Key Takeaways

- Increasing automation and product expansion fuel long-term growth, but heavy investment and competition threaten margins and delay profitability.

- Economic uncertainty and SMB exposure heighten risks to revenue and earnings, especially if subdued transaction volumes and compliance costs persist.

- Weakening SMB spending, fierce competition, and increased investment needs may strain BILL's revenue growth, margins, and ability to scale in a challenging macroeconomic and regulatory environment.

Catalysts

About BILL Holdings- Provides financial operations platform for small and midsize businesses worldwide.

- While the company continues to benefit from the increasing digitization of back-office functions and the shift to automated B2B payments, current macroeconomic uncertainty is leading many SMBs to reduce both transaction volumes and overall spend, which could limit revenue growth in the near-to-medium term, especially if this cautious behavior persists.

- Although advanced capabilities including automation, AI integration, and expanded product offerings (such as procurement and multi-entity management) position BILL to increase revenue per user, ongoing investments in innovation and higher sales and marketing expenses may pressure net margins and delay meaningful earnings expansion if returns on these investments fall short of expectations.

- Even as the trend away from legacy accounting systems and toward SaaS platforms supports potential long-term demand, heightened regulatory scrutiny and tightening compliance requirements for fintechs can increase operational complexity and compliance costs, which could offset improvements in profitability and operational leverage.

- While the rollout of new payment products like invoice financing and advanced ACH provides levers for monetization, growing competition from larger financial institutions, integrated fintechs, and native embedded payment solutions may force BILL to increase customer acquisition costs or reduce pricing power, negatively impacting net margins and revenue growth.

- Despite significant cross-sell opportunities in the accounting and supplier channels and positive momentum in customer adoption, SMB customer concentration exposes the company to heightened risk from economic cycles; prolonged weakness in SMB formation or rising credit and interest rate pressures could further depress transaction volumes, curbing both revenue and earnings expansion.

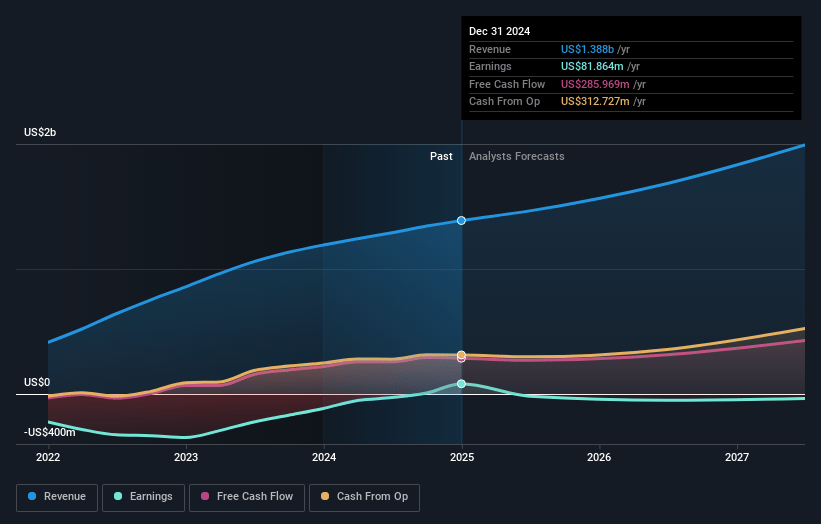

BILL Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BILL Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BILL Holdings's revenue will grow by 19.1% annually over the next 3 years.

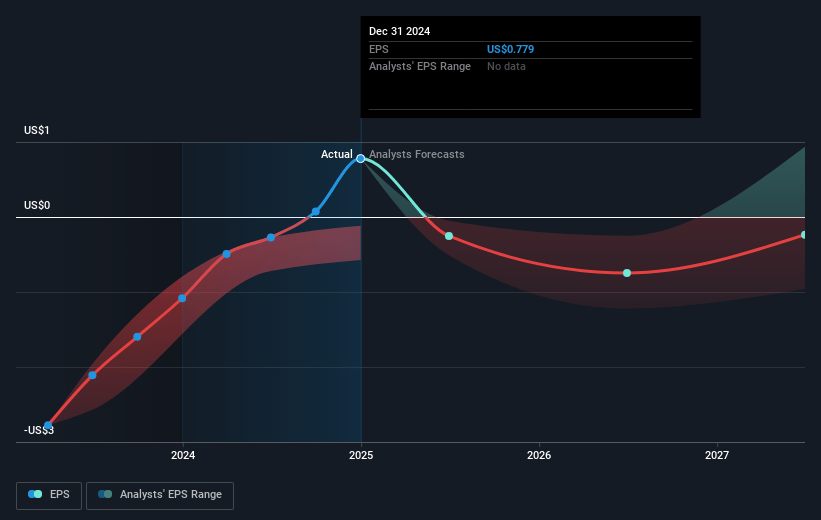

- The bearish analysts are not forecasting that BILL Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate BILL Holdings's profit margin will increase from 2.7% to the average US Software industry of 13.2% in 3 years.

- If BILL Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $318.3 million (and earnings per share of $3.46) by about July 2028, up from $38.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, down from 123.0x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to decline by 3.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.93%, as per the Simply Wall St company report.

BILL Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged macroeconomic uncertainty and tighter fiscal or trade policies are causing SMB customers to reduce transaction volumes and overall spend, which could lead to slower revenue growth for BILL in future periods.

- The increasing reliance on discretionary spend categories within BILL's Spend & Expense solution exposes the company to volatility in customer behavior; if SMBs continue to cut back in these areas, transaction volume and associated fees could decline, putting near-term and long-term pressure on revenues and earnings.

- Entrenched and intensifying competition from both larger fintechs and legacy banks, as well as the risk of commoditization in AP/AR automation software, threaten to erode BILL's market share and force pricing pressure that could impact net margins and profitability over time.

- Ongoing investments in new product development, artificial intelligence, and sales infrastructure, while necessary for sustaining innovation and growth, may continue to weigh on operating margins if corresponding revenue acceleration does not materialize as quickly as expected.

- Changes in regulatory or cross-border trade environments, such as increased tariffs or heightened compliance costs, may introduce friction and costs in BILL's international payments business, limiting the company's ability to monetize global transaction flows and negatively influencing revenue growth rates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BILL Holdings is $49.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BILL Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $89.0, and the most bearish reporting a price target of just $49.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $318.3 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 8.9%.

- Given the current share price of $45.92, the bearish analyst price target of $49.0 is 6.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.