Key Takeaways

- Intensifying competition from hyperscalers and shifting AI infrastructure needs threaten DigitalOcean’s ability to retain high-spending clients and sustain revenue momentum.

- Dependence on SMBs and startups, alongside rising capital needs, exposes the company to revenue volatility and margin pressure amid industry pricing and funding risks.

- Competitive pressures, shifting customer needs, and increasing regulatory and infrastructure demands threaten margins, customer retention, and long-term revenue growth for DigitalOcean.

Catalysts

About DigitalOcean Holdings- Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

- While DigitalOcean's revenue is benefiting from the accelerating adoption of cloud infrastructure and the democratization of software development among SMBs and digital native enterprises, the fundamental threat remains that ongoing consolidation in cloud services may favor larger hyperscale competitors. This could increasingly limit DigitalOcean’s ability to attract large enterprise clients over time, which would constrain both revenue growth and future addressable market expansion.

- Although the company has made significant inroads by rapidly expanding its product offerings for AI and multi-cloud workloads, there is the risk that surging AI and machine learning demand will shift even high-spending SMBs and AI startups toward more advanced or specialized infrastructure that DigitalOcean may not be able to match. This may lead to revenue growth deceleration or heightened customer churn as workloads migrate to better-resourced providers.

- While DigitalOcean continues to enhance profitability through cost optimization and automation, persistent downward pressure on pricing from hyperscalers and emerging cloud-native competitors could compress net margins. The company's focus on serving SMBs and startups could make margins especially vulnerable to industry commoditization of basic cloud services and competition on price.

- Despite progress in landing larger and longer-term enterprise deals and expanding customer cohorts, the company's ongoing dependence on a relatively narrow base of fast-growing digital native enterprises and startups introduces volatility in revenue and net dollar retention. In the event of a prolonged macroeconomic downturn or weakening startup funding environment, this revenue base could prove to be highly unstable.

- While sustained platform innovation, new data center investments, and expanding enterprise account engagement theoretically support DigitalOcean’s long-term earnings and operating leverage, the company faces the risk that increased growth capital requirements—including heavy front-loaded CapEx for AI capacity—could outpace the company’s ability to scale efficiently. This dependence on alternative funding mechanisms and capital markets may limit improvements in future free cash flow and earnings per share if growth opportunities do not materialize as projected.

