Narratives are currently in beta

Key Takeaways

- Focus on AI-driven digital transformation and core modernization is expected to unlock complex high-value projects, driving revenue growth.

- Strategic acquisitions and partnerships enhance service offerings and market reach, potentially improving margins and customer engagement.

- Decline in U.K. revenue, margin pressure, potential volatility, client and M&A disruptions, and execution risks may impact Endava's future earnings and growth.

Catalysts

About Endava- Provides technology services in North America, Europe, the United Kingdom, and internationally.

- Endava's focus on AI-driven digital transformation, particularly through core modernization, is expected to unlock larger, more complex transformation programs. This is likely to drive revenue growth by enabling them to engage in high-value projects that require deep integration into clients' core systems.

- The recent acquisition of GalaxE enhances Endava’s capabilities in core modernization through patented intellectual property (IP). This should improve operating efficiency and potentially increase net margins by offering more secure and cost-effective digital transformation solutions.

- Strategic partnerships with companies like USoft, Mambu, and GoCardless could expand Endava’s market reach and service offerings, particularly in financial services and digital payments. This could lead to higher customer engagement and boost revenue through new sales channels.

- The expansion of delivery capability in strategic locations like India provides a competitive advantage by offering global coverage and access to a diverse talent pool. This is expected to increase operating efficiency and improve net margins by optimizing resource allocation across time zones.

- The integration of AI-enabled accelerators in modernization projects indicates the potential for reduced costs and improved delivery speed. As AI adoption deepens across client operations, this could lead to growth in revenue and earnings through increased demand for advanced, AI-driven services.

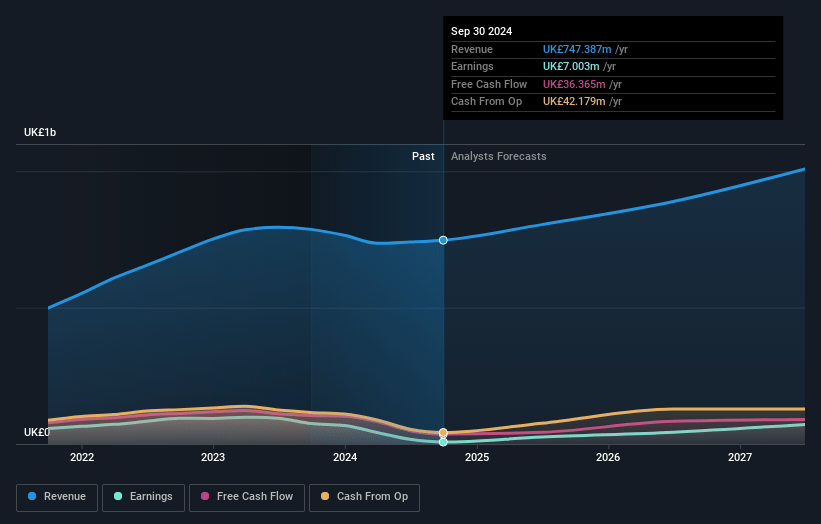

Endava Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Endava's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 8.8% in 3 years time.

