Key Takeaways

- Aggressive investments in AI, analytics, and go-to-market teams are expected to drive substantial margin improvements, revenue acceleration, and large account expansion beyond market expectations.

- An expanding total addressable market and strong global partnerships position Sprinklr for increased multi-year deals, higher retention, and robust international growth.

- Customer churn, market commoditization, and operational complexity threaten growth, revenue stability, and margin performance, especially due to concentration risk among top accounts.

Catalysts

About Sprinklr- Provides enterprise cloud software products worldwide.

- Analyst consensus recognizes benefits to margins and earnings from cost reductions and reorganizations, but may be underappreciating the magnitude of operating leverage: not only is Sprinklr unlocking immediate cost efficiencies, but their strong free cash flow generation and aggressive redeployment into AI innovation and go-to-market teams could drive a rapid and sustained step-change in both margins and top-line growth as early as fiscal 2027.

- While consensus sees improvements in the go-to-market model and customer engagement benefiting revenue and retention, the company's deeper adoption of advanced analytics and AI-driven customer health monitoring in its "Project Bear Hug"-combined with a more proactive, high-touch sales culture-positions Sprinklr for a much sharper rebound in large account expansion and logo retention, likely boosting net dollar retention rates and accelerating revenue growth much more quickly than the market expects.

- The accelerating shift by enterprises toward unified, AI-powered customer experience platforms-and away from legacy point solutions-is expanding the company's total addressable market at an even faster rate, allowing Sprinklr to secure larger, multi-year, cross-solution deals that meaningfully augment both revenue scale and average contract value.

- Sprinklr's unified AI-native platform, which is already winning significant enterprise logos in highly regulated and complex sectors, creates a powerful moat as enterprise customers increasingly prioritize data security, compliance, and vendor consolidation; this should yield higher renewal rates, more lucrative upsells, and sticky multi-product revenue streams over the next several years.

- With growing global adoption of digital engagement and automation initiatives, Sprinklr's deepening international expansion, especially via partnerships with top-tier system integrators like Accenture and Deloitte, can unlock new geographies and verticals with strong margins, offering an underappreciated multi-year driver for both revenue and operating income growth.

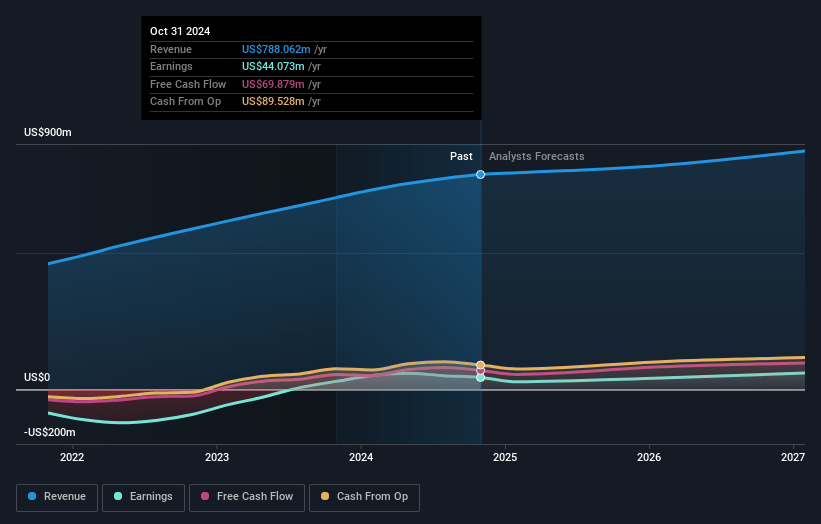

Sprinklr Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sprinklr compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sprinklr's revenue will grow by 8.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 13.6% today to 5.5% in 3 years time.