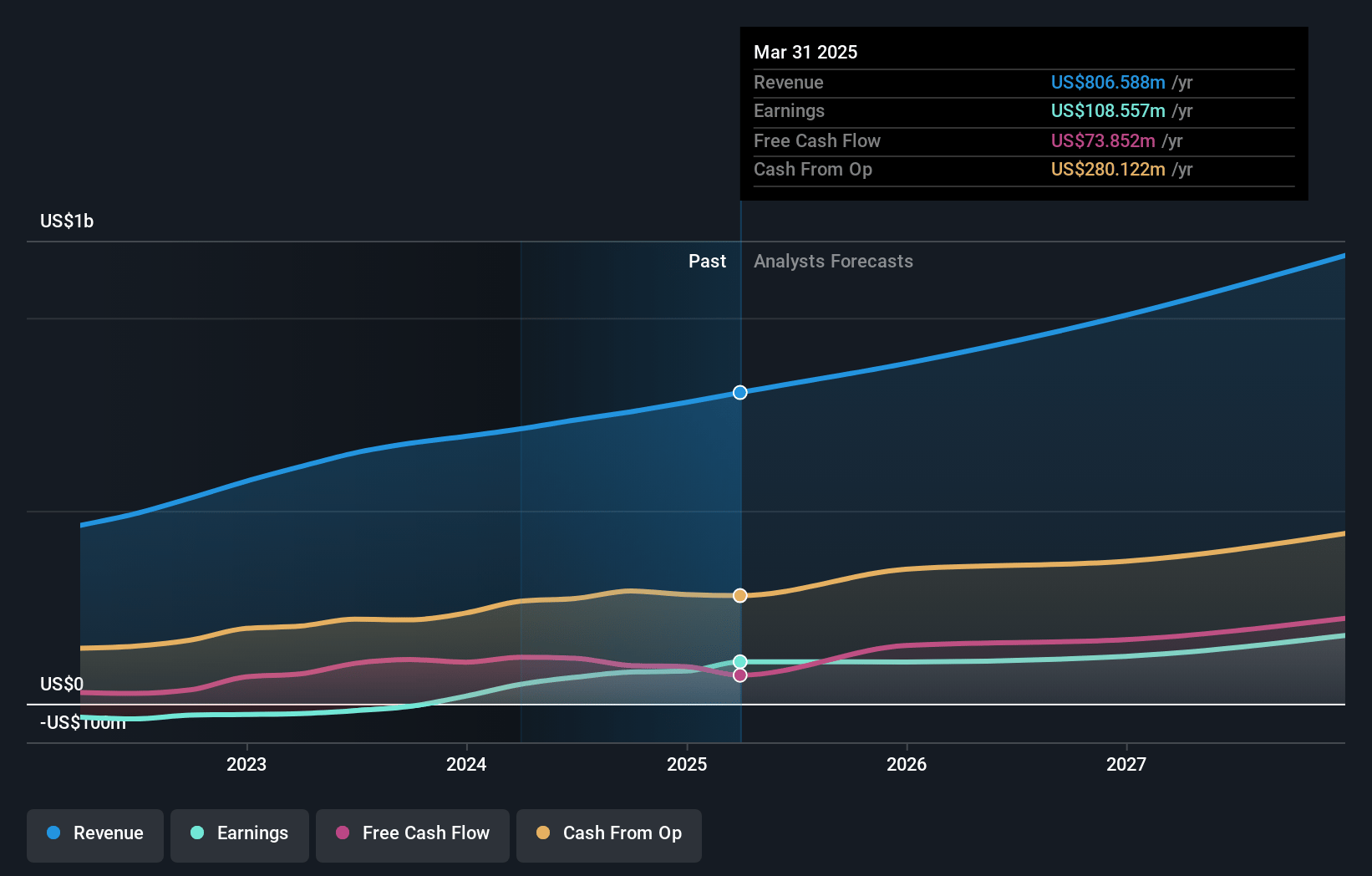

DigitalOcean Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on DigitalOcean Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming DigitalOcean Holdings's revenue will grow by 13.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.5% today to 13.9% in 3 years time.

