Narratives are currently in beta

Key Takeaways

- Zoom's AI-focused platform and sector-specific solutions aim to enhance customer value and expand revenue streams across healthcare, education, and underserved markets.

- New share repurchase program and channel-driven sales in Contact Center demonstrate commitment to shareholder value and potential for revenue growth.

- Increased investment in AI and competitive pressures may strain current revenue growth, affect net margins, and impact cash flow despite strategic adjustments.

Catalysts

About Zoom Video Communications- Provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- The launch of Zoom's new AI-first Work Platform, including AI Companion 2.0, is expected to drive future revenue growth by enhancing customer value and potentially creating new monetization streams with industry-specific AI solutions. This could positively impact overall earnings and expand their Total Addressable Market (TAM).

- Zoom's focus on sector-specific customization and new AI Companion paid add-ons for health care and education aims to drive increased revenue from these industries, leveraging existing customer loyalty and meeting unique industry needs. This approach could enhance revenue and profit margins in these sectors.

- The introduction of Zoom Workplace for Frontline workers targets large, underserved markets such as retail, healthcare, and manufacturing, potentially expanding revenue streams by enlarging their customer base. This expansion could positively impact both revenues and margins through scalable SaaS offerings.

- The growth in Zoom's Contact Center segment, including securing the largest-ever customer deal of over 20,000 seats, indicates potential for significant revenue growth in high-demand markets. The channel-driven sales are expected to drive higher earnings and gross margins as the platform gains traction in Enterprise and EMEA markets.

- The incremental $1.2 billion share repurchase program reflects Zoom's commitment to driving shareholder value through effective capital allocation, which could significantly enhance EPS and signify financial health and optimism about future growth prospects.

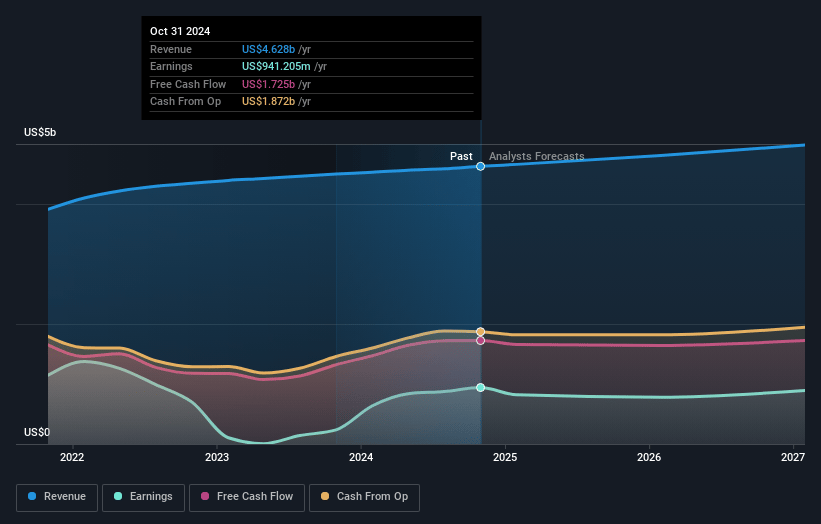

Zoom Video Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zoom Communications's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.3% today to 18.6% in 3 years time.

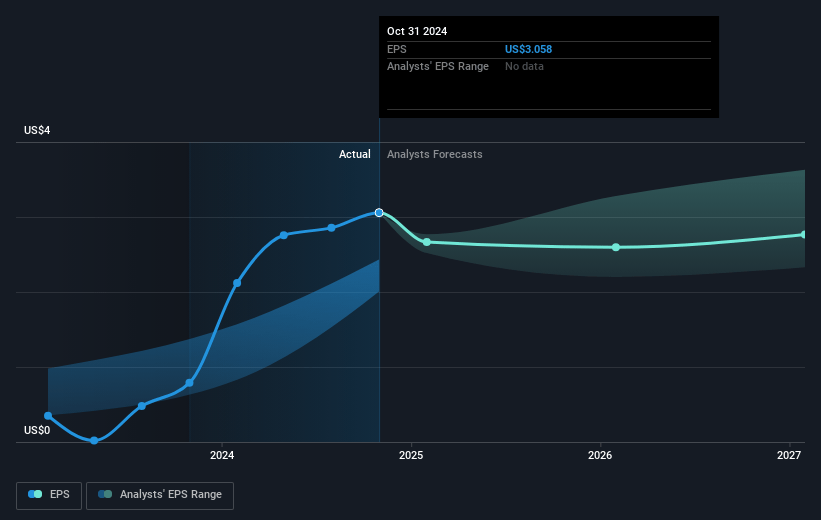

- Analysts expect earnings to reach $960.2 million (and earnings per share of $3.07) by about January 2028, up from $941.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $734.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.6x on those 2028 earnings, up from 25.6x today. This future PE is lower than the current PE for the US Software industry at 41.3x.

- Analysts expect the number of shares outstanding to grow by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Zoom Video Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential for macroeconomic changes and regulatory challenges related to AI could impact the company's revenue growth and overall financial performance.

- Although the company is embracing a no additional cost approach for its AI Companion product, this strategy may limit revenue growth opportunities in an already competitive market.

- Increased investment in AI and emerging growth products is causing elevated costs, which could negatively impact net margins and operating income.

- The market for AI-augmented communication platforms is becoming increasingly competitive, which could pressure Zoom’s ability to maintain its current market share and revenue levels.

- Lengthening billing terms and adjustments in discount practices, while positive for customer retention, could delay revenue recognition and impact cash flow in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $92.15 for Zoom Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $960.2 million, and it would be trading on a PE ratio of 36.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $78.54, the analyst's price target of $92.15 is 14.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives