Key Takeaways

- The transition to a software-focused, partner-driven model and innovative product launches are boosting margins, expanding recurring revenues, and increasing average revenue per customer.

- Growing adoption among financial institutions and strong multi-year partnerships enhance revenue visibility while strategic investment in AI and automation support long-term growth and market share gains.

- Dependence on external partners, macroeconomic sensitivity, delayed product adoption, ongoing financial transition, and customer concentration all pose risks to sustainable growth and profitability.

Catalysts

About Blend Labs- Provides a cloud-based software platform for financial services firms in the United States.

- The shift to a software-first, partner-driven model-culminating in the exit from the capital-intensive Title365 business-will structurally improve gross margins and operating leverage, accelerating net margin expansion and positioning Blend for more scalable, recurring revenues going forward.

- Expanding adoption of Blend's modular, API-rich digital solutions among leading mortgage servicers, banks, and credit unions reflects increasing urgency among financial institutions to digitize their lending and account origination processes in response to shifting consumer expectations, supporting multi-year revenue growth.

- Product suite innovation-with the launch of high-ARPU, high-conversion products like Rapid Refi and Rapid Home Equity, and recent entry into business deposit account opening-broadens Blend's addressable market and increases cross-sell potential, directly boosting average revenue per customer.

- The company's record RPO (Remaining Performance Obligations) and multi-year, multi-product expansion deals with top institutions signal growing customer trust and stickiness, improving long-term revenue visibility and reducing revenue volatility.

- Strategic reinvestment in AI and workflow automation, coupled with a proven track record of successful integrations and ecosystem partnerships, positions Blend to capture incremental share as regulation becomes more complex and as legacy banks accelerate digital transformation-driving sustained top-line growth and margin improvement.