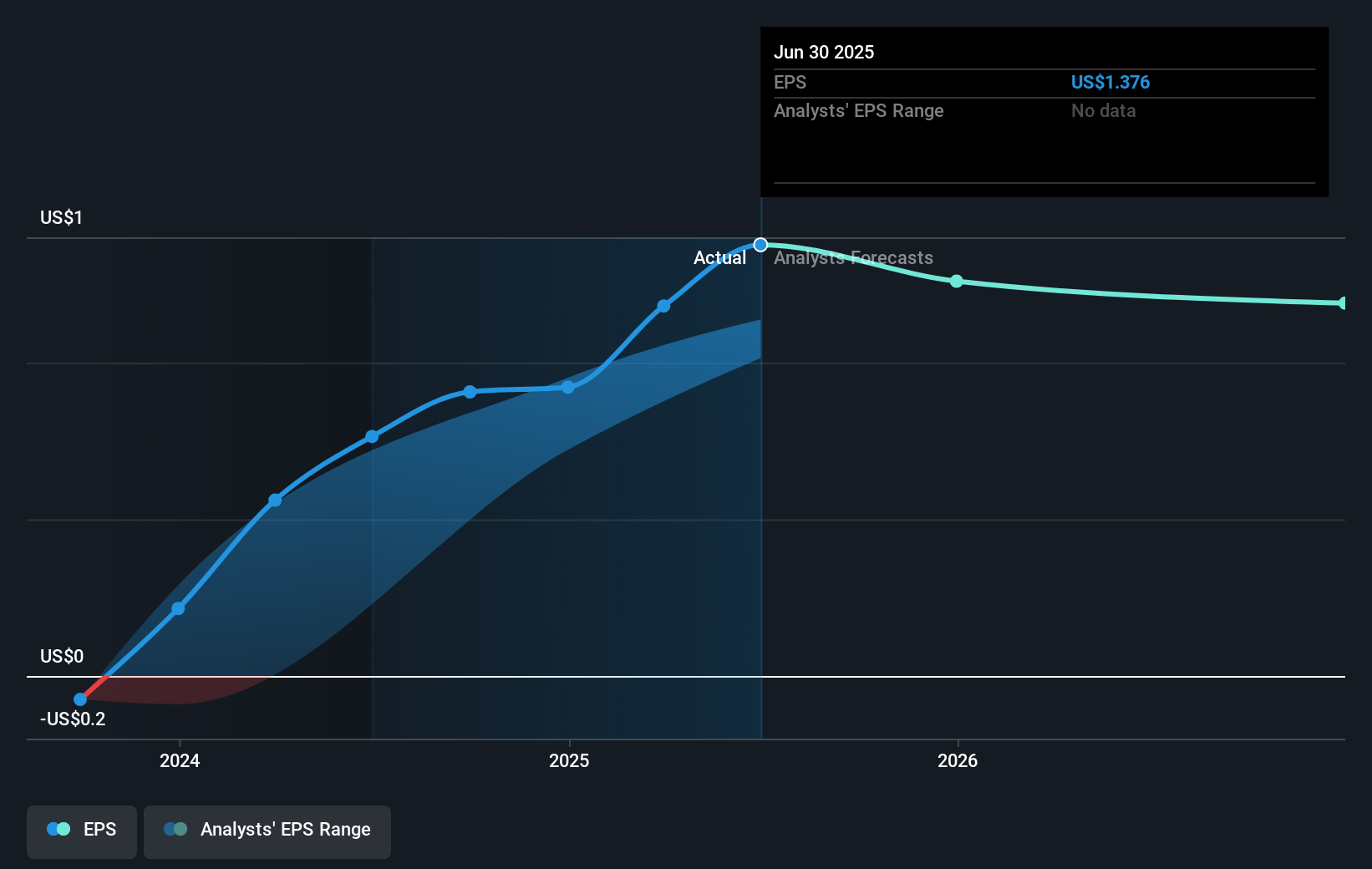

- The bearish analysts expect earnings to reach $165.4 million (and earnings per share of $1.4) by about July 2028, up from $108.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, down from 24.2x today. This future PE is lower than the current PE for the US IT industry at 27.6x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.02%, as per the Simply Wall St company report.

DigitalOcean Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing consolidation in the cloud infrastructure market and persistent competitive pressure from hyperscalers like AWS, Microsoft Azure, and Google Cloud could erode DigitalOcean’s addressable market, reduce pricing power, and limit customer acquisition opportunities, negatively impacting long-term revenue growth.

- Rising demand for advanced AI and machine learning workloads may require more sophisticated infrastructure and specialized services than DigitalOcean currently offers, increasing the risk of higher-value developer and enterprise customers migrating to larger providers and leading to lower average revenue per user and slower ARR growth.

- Increasing data privacy regulations and global compliance requirements may favor companies with deeper compliance resources and international infrastructure, significantly raising operational complexity and cost for DigitalOcean, thereby pressuring net margins as the need for additional investment grows.

- Continued reliance on small

- and medium-sized businesses and startups makes DigitalOcean’s revenue base more susceptible to macroeconomic downturns and sector volatility, increasing customer churn and threatening the long-term stability of earnings and cash flow.

- The commoditization of basic cloud services, combined with potential industry-wide price wars and the need to invest more heavily in multi-cloud compatibility and large-scale capacity expansions, may compress gross margins and force higher capital expenditures, leading to pressured free cash flow and lower long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for DigitalOcean Holdings is $31.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of DigitalOcean Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $165.4 million, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of $28.82, the bearish analyst price target of $31.0 is 7.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.