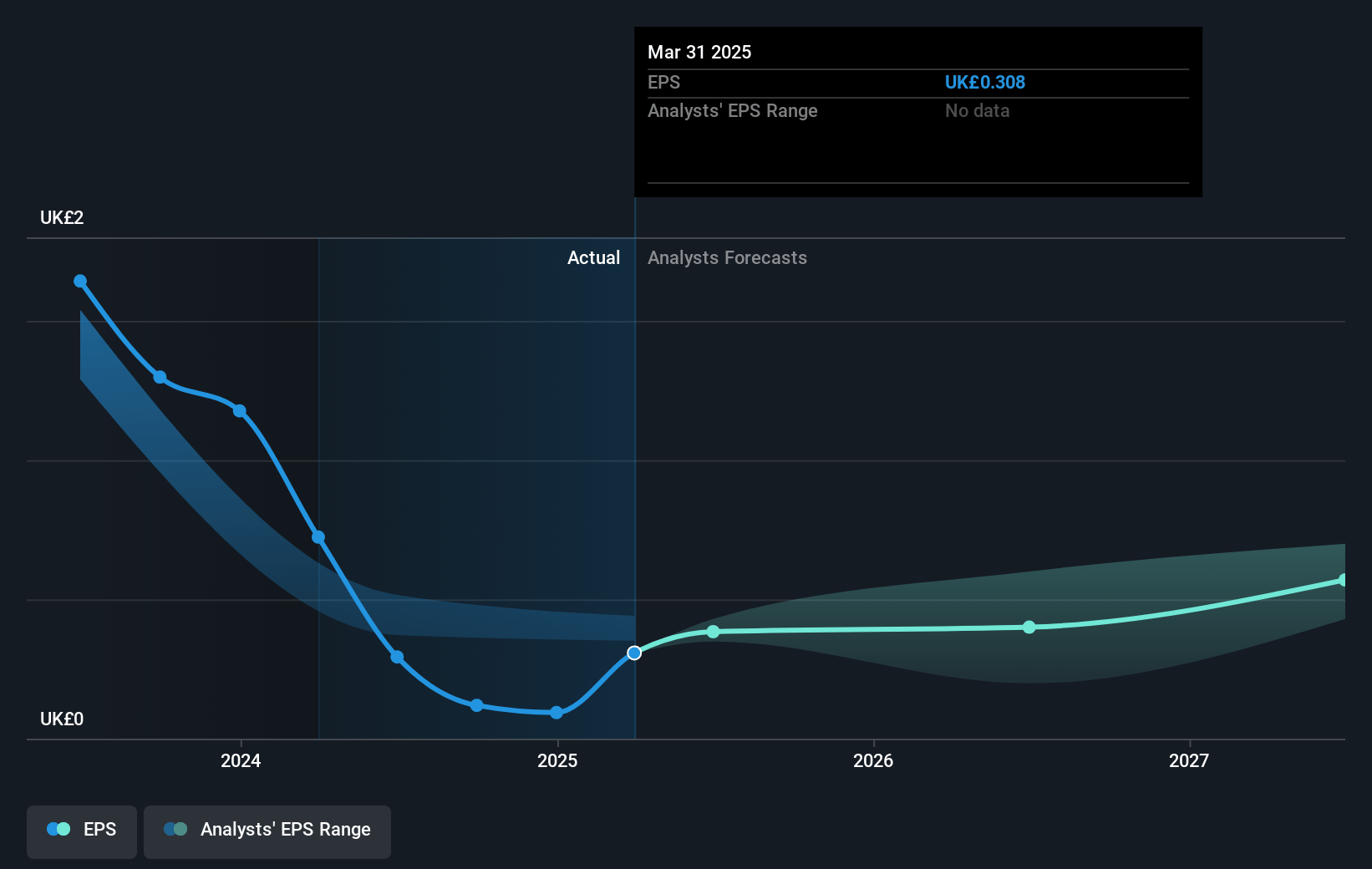

- Analysts expect earnings to reach £89.4 million (and earnings per share of £0.9) by about January 2028, up from £7.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £53.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.5x on those 2028 earnings, down from 209.5x today. This future PE is greater than the current PE for the US IT industry at 46.7x.

- Analysts expect the number of shares outstanding to grow by 18.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Endava Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Some areas like the U.K. revenue experienced a decline (8% decline), mainly due to a decrease in payments, which could potentially impact future revenues.

- Decline in operating margins impacted profit before tax (PBT), translating into a reduction of adjusted PBT margin from 15.8% to 9.9%, indicating pressure on earnings.

- The financial guidance indicates a sequential revenue growth acceleration, but there is caution around macroeconomic conditions and client budget constraints, which may lead to volatility in revenue.

- A major partnership with a media client is expected to quickly ramp down due to an M&A transaction, which may cause disruptions in revenue and client concentration.

- The integration of GalaxE and business optimization initiatives are expected to improve margins, but delays or execution risk in these initiatives could impact future earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £37.73 for Endava based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £54.44, and the most bearish reporting a price target of just £30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.0 billion, earnings will come to £89.4 million, and it would be trading on a PE ratio of 53.5x, assuming you use a discount rate of 8.6%.

- Given the current share price of £30.9, the analyst's price target of £37.73 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives