, where Dynatrace's focus on deterministic answers and automation could support higher platform adoption and expansion driven earnings.

- Industry wide consolidation of monitoring and observability tools into fewer, end to end platforms positions Dynatrace to benefit from large replacement deals, which management links to strong net new ARR and larger average ARR per customer.

- Growing demand to observe AI workloads, including agent based systems built on major cloud AI services, plays directly to Dynatrace's ability to handle high volume logs, traces and metrics at scale. Management connects this to consumption growth running north of 20% and strength in logs related revenue.

- The increasing importance of business observability, where companies want technical telemetry tied to business events, broadens Dynatrace's role inside large enterprises and can support higher net retention, larger 7 figure deals and higher free cash flow over time.

Assumptions

This narrative explores a more optimistic perspective on Dynatrace compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

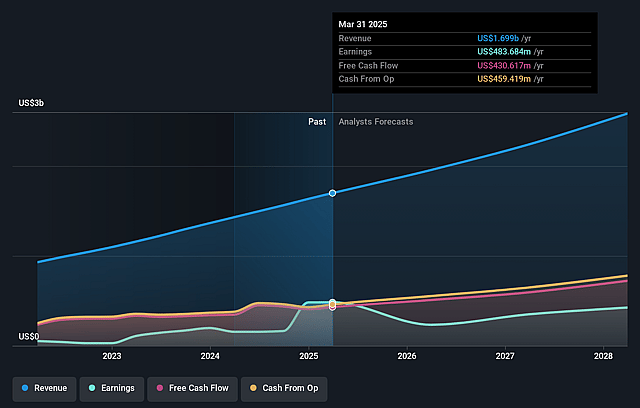

- The bullish analysts are assuming Dynatrace's revenue will grow by 17.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 27.3% today to 23.9% in 3 years time.

- The bullish analysts expect earnings to reach $719.6 million (and earnings per share of $1.57) by about February 2029, up from $506.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $277.2 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 37.0x on those 2029 earnings, up from 20.1x today. This future PE is greater than the current PE for the US Software industry at 26.9x.

- The bullish analysts expect the number of shares outstanding to grow by 0.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- If large, complex observability and AI agent projects take longer to close or are pushed out, as management already flags timing variability on large tool consolidation deals, the company may see slower ARR additions and a less favorable split of net new ARR between halves of the year, which would affect revenue and earnings growth profiles.

- The focus on very large, high propensity to spend customers, along with heavier weighting to big consolidation wins, concentrates performance in a smaller group of enterprises. Any slowdown, repricing or churn in that cohort could weigh on net retention rate, net new ARR and ultimately subscription revenue.

- Relying on high consumption growth to drive early DPS expansions and upsells means that if usage growth moderates for logs or other modules, the current pattern of early renewals and over 20% consumption growth may not persist. This could pressure ARR expansion, subscription revenue and free cash flow margins over time.

- The multiyear push to become the AI powered observability platform for autonomous operations depends on tight integrations with third parties such as ServiceNow, hyperscalers and developer tools. Any change in partner priorities, competing offerings or tighter budgets for AI observability could reduce the size or pace of these deals, affecting ARR, subscription revenue and earnings.

- DPS now covers 70% of ARR and drives customers to adopt roughly twice the number of capabilities, but as adoption approaches the company’s own 80% to 85% target range, the incremental uplift from migrating the remaining cohorts may diminish. This could temper future improvements in net retention, ARR per customer and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Dynatrace is $68.0, which represents up to two standard deviations above the consensus price target of $57.55. This valuation is based on what can be assumed as the expectations of Dynatrace's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $68.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $3.0 billion, earnings will come to $719.6 million, and it would be trading on a PE ratio of 37.0x, assuming you use a discount rate of 8.4%.

- Given the current share price of $33.71, the analyst price target of $68.0 is 50.4% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dynatrace?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.