Blend Labs Future Earnings and Revenue Growth

Assumptions

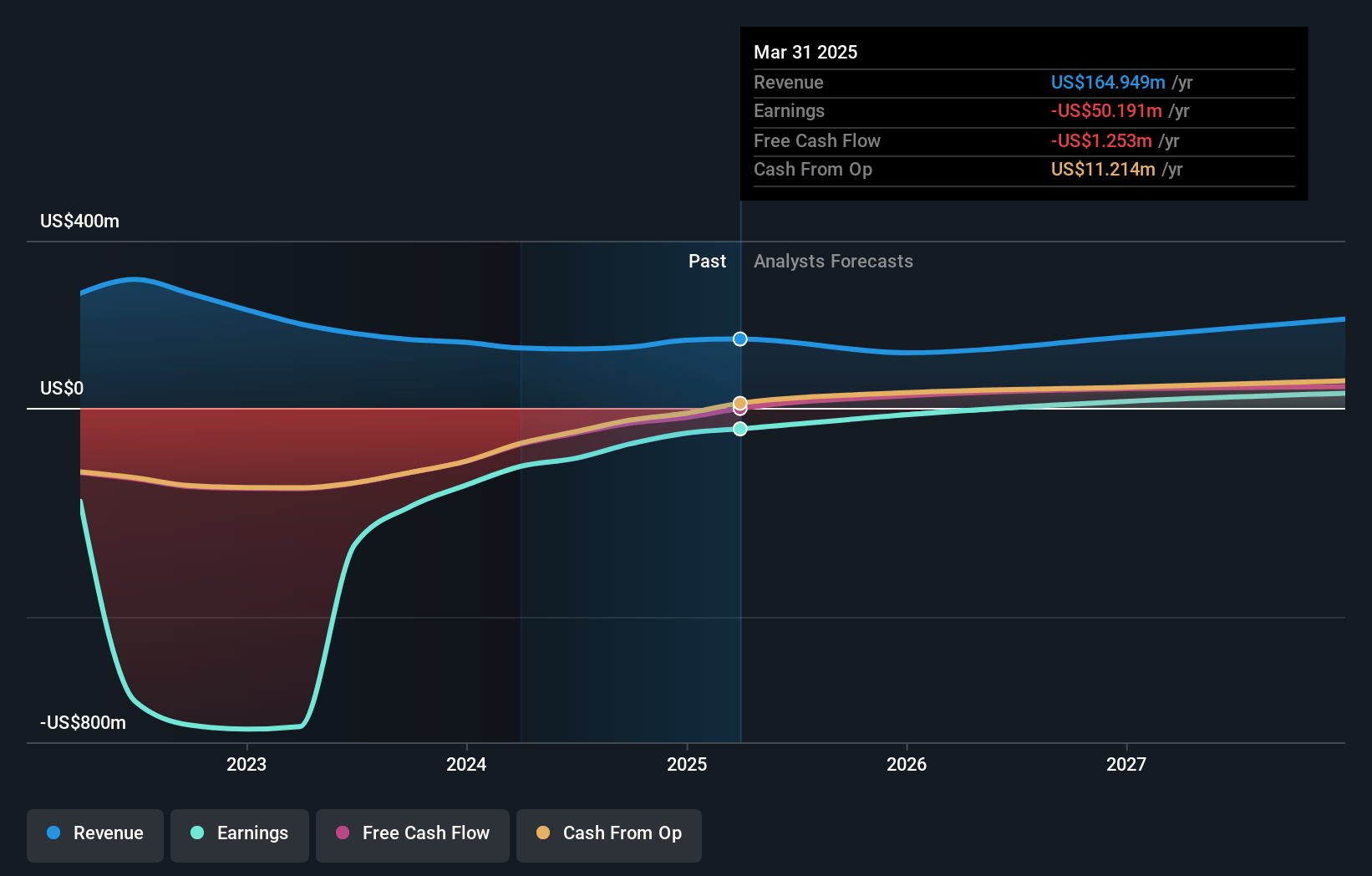

How have these above catalysts been quantified?- Analysts are assuming Blend Labs's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -30.4% today to 20.8% in 3 years time.

- Analysts expect earnings to reach $41.7 million (and earnings per share of $0.12) by about July 2028, up from $-50.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $46.0 million in earnings, and the most bearish expecting $23.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.9x on those 2028 earnings, up from -18.0x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Blend Labs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Blend Labs' transition away from direct ownership of title and insurance businesses toward a "partner-first" software model may result in lower reported revenue per loan and creates reliance on external providers, risking value leakage, loss of product control, and potentially increased margin volatility if partnerships underperform-negatively impacting revenue quality and long-term gross margins.

- The company's current and future growth is closely tied to cyclical factors in mortgage origination, which remains highly sensitive to macroeconomic conditions such as interest rate levels and housing market volumes; sustained higher-for-longer interest rates or housing affordability declines could dampen borrower demand, resulting in weaker loan volumes and revenue growth.

- Blend Labs has guided that economic value per funded loan will reach a trough in Q2 2025 due to upfront dilution from large customer wins starting only with core mortgage products, and there is execution risk that add-on product adoption (e.g., Blend Close, Rapid Refi) may not ramp as anticipated, delaying accretive contribution and revenue expansion-this could suppress near

- to medium-term net margins and earnings growth.

- Despite recent cost reductions and positive free cash flow, Blend's longer-term financial profile is still in transition, with the risk that renewed investment (in AI, new product areas, and go-to-market) or unanticipated operating expenses outpace revenue growth, threatening sustained non-GAAP profitability and potentially necessitating additional capital raises that could dilute shareholders.

- Customer concentration risk persists, as the company's largest renewal/expansion deals are sourced from a handful of major financial institutions; the loss, curtailment, or renegotiation of any large contract-or increased competition from in-house platforms or rivals-could create significant revenue and earnings volatility in an already consolidating sector.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.008 for Blend Labs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $200.6 million, earnings will come to $41.7 million, and it would be trading on a PE ratio of 40.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of $3.49, the analyst price target of $5.01 is 30.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.