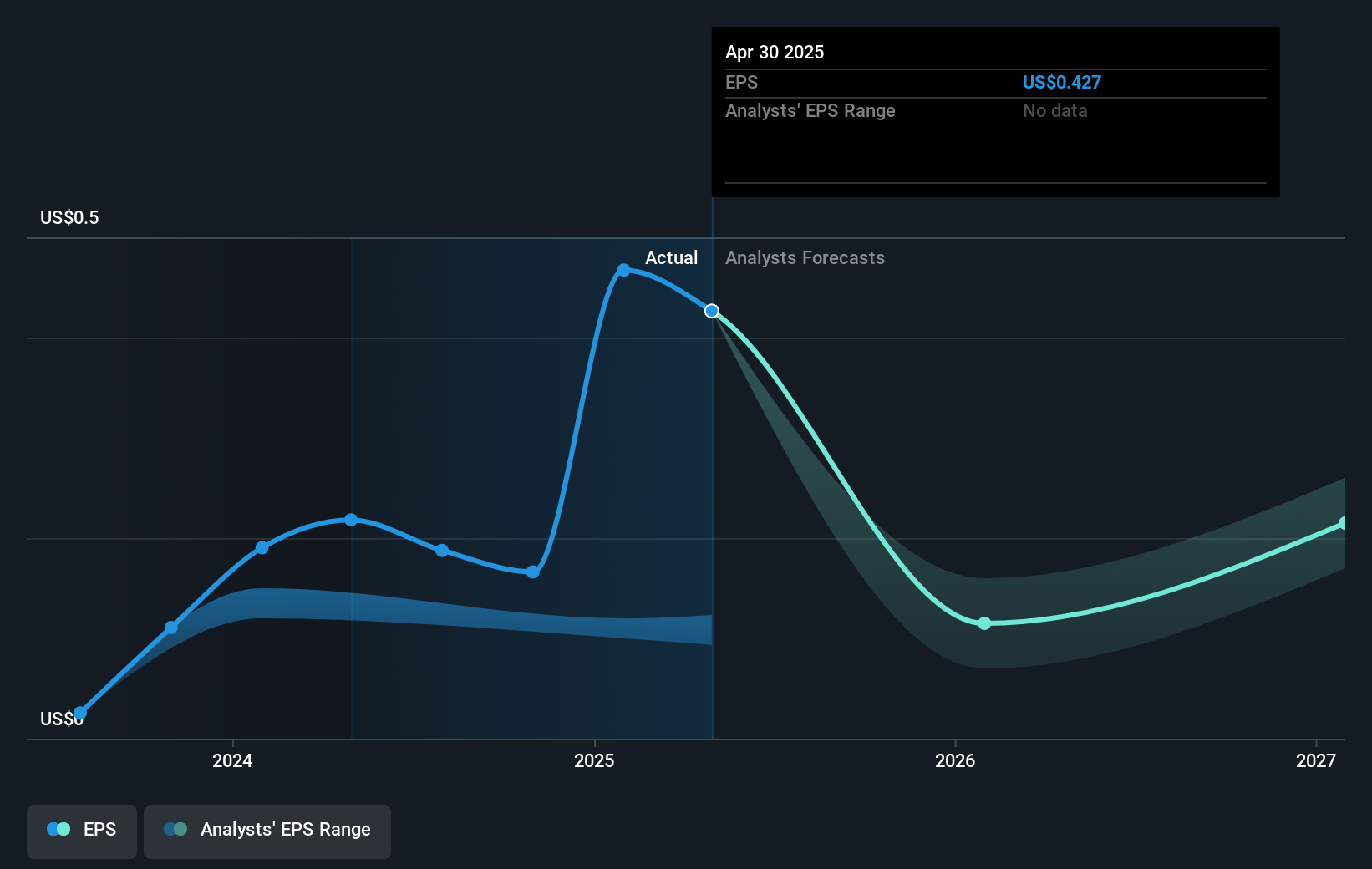

- The bullish analysts expect earnings to reach $55.7 million (and earnings per share of $0.11) by about July 2028, down from $109.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 97.1x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.94%, as per the Simply Wall St company report.

Sprinklr Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing customer churn and elevated downsell activity over the past two years, especially among high-value enterprise accounts, have resulted in slower growth of large customer cohorts and have pressured overall revenue and net retention rates, potentially constraining long-term revenue growth.

- Increased technical and operational complexity as Sprinklr broadens its suite and pursues integration across products has led to delayed implementations, inconsistent customer experiences, and higher support and restructuring costs, which may further compress operating margins and earnings if not resolved.

- Intensifying scrutiny of enterprise software spending amid macroeconomic uncertainty is prolonging sales cycles and increasing the risk of customer consolidation away from non-essential vendors, which threatens both revenue stability and new customer acquisition rates, especially during transitional business periods.

- The accelerating shift toward commoditized, AI-driven social and customer engagement platforms risks eroding Sprinklr's differentiation in a market where larger vendors and new generative AI entrants could capture share, putting long-term pressure on gross margins and restraining future earnings growth.

- Sprinklr's heavy dependence on its top 500 customers, who account for approximately 80% of total revenue, exposes the company to concentration risk; loss or downsizing of a few major contracts could cause significant volatility in both revenue and profit margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sprinklr is $15.66, which represents two standard deviations above the consensus price target of $10.5. This valuation is based on what can be assumed as the expectations of Sprinklr's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $55.7 million, and it would be trading on a PE ratio of 97.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of $9.05, the bullish analyst price target of $15.66 is 42.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.